2008 Playbook Update: What’s Happened So Far…

Submitted by Nick Colas and Jessica Rabe of DataTrek

Three points to cover today:

-

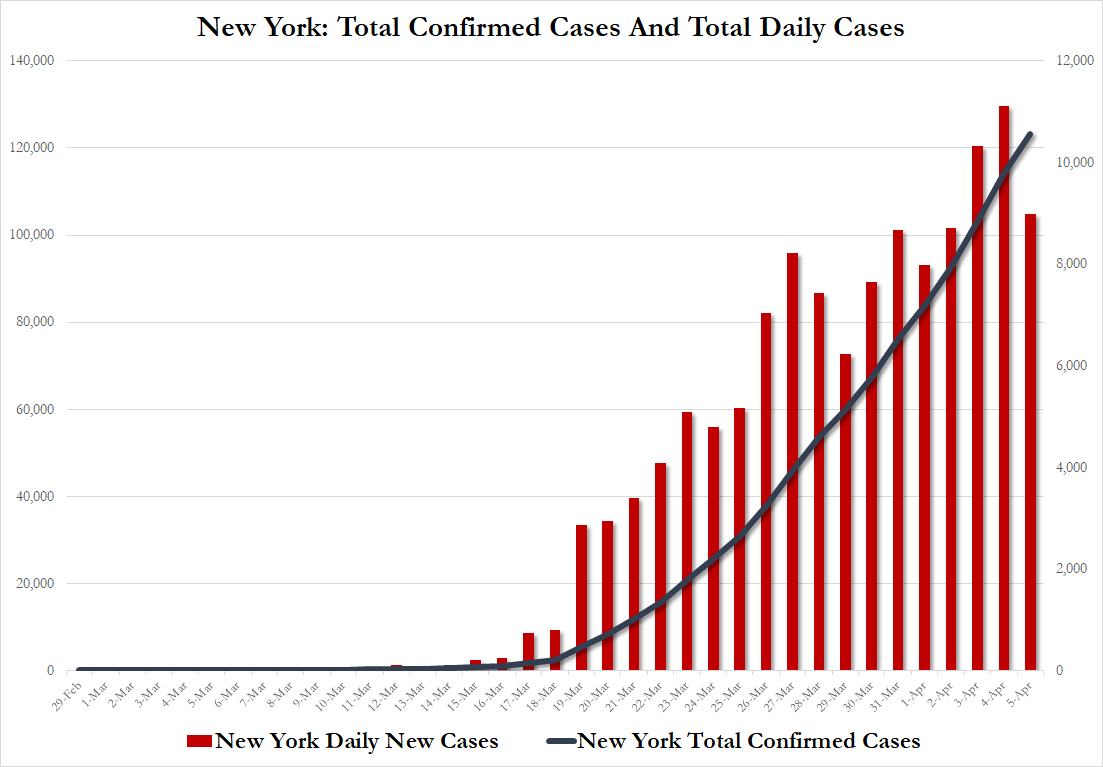

New York City is bracing for “Peak COVID-19” this week but there are hopes that we can avoid the worst-case outcomes.

-

The 2008 Playbook calls for 2-3 weeks of volatile stability for the S&P 500.

-

The 1973/1974 history is another guide for what happens when investors reset corporate earnings expectations sharply lower: a 2-year bear market and a 37% decline (just like 2008).

#1: Update from New York City:

-

Driving around town doing food shopping yesterday we saw very few people out and about. The local supermarket was well stocked (ex cleaning supplies and TP, of course).

-

Even the hardiest local store owners are increasingly choosing to close up for now. Our local corner bodega, owned/run by 2 Korean families, has been shuttered for a week. They are normally open 24/7/365.

-

Overall, the city is amazingly quiet. Anecdotal evidence says Manhattan families have left New York to isolate themselves at weekend/rental properties outside the city with more room for their children. Younger single New Yorkers, in many cases reliant on the city’s hospitality/services industries, have gone home to be with their families while they wait for unemployment checks.

-

Many businesses and individuals are simply not paying April rent, and obviously May is not looking good either. There is lots of chatter about apartment buildings with heavy Airbnb exposure that will see many broken leases in the coming weeks.

Bottom line: New Yorkers actually go into the week with some modest hope that our peak-infection/hospitalization rate, due in the next 7-14 days, may not as be as bad as the worst-case scenarios. That’s what the latest data says, anyway, and no one will be happier than New Yorkers if the models prove dramatically incorrect. Anything better than awful will feel like a huge win at this point.

#2: 2008 Playbook Update: what’s happened so far…

-

19 days into 2020’s COVID-19 Crisis the S&P 500 is down 9.4% from March 9th, the first down +5% day of this period that we use as our starting point.

-

That is roughly half the 20.8% decline from September 29th, 2008 to October 24th, 2008, which had the same number of trading days as the 2020 comparison noted above and also started with a down +5% day.

-

The reason for that better 2020 performance is the speedy response by the Federal Reserve and Congress to address financial market liquidity concerns and household/business cash flow stresses.

-

Last week’s daily changes in the S&P 500 closely mirrored the ones from October 20th – 24th 2008 (the analog week then-to-now) in freakishly similar fashion: Monday (+4.8% then, +3.4% now), Tuesday (-3.0%, -1.6%), Wednesday (-6.1%, -4.4%), Thursday (+1.3%, +2.3%) and Friday (-3.5%, -1.5%).

-

The net result: in the 2008 Financial Crisis, the S&P fell by 6.8% in its comparable week to now; in 2020, the decline was 2.1%.

And what it says to expect over the near term:

-

Over the next 2-3 weeks: a lot of volatility that doesn’t really take us anywhere. In 2008’s comparable period the S&P ranged from 877 (the equivalent of Friday’s 2,489 level) to a high of 1,006 (+15% over 7 days) but closed the 3-week sequence essentially unchanged at 873.

-

Worth noting: the analogous 2008 forward 3-week period to now includes a US general election, where the S&P 500 dropped 10% over 2 days right after Barack Obama’s win.

-

Also worth a mention: the 2008 lows came in the week after the 3-week holding period we’re describing here. The S&P 500 fell 14% from November 14th to the 20th and bottomed on the latter date at 752.

Takeaway: even if 2020 continues to run a half-the-damage version of the 2008 Playbook, the next 2-3 weeks will still see pronounced day-to-day volatility and no net change in stock prices at the end of that period, but… The 2008 experience says to expect a fast flush after this, which:

-

If 2020 holds to its 50%-as-bad ratio would take the S&P 500 to 2314 (down 7% versus down 14% in 2008). That would be a minor new low from March 23rd’s close of 2,237.

-

If 2020 hews more closely to the 2008 final flush, that would take the S&P 500 to 2,140 (the full 14% drawdown from Friday’s close).

#3: 1973/1974 Playbook

-

You have to go back to the 1973 – 1974 oil shock to find a time when investors had to reset corporate earnings expectations because of a truly unexpected and profound exogenous shock. It is an imperfect comparison, of course, to now.

-

We got to wondering how the S&P 500 traded starting in October 1973 through December 1974.

-

At the start of October 1973, the S&P 500 was already down 8.1% on the year.

-

As the Saudi oil embargo kicked in during October and through the rest of 1973, the S&P fell by a further 10.0% through year end. Its total return in 1973 was -14.3%.

-

The index then fell through most of 1974, bottoming in October down 36% on the year before rebounding 10% to close the year with a negative 25.9% total return.

Takeaway: as we’ve highlighted regularly since the virus crisis started, the S&P 500 at 2,500 expresses essentially 100% confidence that structural corporate earnings power remains solid. That level is 21x trailing 10-year average S&P 500 earnings of $122/share; in 2009 we bottomed at 10x trailing S&P earnings.

Pulling these 3 points together:

-

New York City is not just the US epicenter of the virus; it is also Wall Street’s most-watched case study of peak health system stress and eventual economic recovery. Once the daily hospitalization rates start to convincingly stabilize (1 to 2 weeks away), the conversation will inevitably shift to restarting the city’s economy. How that happens and at what pace will be the market’s template for the rest of the United States.

-

Any local NYC or national restart will be unpredictable in terms of cadence and industry-specific fundamentals. Some days will bring good news, others bad. That narrative fits with the 2008 playbook of volatile meandering over the next 2-3 weeks.

-

The 2008 and 1973/1974 Playbooks highlight what we need to avoid: a wholesale market rethink of corporate earnings power. The effectiveness of US fiscal and monetary stimulus will need to act as the counterweight to those concerns until the domestic economy starts to come back to life.

Tyler Durden

Mon, 04/06/2020 – 08:18

via ZeroHedge News https://ift.tt/3bS84MH Tyler Durden