“No One Has Ever Seen This Before”: With Companies And Analysts Flying Blind, Q1 Earnings Massacres Loom

It’s appearing as though Wall Street hasn’t quite prepared for what is coming down the pipeline, as companies across the board prepare to blindside analysts with upcoming earnings reports.

Walgreens, this morning, was a perfect example. Everyone believed they were a company that was coronavirus-proof, yet the stock fell after the company admitted it was still seeing decreasing foot traffic – even after the company beat its earnings estimates.

In the age of the coronavirus, almost all analysts are “flying blind”. And this is likely to lead to some shocks from earnings reports that will be felt across the street. Many companies have already admitted publicly that they have no clue where the pandemic is going to take their business.

Which raises the question of how there’s going to be any price discovery; not just from analysts trying to set estimates, but from the market trying to price companies as a result of their Q1 numbers.

Yousef Abbasi, global market strategist at INTL FCStone told Bloomberg on Thursday: “Things are changing drastically day by day because no one has ever seen this before. It’s almost like calling out an arbitrary number because the fundamentals are broken.”

It’s not a question of whether or not there will be a drubbing across the board for all corporations. The question is how bad it is going to be. Only about 17% of all earnings estimates across the S&P 500 were revised last week. This compares to an economy where almost 100% of businesses are shut down – and where those that aren’t shut down will definitely be feeling an impact.

Jonathan Golub, chief U.S. equity strategist at Credit Suisse said:

“While analysts are updating their numbers much more frequently than normal, their estimates remain stale. This pattern will likely continue until the start of earnings season, and beyond.”

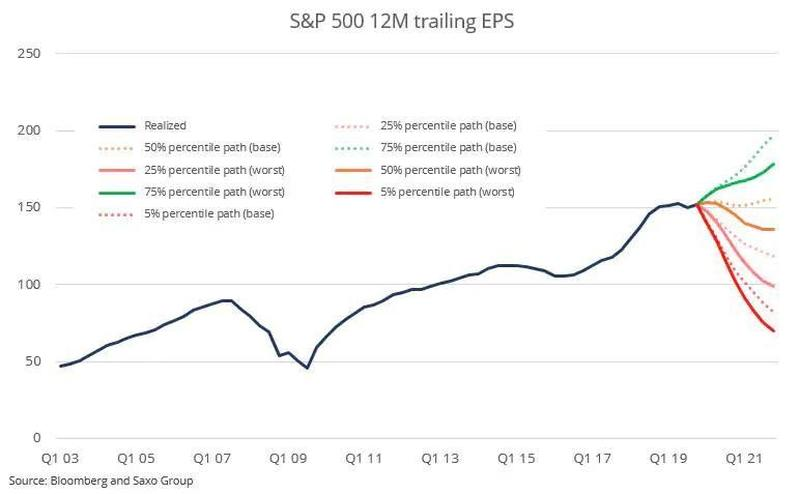

In addition to having no clarity on individual companies’ earnings, analysts have little clarity on how the S&P is priced as a whole right now, namely because the “E” in the index’s P/E ratio is up in the air. 54 names in the S&P 500 have withdrawn guidance since February.

Keith Gangl, a portfolio manager for Gradient Investments said:

“Any name’s got five to 30 analysts setting the consensus – we can know whether companies are underperforming relative to estimates. But now, everybody is taking a stab in the dark.”

Gangl said that he is instead going to be listening to the tone of executives on each company’s respective conference call. Again, to look back at our Walgreen’s example this morning, it was this commentary that moved the stock – not the numbers.

Bryce Doty, senior portfolio manager at Sit Investment Associates Inc. said: “The earnings coming up are probably going to be the most unpredictable or worst estimates we’ve ever seen in the history of this country. It’s a completely different world. Anyone who lived through the financial crisis can’t think the way they did then. It’s a whole new ballgame now.”

And despite the appearance of a haircut in the S&P 500’s P/E multiple, the broad range of outcomes going forward almost assures significantly more volatility in months ahead.

Aaron Clark, portfolio manager at GW&K Investment Management, has looked deeply at the worst affected industries, including travel & leisure.

“It’s more balance sheet analysis than income statement analysis. Have they tapped their credit line, how much liquidity do they have, what’s their interest coverage, when is their debt coming due?” he said.

Paul Markham, global equity portfolio manager at Newton Investment Management agreed: “What you really do in this environment is disregard the first quarter of 2020 and then normalize the earnings.”

He concluded:

“What would be more appropriate is to take the final three quarters and annualize those for the year or to replace the first quarter with something which is very significantly haircut, but not a negative or low earnings number because it’s not necessarily going to be repeated.”

To which we reply “Sure, Paul, but what kind of alchemy do you employ when Q2 and Q3 turn out to be worse than Q1?”

Tyler Durden

Sun, 04/05/2020 – 12:35

via ZeroHedge News https://ift.tt/3aNRWvE Tyler Durden