Goldman’s Buyback Desk: Companies Representing $190BN In Buybacks, 25% Of Total, Have Already Suspended Repurchases

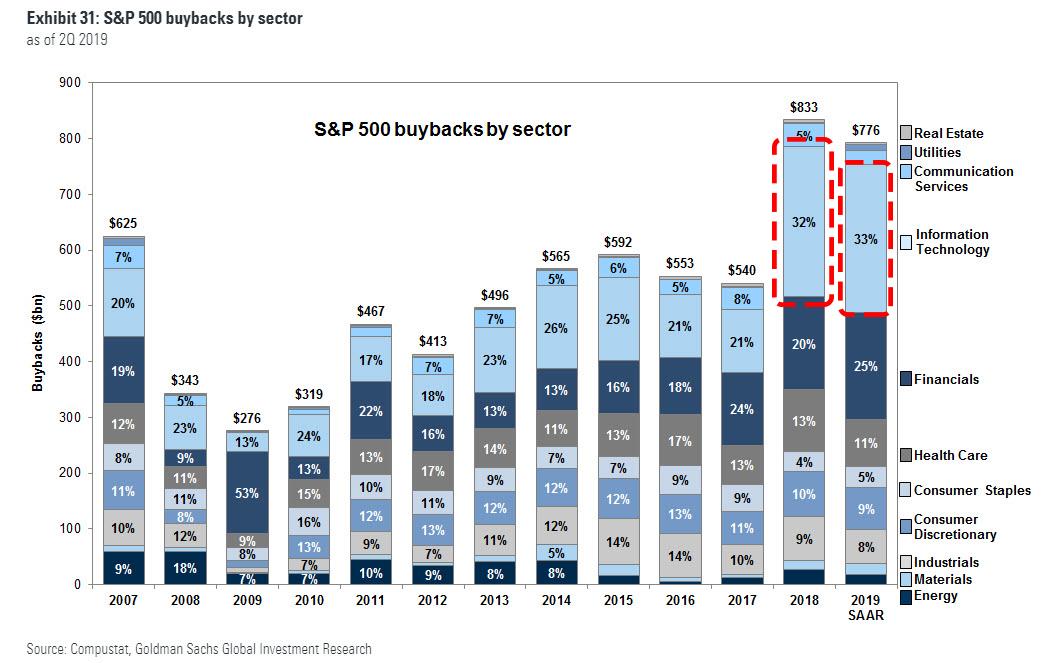

As discussed last weekend, 2018 and 2019 were record years for buybacks, for one main reason: Trump’s tax reform allowed companies to repatriate over a trillion dollars parked offshore at nominal tax rates, which were then used to repurchase stocks, resulting in the bizarre market condundrum of record outflows even as the S&P hit all time highs, as all investor outflows were offset by companies buying back their own stock.

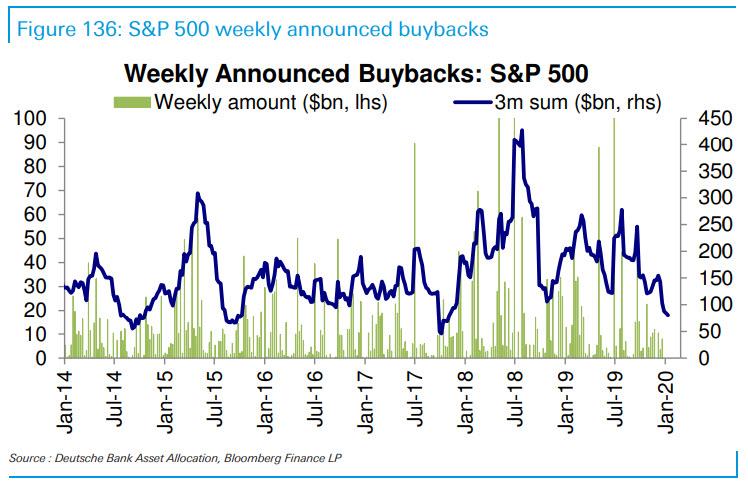

However, even before the coronacrisis, we warned that buybacks had sharply slowed down at the start of the year even as all investors how plowed all in stocks.

But if buybacks were merely slowing at the start of the year, after the recent collapse in the market, buybacks are effectively dead as a driver of stock prices for the foreseeable future.

As Goldman’s David Kostinw writes in his latest weekly kickstart, according to Goldman’s Buyback Desk, “nearly 50 US companies have suspended existing share repurchase authorizations in the past two weeks, representing $190 billion of buybacks or nearly 25% of the 2019 total.”

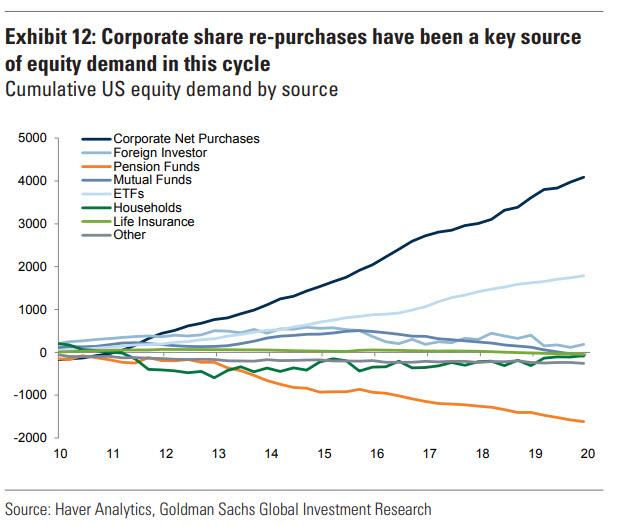

Worse, as Kostin warns, reduced cash flows and select restrictions mandated as part of the Phase 3 fiscal legislation “suggest more suspensions are likely.” And since buybacks have represented the single largest source of US equity demand in each of the last several years…

… Goldman believes “higher volatility and lower equity valuations are among the likely consequences of reduced buybacks.”

Which brings us to the $64 trillion question: can buybacks still provide support to equities?

According to Goldman, with corporate fundamentals deteriorating, share repurchases are likely to be reduced this year, providing less support to equity demand:

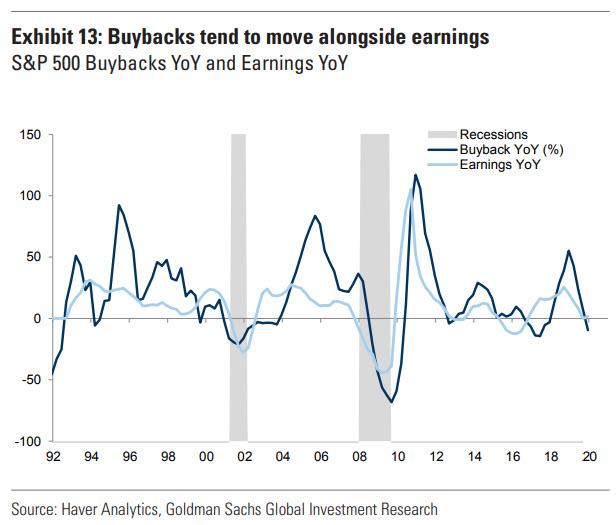

Our US strategy team has found the fluctuations in profit growth are a key driver of buyback growth (Exhibit 13). Our strategists expect S&P 500 EPS to decline 33% in 2020 (with a -123% YoY growth in Q2) and 45% in Europe. Dividends, which are usually less volatile than buybacks, are already pricing large cuts for this year. Dividend swaps are pricing a 17% and 21% S&P 500 cut, and a 38% and 18% EURO STOXX 50 cut for 2020 and 2021 respectively

In short: the buyback bonanza is over for the foreseeable future.

Tyler Durden

Sun, 03/29/2020 – 19:15

via ZeroHedge News https://ift.tt/2xDnpBJ Tyler Durden