The Fate Of Oil’s Torrid Rally Hinges On Trump’s Meeting With US Shale Producers Today: Here’s Why

Oil has staged a tremendous surge in the past 48 hours, largely on the back of speculation that Trump will “encourage” Saudi Arabia and Russia to pursue output cuts, even though as it subsequently emerged when Trump tweeted that the “hopes” to see an N-OPEC output cut, it was an “exaggeration” and wishful thinking more than statement of fact. However, whereas the initial rally – which send the price of oil soaring by 25% on Thursday, or the most ever – faded, the rally got a second wind on Friday following reports that the R-OPEC (Russia + OPEC) alliance of oil producers led by Saudi Arabia and Russia is set to debate production cuts of at least 6 million barrels a day Monday and consider inviting U.S. producers to participate, the WSJ reported citing OPEC country officials.

However, even that hypothetical best case outcome for oil bulls – and certainly the US shale industry – comes with strings attached, and the outcome of Monday’s virtual summit between OPEC, which Saudi Arabia effectively crushed one month ago when it decided to flood the market with oil, and non-OPEC nations “will largely depend on a discussion Friday between the White House and U.S. oil companies” according to the WSJ.

The reason: both Saudi Arabia and Russia are demanding that US shale producers, some of whom such as Whiting Petroleum have already filed for Chapter 11 protection yet continue to pump as normal, join the production cuts. As the WSJ reports, “Saudi Arabia and Russia won’t cut unless they get signals from U.S. producers they will reduce output, the officials said. But they added that official joint curbs would be more difficult to enact in the U.S. because of antitrust laws.”

Meanwhile, Trump appears to be left with the impression that Russia and Saudi Arabia will shoot themselves in the foot and cut production on their own:

President Trump said Thursday he had spoken to Saudi Crown Prince Mohammed bin Salman, and that he was hopeful that a truce could be worked out in the oil-price war between the kingdom and Russia. The president’s remarks sparked a record-breaking percentage climb in oil prices, with Brent and U.S. crude notching gains of 21% and 25%, respectively.

R-OPEC sees things differently, and while it is prepared to discuss output curbs of at least 6 million barrels a day Monday on a conference call, it plans on inviting oil producers from Texas and Canada, even though North American producers haven’t attended OPEC gatherings in many years.

Which means that oil producers will only cut if US shale cuts too. As a result, the outcome of Monday’s meeting – and the fate of the torrid oil rally – will depend on a gathering this Friday between Trump and top U.S. producers at the White House, and specifically on whether Trump succeeds in convincing US producers to curb their output to go along with OPEC.

Will he be successful? Whereas some US producers in Texas are pushing for statewide coordinated restrictions amid a ballooning oil glut, others see the rout as an opportunity to take less competitive players out of the market.

As the WSJ further reports, Texas is considering cuts of at least 500b/d, while the group of US, Canada and Brazil would cut a total of 2mmb/d. These cuts would come in addition to a 3mmb/d cut from Saudi Arabia’s current level, which however at a surge 12mmb/d, means Saudi would only reduce output to where it was in February. Finally, Russia would be expected to cut by 1.5mmb/d, which is more than Saudi Arabia demanded of Moscow one month ago when Russia pulled the plug on the deal.

In other words, the two variables here are whether Russia and shale will agree to substantial cuts. And while we await to hear what Moscow thinks, the question whether US shale will agree will depend on how confident US oil producers are that they will be bailed out by the Fed as Steven Mnuchin hinted yesterday, and if so, they will feel no urge to cut, ensuring that oil re-plunges on short notice.

At first blush, it does not look promising: speaking on Friday morning, Larry Kudlow effectively killed the idea that US shale will participate in shale discussions:

- KUDLOW: WE TALK TO RUSSIA, SAUDIS, NO NEED TO GO VIA OPEC

- KUDLOW: WHITE HOUSE TALKING TO RUSSIA, SAUDIS ON OIL

- KUDLOW: TRUMP TALKS WITH RUSSIA, SAUDIS WILL YIELD RESULTS

That said, in the 11th hour, a loophole to overcome any producer “unwillingness” to shutdown appears to have emerged: in what would be a major victory for OPEC, the WSJ reports that the Trump Administration has discussed a mandated shutdown of oil production in the Gulf of Mexico due to the coronavirus spreading among workers on offshore platforms.

It is unclear whether the proposal, which comes as several workers on oil platforms test positive for the new virus, is still under serious consideration. But shuttering gulf platforms over health concerns would also have the effect of curtailing U.S. oil production amid a world-wide glut of oil that has sent prices plummeting.

It would also mean that Putin wins.

https://t.co/dFWg5a6qS2 pic.twitter.com/KDuMCqdxGx

— RANsquawk (@RANsquawk) April 3, 2020

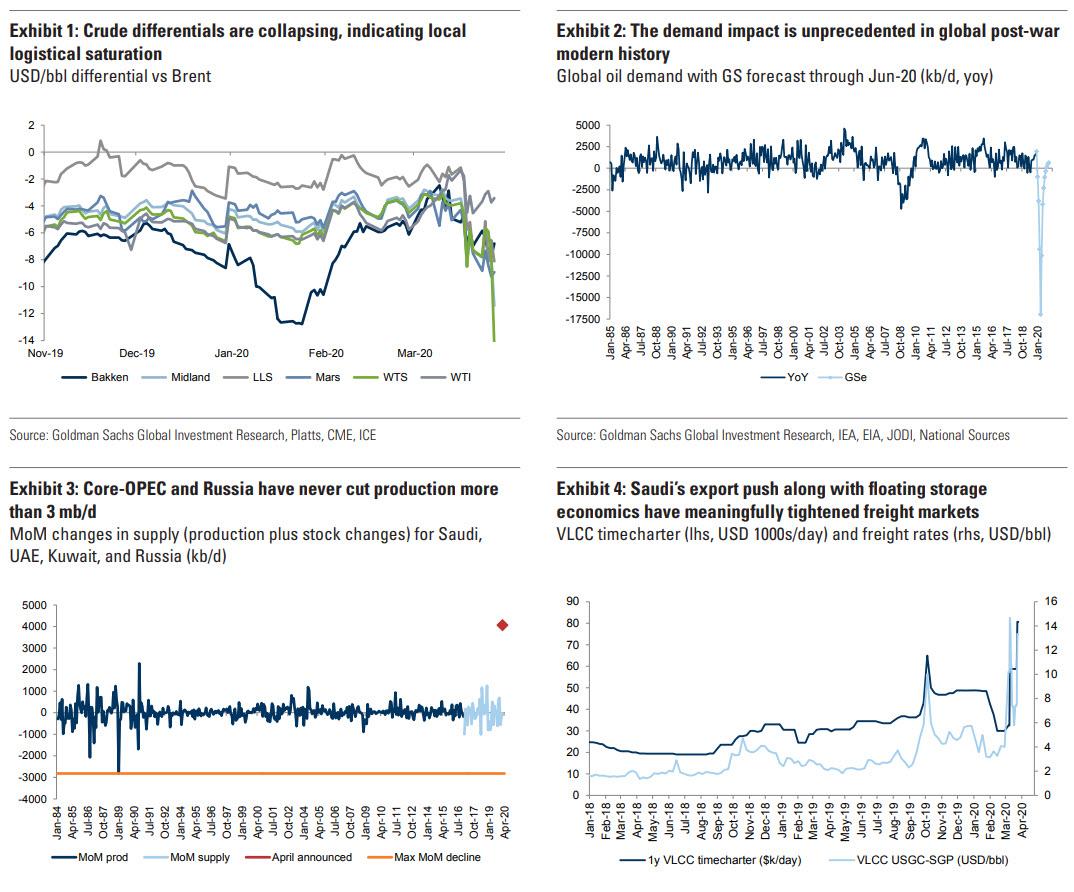

Finally, one big picture question: in a world where there is now as much as 26 million b/d in less oil demand due to the coronavirus, will a 10 million barrel cut even make a dent? That’s the point raised in Goldman’s latest analysis.

In a note published overnight, the bank’s commodity analyst Damien Courvalin writes that “even if a deal was to be reached, we believe the coordination required would lead to an only delayed and gradual implementation. Given the size of the current demand hit of 26 mb/d and the growing signs that isolation policies are being extended globally, such output cuts are in our view necessary rather than voluntary. This is important as coordinated supply cuts only support prices if they precipitate or come in addition to the shut-in of production that would have otherwise occurred once logistical saturation proved binding.”

Paradoxically, aggressive voluntary or necessary supply cuts and a subsequent market deficit would benefit shale producers given their highly pressurized wells and short drilling times. Such output flexibility is unique to shale and core-OPEC/Russia, implying that the coronavirus led demand collapse may ultimately benefit shale and low-cost producers alike, turning on its head once again the just started Revenge of the New Oil Order.

And because of the already occurring demand collapse, “a coordinated response is therefore likely to be too little to late for inland crude markets, especially in North America, leaving local prices to have to retrace their recent gains. In particular, we believe that a speculative led WTI rally that would delay such a rebalancing would quickly prove self-defeating with our 2Q price forecast still $20/bbl.”

Tyler Durden

Fri, 04/03/2020 – 10:30

via ZeroHedge News https://ift.tt/3bZHnWz Tyler Durden