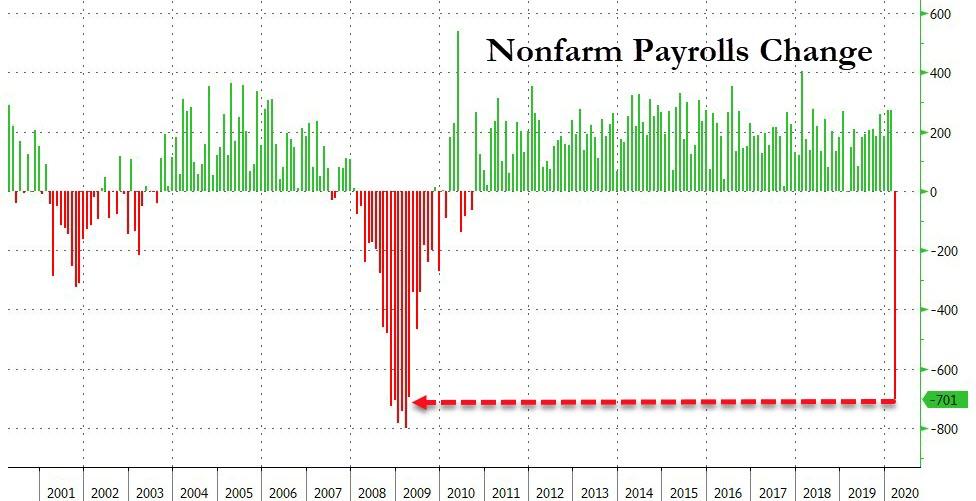

March Jobs Disaster: 701,000 Jobs Lost, Unemplyment Rate Soars Most In 45 Years As US Slides Into Depression

Just like that the 113 record straight months of employment growth is over with a bang.

While today’s payrolls report was expected to be not quite as terrible as the recent initial claims suggested, especially since the March survey week took place around March 13 or ahead of the big shutdown and layoff announcements, it ended up being catastrophic nonetheless, with the BLS reporting moments ago that a whopping 701K jobs were lost in March, 7x more than the 100K expected, and just shy of the worst payrolls prints recorded during the financial crisis.

That this happened well before the worst of the cronavirus induced coma hit, suggests that what comes next will be truly biblical.

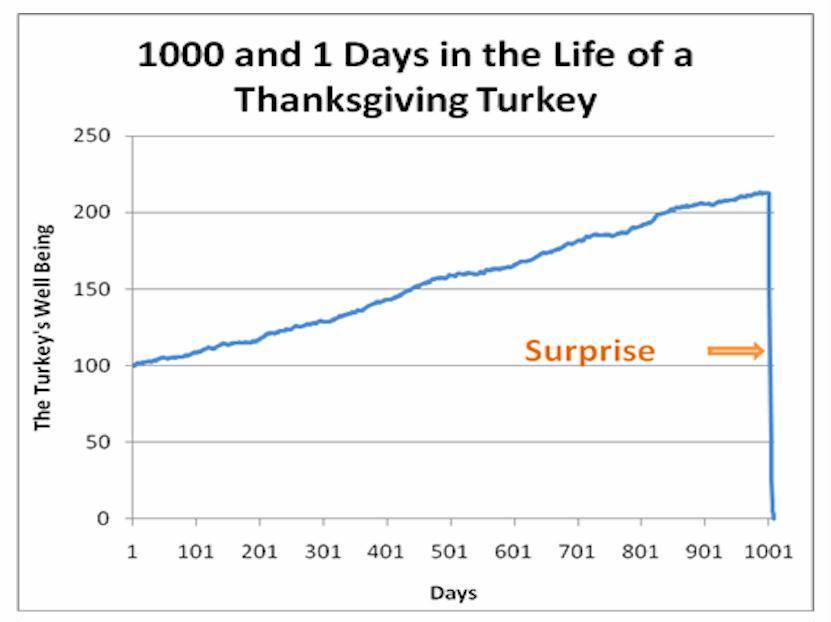

For some reason the famous “Taleb Turkey” comes to mind:

Not like it matters, but there were also revisions: the change in total nonfarm payroll employment for January was revised down by 59,000 from +273,000 to +214,000, and the change for February was revised up by 2,000 from +273,000 to +275,000. With these revisions, employment gains in January and February combined were 57,000 lower than previously reported.

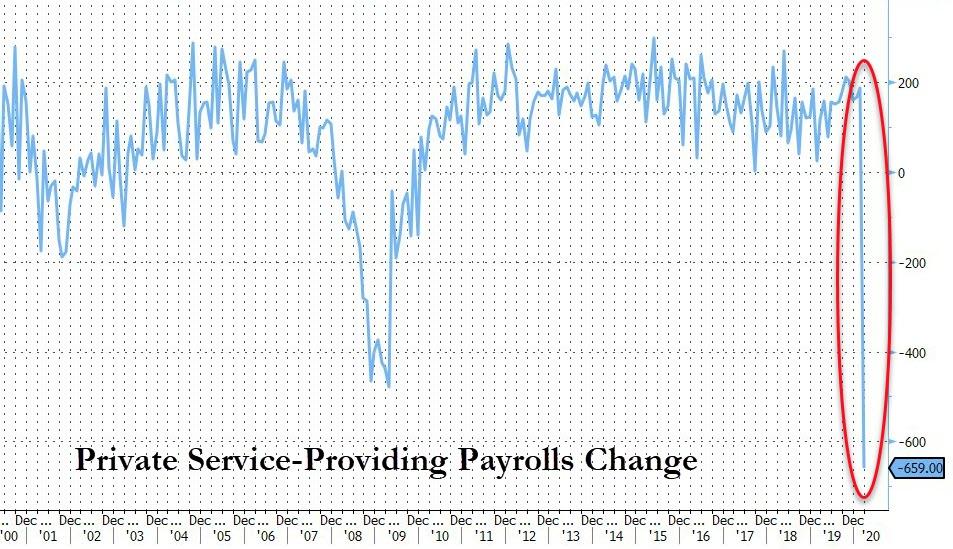

Private sector jobs dropped by 713K (vs Exp. 163K), with almost all the drop the result of a record collapse in service-providing jobs.

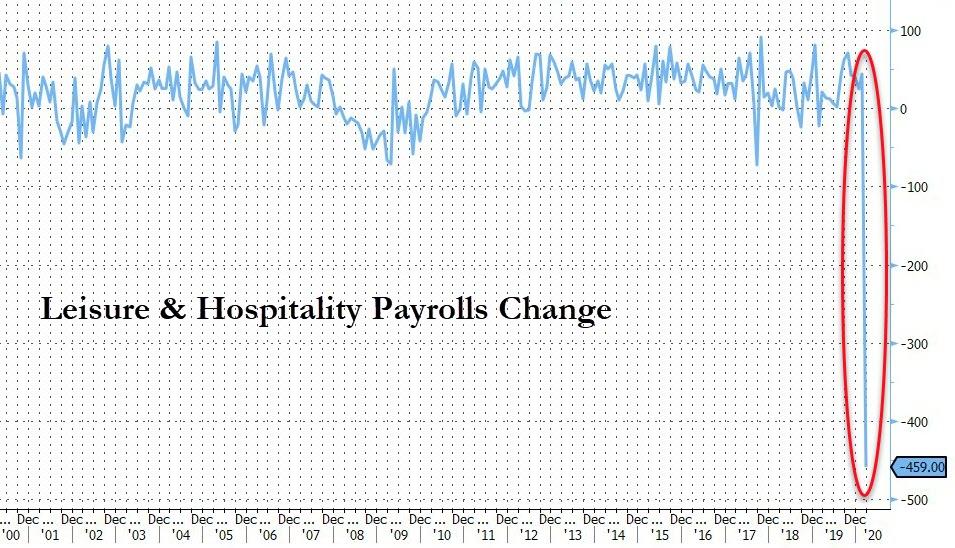

And of all service jobs, leisure and hospitality were hardest hit:

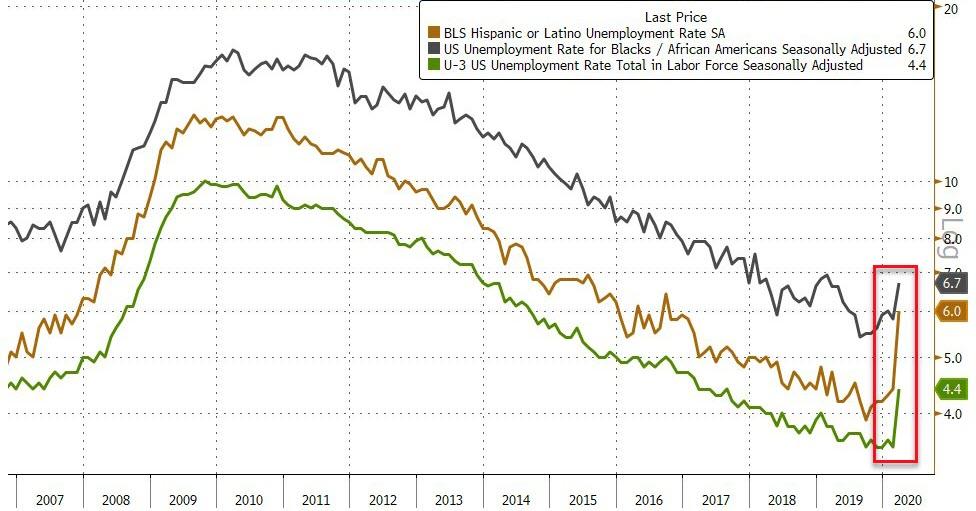

The unemployment rate soared from 3.5% to 4.3%, led by a record surge in Hispanic unemployment.

In March, the unemployment rate increased by 0.9 percentage point to 4.4 percent. This is the largest over-the-month increase in the rate since January 1975, when the increase was also 0.9 percentage point. The number of unemployed persons rose by 1.4 million to 7.1 million in March. The sharp increases in these measures reflect the effects of the coronavirus and efforts to contain it. The participation rate plunged from a 7-year-high to tie the lowest level in 5 years.

While hardly relevant at a time when the US economy slides into depression, the average hourly earnings actually rose as most of the jobs lost were low paying; that and a favorable base-effect helped push the average hourly earnings by 0.4% sequentially and 3.1% on an annual basis.

Average hourly earnings for all employees on private nonfarm payrolls increased by 11 cents to $28.62. Over the past 12 months, average hourly earnings have increased by 3.1 percent. Average hourly earnings of private-sector production and nonsupervisory employees increased by 10 cents to $24.07 in March.

The average workweek for all employees on private nonfarm payrolls fell by 0.2 hour to 34.2 hours in March. The decline in the average workweek was most pronounced in leisure and hospitality, where average weekly hours dropped by 1.4 hours. In manufacturing, the workweek declined by 0.3 hour to 40.4 hours, and overtime declined by 0.2 hour to 3.0 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.3 hour to 33.4 hours.

Finally, a look at the various job sectors:

- March, employment in leisure and hospitality fell by 459,000. Most of the decline occurred in food services and drinking places (-417,000); this employment decline nearly offset gains over the previous 2 years. Employment in the accommodation industry also declined in March (-29,000).

- Employment in health care and social assistance fell by 61,000 in March. Health care employment declined by 43,000, with job losses in offices of dentists (-17,000), offices of physicians (-12,000), and offices of other health care practitioners (-7,000). Over the prior 12 months, health care employment had grown by 374,000. In March, social assistance saw an employment decline of 19,000, reflecting a job loss in child day care services (-19,000). Over the prior 12 months, social assistance added 193,000 jobs.

- Employment in professional and business services decreased by 52,000 in March, with the decline concentrated in temporary help services (-50,000). Employment also decreased in travel arrangement and reservation services (-7,000).In March, employment in retail trade declined by 46,000. Job losses occurred in clothing and clothing accessories stores (-16,000); furniture stores (-10,000); and sporting goods, hobby, book, and music stores (-9,000). General merchandise stores gained 10,000 jobs.

- Employment decreased over the month in construction (-29,000). In March, nonresidential building (-11,000) and heavy and civil engineering construction (-10,000) lost jobs. Construction employment had increased by 211,000 over the prior 12 months.

- Employment in the other services industry declined by 24,000 in March, with about half of the loss occurring in personal and laundry services (-13,000). Over the prior 12 months, other services had added 89,000 jobs.

- Mining lost 6,000 jobs in March, with much of the decline occurring in support activities for mining (-5,000). Since a recent peak in January 2019, mining employment has declined by 42,000.

- In March, manufacturing employment edged down (-18,000). Over the past 12 months, employment in the industry has shown little net change.

- Federal government employment rose by 18,000 in March, reflecting the hiring of 17,000 workers for the 2020 Census.

- Employment in other major industries, including wholesale trade, transportation and warehousing, information, and financial activities, changed little over the month.

And now we brace for April, when the really ugly number will be revealed, and when according to some, the US economy may lose as many as 10 million jobs.

Tyler Durden

Fri, 04/03/2020 – 08:35

via ZeroHedge News https://ift.tt/3bTOujf Tyler Durden