Is America Able To Handle COVID-19? – Global Prospects Hang On This Question

Authored by Alastair Crooke via The Strategic Culture Foundation,

As the lockdowns across Europe began to bite, the U.S. Establishment began its ‘wobble’. The more elegant amongst élite circles pointed to a dangerous mis-match in timelines: The medical advice has been: ‘lockdown until the virus begins to subside’, but that advice encompassed too, the possibility of Covid-19 returning later in the year in a Phase Two, thus requiring further personal distancing.

Hands shot high in absolute horror amongst some business and Wall Street leaders: Could the U.S. economy sustain such a prospect? Might not a long shutdown inflict permanent damage? Would there even be an economy left – to resurrect – in the wake of ‘peak Coronavirus’?

The mis-match thesis then acquired a third strand: To immediate economic fears standing in contradistinction to longer term medical perspectives was added the third question: Are Americans culturally ‘built’ for lockdown (that is to say, will an individualistic, libertarian-minded – and armed society – acquiesce to being ordered to stay home over a long period)?

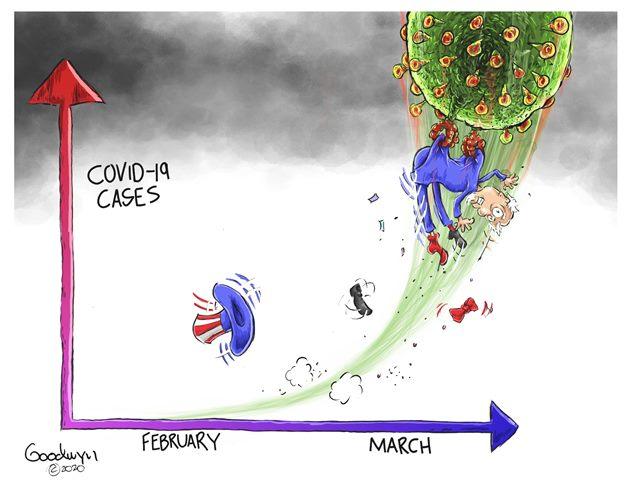

Not surprisingly, President Trump – with an advancing Election, and his colours pinned to the mast of sound economic management – hit on the formula that the ‘cure cannot be worse than the disease’: Let’s have the economy open by Easter (12 April – i.e. 15 days hence), he declared.

The issue of the virus is not manufactured, (though there are still many in the U.S., who regard it as an overblown scare), nor is the dilemma of the divergent timelines. Actually – a great deal hangs on how these timelines play out – our global economic and political prospects, no less.

Just about everyone and his dog now claims to have modelled Covid-19. But in truth, we still know very little on which to accurately predict the virus’ course. The ‘data’ is made unreliable: firstly, because not only does the virus have different mutations, but secondly, owing to it acting in two quite different modes: One is mild, or even asymptomatic (the 80%); and the second mode is serious (requiring hospitalisation) – and for a minority of the 20% – deadly.

But consequently, we simply do not know how much of the population is infected, or is still to be infected – precisely owing to its very mildness or, its asymptomatic characteristics amongst the 80 percent-ers. There hasn’t been enough testing – and anyway, given its mild or non-noticeable iteration, many people may have it, but don’t test.

So the data modelling is more ‘art’, than predictive, and therefore introduces economic uncertainty. The damage to the economy is obvious from the first, but the question least considered is the importance of the third strand: Is Trump right when he says that America ‘is not built for lockdown’?

He may be right, in one sense; but if he opts to prioritise a quick opening of the economy over the welfare of the American people, he may face incalculable consequences – should Covid-19 bite him in the backside: Either by mutating (as did the Spanish ‘flu in August 1918); or simply, by beginning a second phase through a resurgence of community infection later in the year.

Plainly, Trump is of the ‘fears are exaggerated’ school of thought, and seems poised to bet his Presidency on it. In this era, viral social media images of hospitals overwhelmed, and of patients fighting to breathe their last, unaided, and lying on the floor, jam-packed in corridors, or in converted gyms – can become politically toxic. The counter- response that the financial system is struggling for oxygen, under lockdown, too, may strike many people as a ‘little lacking’ in common humanity – perhaps?

The dilemma is cruel. And maybe the social timeline ‘strand’ has more substance, than is generally granted? Americans are libertarian in many ways (not least, in their determination to carry arms). This is reflected also, in their deliberate eschewing of a public health programme, and in the purposefully limited support provided to the hourly paid – who are laid off. It is the ethos of individualism, a work ethic and the consequence of a ‘libertarian’ constitution.

The St Louis Chair of the Fed has predicted 30% unemployment and 50% of the economy at standstill by the end of June. Is it sustainable to have these furloughed workers dying in the street, because they cannot afford America’s ‘boutique’ health-service for the wealthy? (we’ve seen videos of people unexpectedly falling down in the street, dying, as passers-by skirt the afflicted victim – from both China and Iran). Such videos would be inflammatory in the U.S.

What happens if ‘lockdown’ were extended, and the unemployed were to attack supermarkets for food they cannot afford; or because the supermarket shelves are empty (this has happened in Europe)? What would videos of the U.S. National Guard look like as they arrive, armed for war, to put down the ‘looters’? What happens if the rioters angry at their plight – and without money – use their right to bear weapons to fight against the National Guardsmen? Can the U.S. national fabric handle such strains? Might it not disintegrate?

Here, the U.S. differs from Europe. America has not, since the Civil War, had to experience the harsh circumstances in hospitals approximating to wartime, on its own soil.

So, is Trump right, then, to prioritise keeping the U.S. economy open? Well, firstly, the notion that bits of the economy can be opened where infection-rates are low, whilst other parts are locked down, seems odd: Covid-19 – we do know – is highly infectious. Those who show no symptoms – whether they are under 50 years, or under 40 years-old – would not preclude them from being silent ‘super-carriers’ of the disease. We have not heard there is a test for anti-bodies, which might signal that an individual enjoys immunity. But unless an area has no infections, putting even one carrier into a workplace, would be sufficient to trigger a localised community infection.

Perhaps then, Trump might be right that anything other than a short (and possibly ineffective) lockdown is not manageable in the U.S.: That it might tear apart an already polarised, armed and inegalitarian, social fabric. There is then, a substantial point here: How far, and for how long, can an U.S. or European society accept a ‘command’ or martial-law administration – before citizens rebel, and head to the beaches for summer? What then?

Is it possible that can Trump may emerge from these events as the ‘saviour of the U.S. economy’? Here, we touch on the key question of the adaptability of élites. Are the U.S. élite capable of true transformation of consciousness as circumstances alter? On the answer to this question will hang the geo-political future. It was the inability of the Soviet elites to give up on their corrupt and privileged status quo that led to the implosion of the USSR in 1987.

We are often told that Americans are great innovators and graspers of opportunity. But today, the U.S. élites are utterly intent on preserving a status quo – as the viability and even the reality of that status quo is being questioned by important insiders. For the élite majority, though, the mind-set is intransigent and adamant. The status quo suits them well. They do not wish to see to see it reformed or changed. They refuse to think differently.

Eventually, the coronavirus will subside; but what will America look like when it does? For the moment, the élites believe that America will look just as it did, in February, before the impact of the pandemic hit U.S. markets. So, we have had the Fed, the Bank of England, the Bank of Japan all doing the same thing, over and over again, hoping that the economy will snap-back to ‘normal’. But it isn’t working.

The Fed fears a collapse in credit (with due reason), but ‘normality’ is not returning from the rush of liquidity hosed across credit markets. In the 2008 crisis, the Fed responded with all sorts of easing. This time the Fed is throwing the ‘kitchen sink’ at markets, offering ‘facilities’ for almost every asset class. At the present rate of growth, the Fed balance sheet will be $6 Trillion in days – and reach a total equivalent to almost 50% of the U.S. GDP by June. Another, unimaginable chunk of debt.

The problem is that the Fed’s measures will fail as stimulus – because it is not a problem of demand shortfall, but of supply-shock – as the globe implements ‘shut-down’ in order to slow infection. But, with recession or depression looming, asset prices are collapsing. Bloomberg has noted that core tenets such as what constitutes a safe asset, or the expectation of returns over the next decade, are all being thrown out of the window – as Central Banks strive to avert a global recession: The latter have unleashed a money tsunami, unlike anything seen before, and the fear of inflation is rising, together with a sense that all the old metrics of what constitutes safe investments are gone for good.

Meanwhile the U.S. Congress has passed a $2 trillion bill to counter the effects of Covid-19. It was well received for a while in the U.S. markets, before they fell again. The bill may help keep a part of the big business status quo alive, for now, but the bottom line is that these spending bills – as Jim Rickards notes – “provide spending but they do not provide stimulus”. And all that spending – like that of the Fed – essentially will be helicopter money: i.e. monetised debt.

The essential dilemma is that the Central Bankers’ Holy Grail – stimulus – depends on consumers, who constitute 70% of the U.S. economy; and on whether they decide consume – and to what extent. And that will depend upon their psychology in the post-Covid-19 era, and not on what the Fed does, or does not, do now.

If consumers get used – during lockdown – to doing without; to economising; they may well decide that increased savings and debt reduction, are the best ways to prepare for straitened times. 83% of U.S. businesses are small or medium sized companies. Some may survive and resume work, but others will not re-open after the lockdown. It will be a different atmosphere: a different economic era.

Of course, the élites want to go ‘back to normal’ as quickly as possible, but the ‘bottom line’ emerging from the Fed’s failure to staunch market paralysis is that that which the élites had thought to be ‘normal’ is proving not to have been normal at all. It is now apparent as having been a financialised bubble – and Covid-19 happens to have been the pin that popped it. This bubble was just the biggest, in a long line of Fed-blown bubbles (NASDAQ, sub-prime mortgages, etc.) – and now, the final ‘everything-bubble’ has burst. There’s nothing now left for the Fed to ‘bubble up’. It’s probably over.

Here’s the larger – global – point. Again, it revolves around psychology: Have these events been the ‘pin’ which also pops some sort of mass psychological bubble (a sealed Cartesian, mental retort)? Will public faith in the status quo crash, along with the financialised ‘everything-bubble’? Will a momentary flash of enlightenment to the house-of-cards reality that Americans had been living, cause them to start seeing their world afresh, and in its raw, hard reality? If so, the world order stands on the cusp of change.

For some time now, a general popular disquiet has been incubating. The question is whether, in the cold post-Covid-19 reality, Americans will begin to cease their acquiescence to – and their co-operation with – the status quo.

This might mean trouble as America and some European states try to manage the pandemic through invoking the necessity of a war-time command-governance. Will people accept such a command system, if they see its principal purpose being the return to a failed status quo ante?

Tyler Durden

Wed, 04/01/2020 – 00:05

via ZeroHedge News https://ift.tt/2Ju8cpt Tyler Durden