Fed’s Balance Sheet Hits $6 Trillion: Up $1.6 Trillion In 3 Weeks

“We’re going to need a bigger chart.”

That’s all one can say when seeing what happened to the Fed’s balance sheet in the past week.

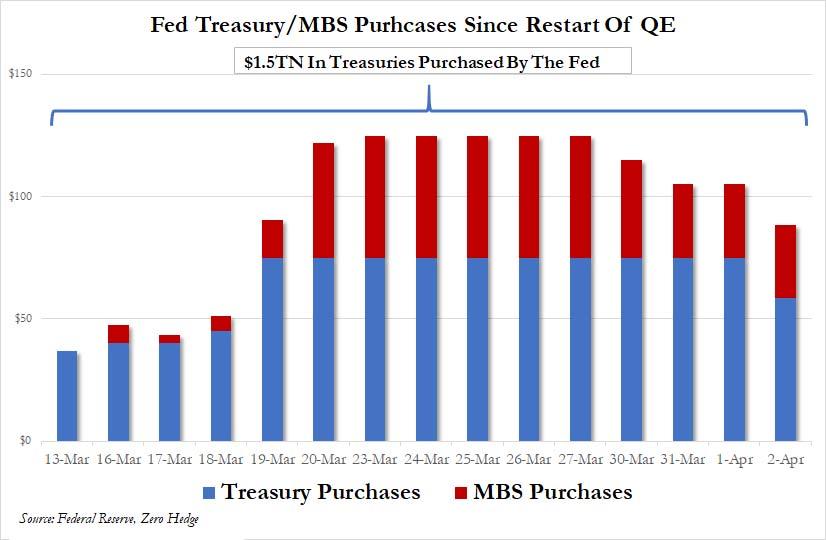

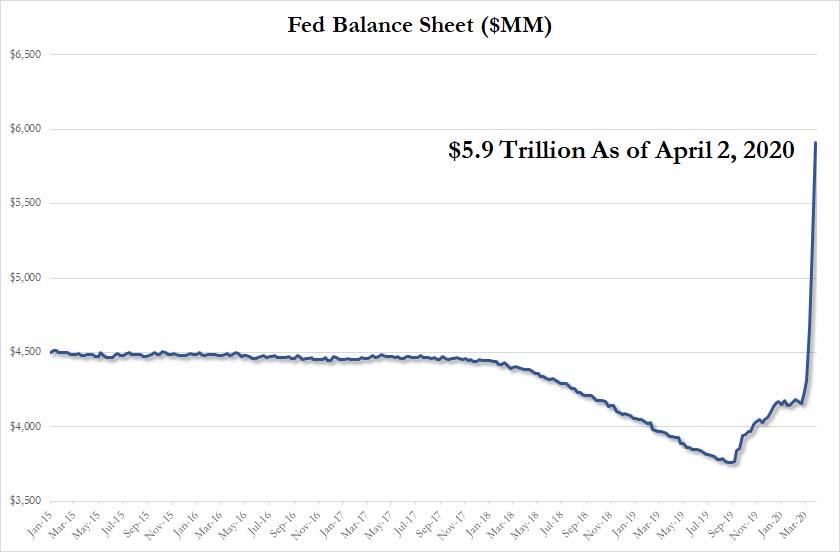

According to the Fed’s latest weekly H.4.1 (i.e., balance sheet) update, as of April 1 the Fed’s balance sheet hit a record $5.811 trillion, an increase of $557 billion in just one week. And when one adds the $88.5BN in TSY and MBS securities bought by the Fed today…

… we can calculate that as of close of business Thursday, the Fed’s balance sheet was an unprecedented $5.91 trillion, an increase of $1.6 trillion since the start of the Fed’s unprecedented bailout of everything on March 13 when the Fed officially restarted QE. And since we know that tomorrow the Fed will buy another $90 billion, we can conclude that as of Friday’s close, the Fed’s balance sheet will be a nice, round $6 trillion.

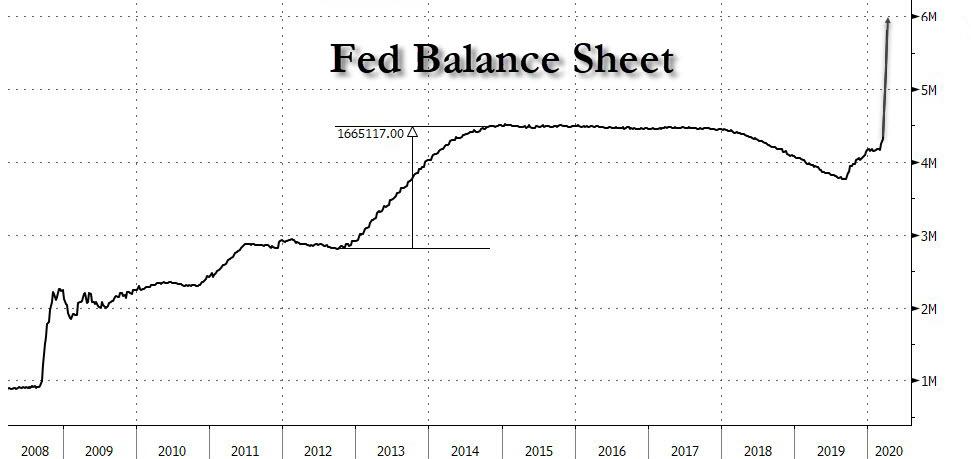

Finally, here is what the Fed’s balance sheet looks like over a longer timeframe: it shows that in just the past 3 weeks, the Fed’s balance sheet has increased by a ridiculous $1.6 trillion – the same amount as all of QE3 did over 15 months – and equivalent to an insane 7.5% of US GDP.

One more insane statistic: the Fed’s balance sheet was $3.8 trillion in August 2019 when the shrinkage in reserves supposedly triggered the repo crisis. Fast forward, 6 months, when the Fed’s balance sheet is now 60% higher.

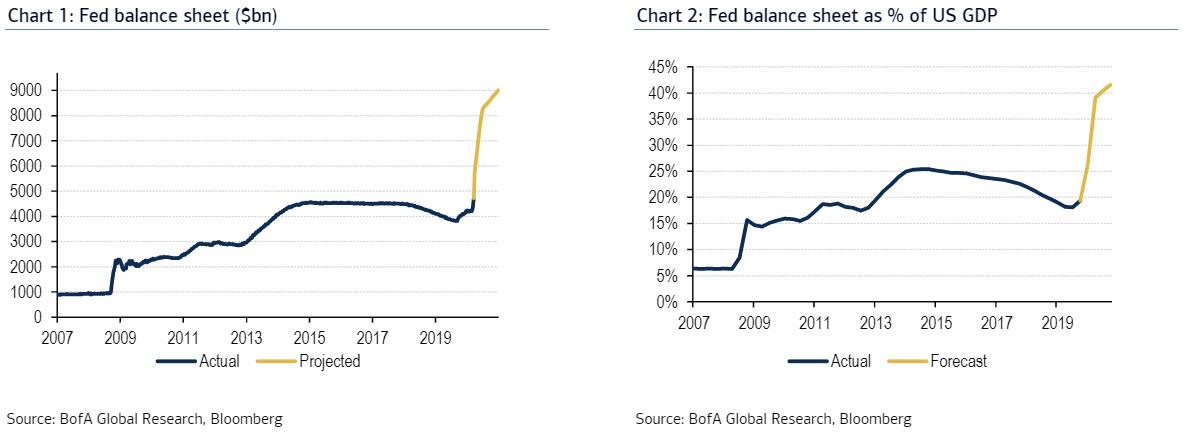

Last Saturday we said that according to former NY Fed staffer, the Fed’s balance sheet will double to $9 trillion by the end of the year.

Just three weeks after the Fed restarted its “all in” gamble, the balance sheet is already one third of the way there.

Tyler Durden

Thu, 04/02/2020 – 17:33

via ZeroHedge News https://ift.tt/2xEVLV7 Tyler Durden