The Angels Are Freefalling: Q1 Saw Record Downgrades To Junk And The Real Pain Is Coming

Back in November of 2017, this website was the first to suggest that a flood of “fallen angels”, or the lowest, BBB-rated investment grade bonds that are downgraded to junk, will be the event that triggers the next corporate debt crisis. In “Hunting Angels: What The World’s Most Bearish Hedge Fund Will Short Next“, we quoted from the IMF’s Oct 2017 “Global Financial Stability Report” which issued an ominous warning:

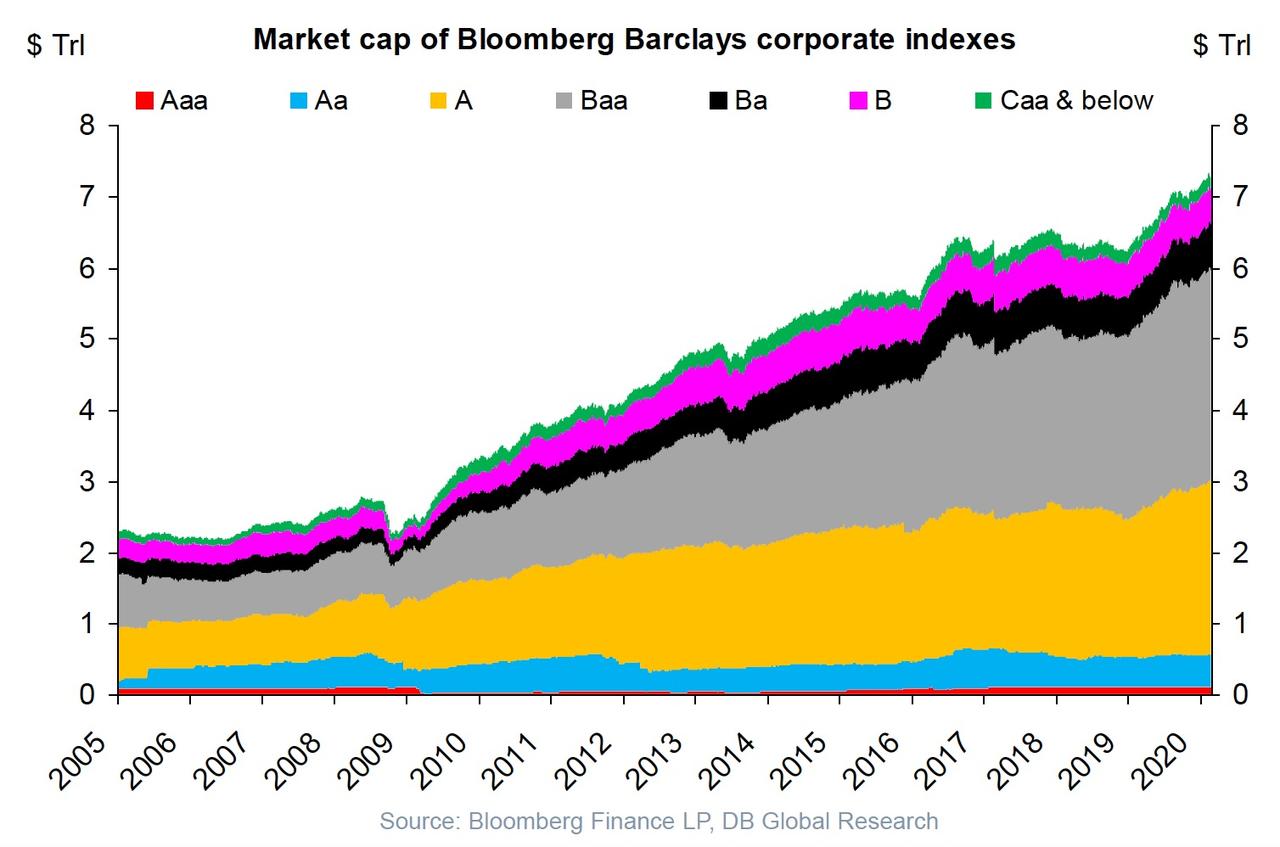

… BBB bonds now make up nearly 50% of the index of investment grade bonds, an all time high. BBB bonds are only one notch above high yield, and are at the greatest risk of becoming fallen angels, that is bonds that were investment grade when issued, but subsequently get downgraded to below investment grade, or what is known these days as high yield. It then points out that investors have never been more at risk of capital loss if yields were to rise. In addition, it notes volatility targeting investors will mechanically increase leverage as volatility drops, with variable annuities investors having little flexibility to deviate from target volatility

Following this article, the topic of a tsunami in “fallen angel” credits took on greater urgency, because with over $3 trillion in bonds on the cusp of downgrade, as we discussed in “The $6.4 Trillion Question: How Many BBB Bonds Are About To Be Downgraded“, countless asset managers warned (here, here and here) that this was the biggest threat to the credit pillar of both the US economy and stock market (recall the bulk of BBB rated issuance was used to fund the trillions in buybacks that levitated the stock market over the past few years).

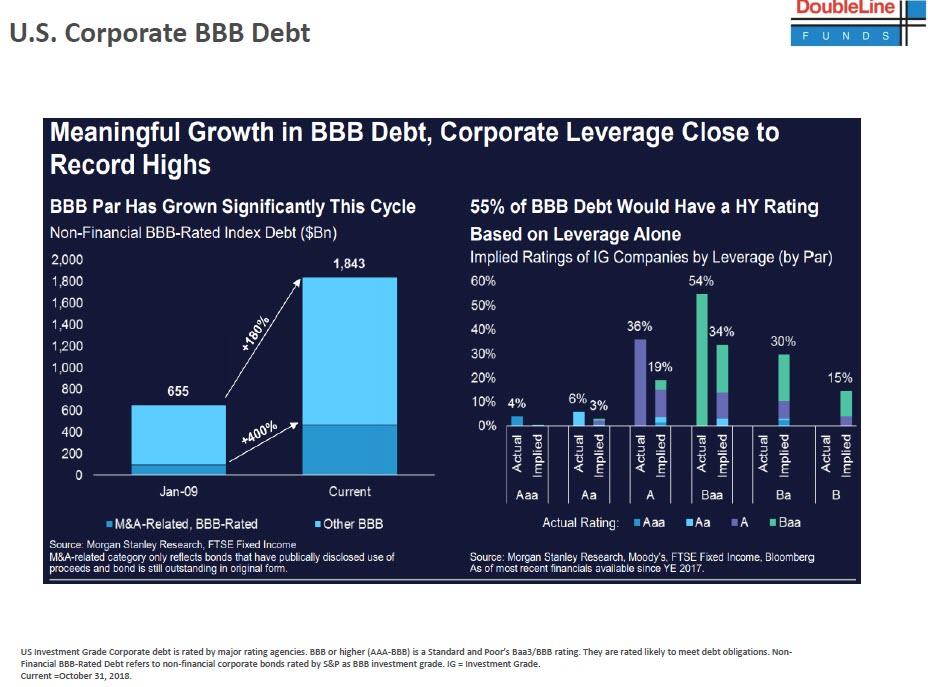

However, despite a few close scares, and the downgrades of some massive IG names to junk such as Ford and more recently, Macy’s, there never emerged a clear catalyst that would trigger a wholesale downgrade of IG names to junk, especially since the Fed ending its monetary tightening in late 2018 and unleashed another rate cut cycle coupled with QE4 in 2019 sent IG and HY yields and spreads to record lows, even though as Morgan Stanley pointed out no less than 55% of BBB-rated investment grade bonds, would have a junk rating based on leverage alone.

But the bandwagon of fallen angel optimism that prompted the mockery of anyone who warned about the risk of a fallen angel tsunami resulting a corporate bond crash, came to screeching halt last month when Saudi Arabia started an all-out price war with Russia and US shale producers, destroying the OPEC cartel overnight and causing the biggest one-day drop in oil prices in almost 30 years. As a result, more than $140 billion of bonds issued by North American energy companies are at risk of losing (or have already lost) their investment grade status, while a prolonged downturn could affect an additional $320 billion of triple-B rated midstream debt.”

And oil is just the beginning. As the full extent of the coronavirus forced shutdown coma emerges, with the US economy locked down indefinitely, the long awaited moment when the corporate bubble bursts has finally arrived, appropriately enough with a bang, and as thousands of companies suffered an unprecedented cash flow collapse and slowly make their way toward their nearest bankruptcy court, they first have to be downgraded.

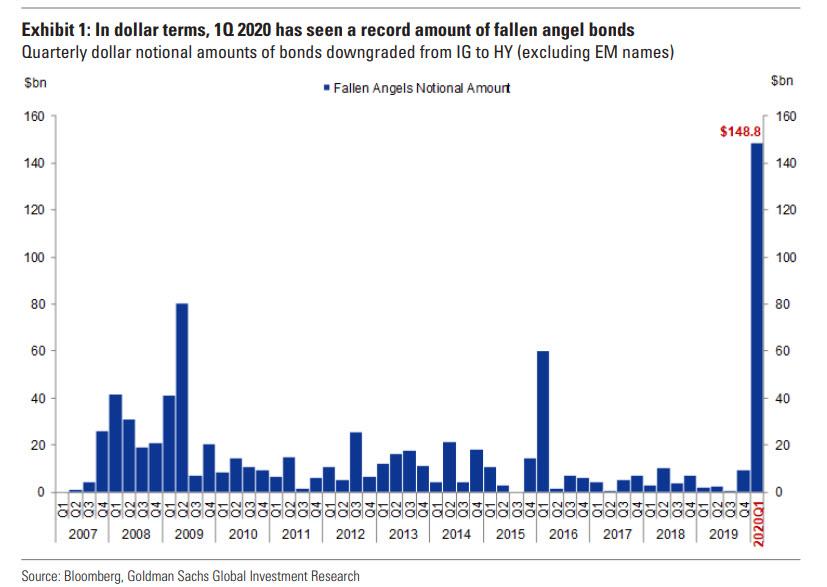

And that’s exactly what is happening as the pace of rating downgrades has materially accelerated over the past few weeks. As shown below, Goldman analysts find that the amount outstanding of newly minted fallen angel bonds has jumped to $149 billion this quarter, a higher amount than the previous peak reached in the second quarter of 2009 (though comparable when scaled back by the overall size of the IG market). The downgrades have been quite concentrated, with three issuers out of seventeen (Occidental Petroleum, Kraft Heinz, and Ford) accounting for roughly three quarters of the overall amount of downgraded bonds.

At the same time, the pick-up in negative rating actions has also been visible within the broader IG and HY markets. In total, over $765 billion worth of IG and HY-rated bonds have experienced at least a single notch downgrade by at least one of the three major ratings agencies, so far this year.

Now that the angels are in freefall, just how bad could it get? To assess how much fallen angel risk remains in the IG market, here are some observations:

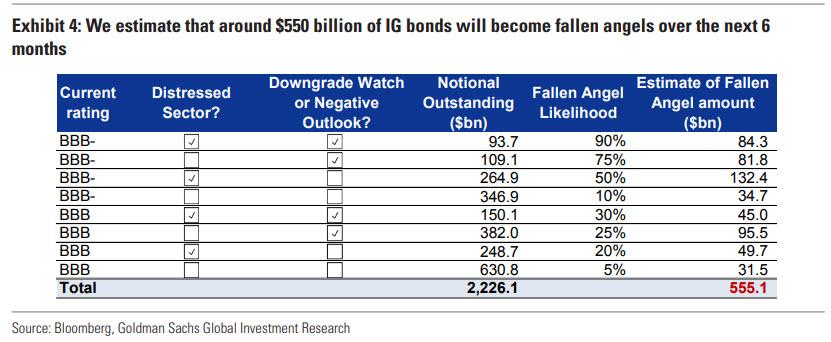

- First, focusing on bonds with a notch rating of BBB or BBB-. Historically, 97% of the bonds downgraded from IG to HY were rated BBB or BBB in the quarter prior to the downgrade. This initial step results in a universe of bonds worth $2.2 trillion (including both index eligible and non-eligible bonds).

- Second, Goldman classifies industry groups into two categories: “distressed” and “non-distressed”. Examples of distressed sectors include Oil & Gas, Retail, Airlines, and Autos. Examples of non-distressed sectors include Tech, Pharma, Telecoms, and Utilities. While not every firm in a given distressed sector will necessarily be downgraded to HY (and vice versa), it is helpful to differentiate between sectors based on their sensitivity to the oil-virus twin shock.

- Third, for each rating bucket and industry category, the bonds that are either on Downgrade Watch or Negative Outlook are isolated .

With this final iteration, each rating bucket is divided into four subcategories based on the industry type (distressed vs. non-distressed) and Downgrade Watch/Negative Outlook (Yes or No). Using the above decomposition, Goldman assigns a subjective probability of downgrade into HY over a six-month horizon, for each subcategory. These probabilities range from 90%, for bonds in distressed sectors, on Downgrade Watch/Negative Outlook and rated BBB-, to 5% for those in non-distressed sectors, not on Downgrade Watch/Negative Watch and rated BBB. In assigning these subjective probabilities, we rely on some empirical stylized facts. For example, while unexpected downgrades do happen, the bank finds that around 75% of fallen angel bonds were on outlook negative or downgrade watch just prior to downgrade (though that figure has only been 67% in 2020).

As shown in the next chart, summing up across all the subcategories implies that a total $555 billion worth of bonds (in notional value) would migrate from IG into HY over the next six months, in addition to the $149 billion that have already been downgraded year-to-date. This amount represents 7.6% of the $7 trillion outstanding of IG-rated bonds, and 15.7% of the BBB bucket (again including both index-eligible and non-eligible bonds). For context, over the seven-quarter period encompassing the global financial crisis, from fourth quarter of 2007 to the second quarter of 2009, there were a total of $260 billion of fallen angels, representing 7.4% of the overall IG market.

That said there is some good news: recent policy measures, especially the Fed’s newly announced corporate credit facilities have reduced the risk of a substantial contraction in credit availability, however the persistence of the current downturn remains a key source of upside risk to Goldman’s $555 billion estimate of fallen angel bonds. On the positive side, government support for distressed issuers could result in a lower amount. Moreover, past experience shows that most managements on the verge of losing their coveted investment grade status typically fight hard to retain it by slashing dividends, suspending share buybacks, selling assets, etc..

Tyler Durden

Fri, 04/03/2020 – 13:20

via ZeroHedge News https://ift.tt/39ITENg Tyler Durden