3Y Auction Tails On Muted Buyer Demand Despite Unlimited Fed QE

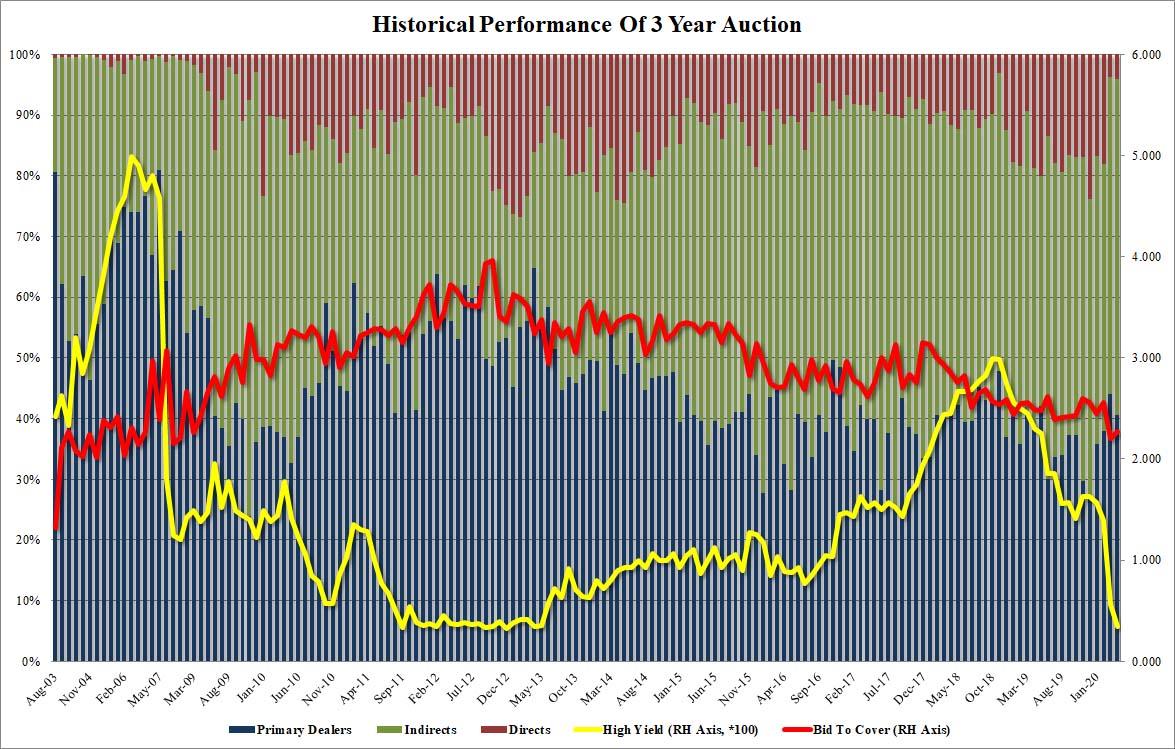

Last month’s 3Y auction, which tailed by 2.7bps or the most in at least 4 years, was ugly as a result of the total chaos that hit the market in the second week of March as both the oil price war and the corona pandemic hit at the same time, and led to a liquidation in both bonds and stocks, certainly not sparing the 3Y auction.

April’s 3Y auction wasn’t quite as bad, and moments ago the US Treasury sold $40BN in 3Y paper – the largest offering for this tenor since April 2010 – it came on the backdrop of the Fed massively monetizing, well, everything, why is probably why despite the near record low yield of 0.348%, the lowest since April 2013, it tailed the When Issued by a much more modest 1.2bps.

The bid to cover also improved modestly, rising from 2.20 in March – the lowest since Dec 2008 – to 2.27, which still was the second lowest in 11 years.

The internals were in line, with Indirects rising modestly from 52.3 to 55.4, Directs taking down a modest 4.1%, which while up from 3.7% last month was still well below the 16% six auction average, and Dealers were left holding on to 40.5%, bonds which they will quickly sell back to the Fed.

In summary, a lackluster auction which despite the near record low yield tailed and the BtC was modest as foreigners showing muted interest. As a result, the 10Y yield rose to session highs after the auction and was last seen at 0.666%, the HOD.

Tyler Durden

Mon, 04/06/2020 – 13:16

via ZeroHedge News https://ift.tt/2RfOIsW Tyler Durden