Bonds & Stocks Sold After Fed Announces Another Taper In Bond-Buying

From an initial $75 billion per day, to $60 billion per day last week, The Fed had just announced another ‘taper’ in its bond-buying program to $50 billion per day for next week…

Having implicitly confirmed there is now a shortage of bonds as demonstrated by the recent repo ops that saw zero submissions as instead of using repo to park bonds with the Fed Dealers merely sell them back to the Fed, the NYFed has announced it will continue cutting back, or tapering, its “unlimited QE” bond-buying next week.

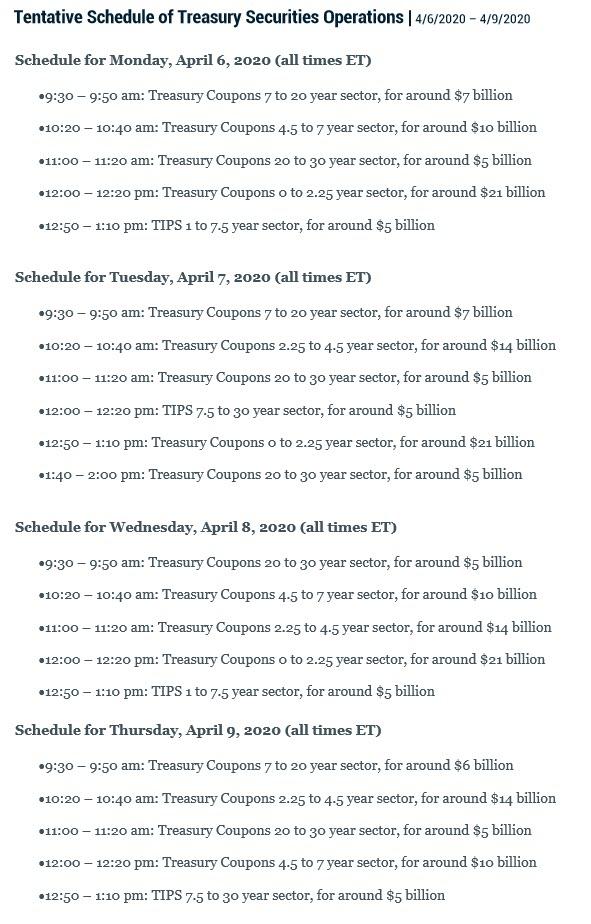

The new schedule is as follows:

This makes some sense as The Fed’s intervention’s purpose – “to support the smooth functioning of markets” that had become impaired – has been at least partially achieved, with key metrics such as off-the-run spreads and the cash-futures basis moving back toward normal levels.

The headline stalled the late-Friday ramp in stocks…

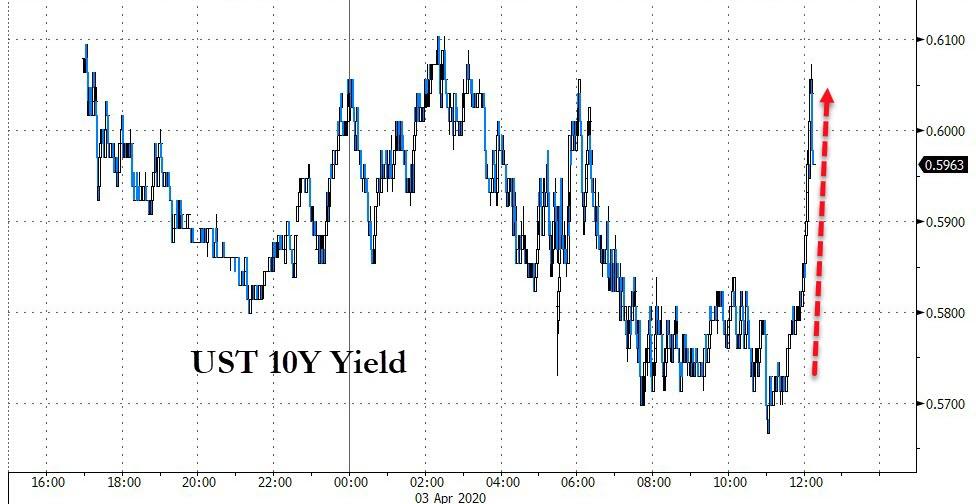

And sent 10Y Yields higher…

Tyler Durden

Fri, 04/03/2020 – 15:18

via ZeroHedge News https://ift.tt/2JBVLbd Tyler Durden