Banks To Make Risk-Free Killing On Small Business Bailout: Fed Will Buy Payroll Loans Issued By Banks

And just like that, the big banks are about to make a killing (again) thanks to the Fed.

As a reminder, as part of the SBA and Treasury’s Payroll Protection Program plan to bail out small and medium business, it gave America’s banks and credit unions some $350BN in guaranteed cash to use to make loans to America’s struggling small and medium business, which proceeds would be use to fund payroll. However, in a bizarre twist, the banks were reluctant to pass through the money to America’s middle class, ostensibly due to concerns about the low rate on the loans (which was originally 0.5%, and was subsequently raised to 1%) and also concerns who these loans could be sold and/or repackaged to if and when the economy turned sour and banks were stuck holding hundreds of billions in NPLs.

Moments ago we got the answer, when the Fed announced it will start another bailout program to provide financing backed by the same loans being made to small businesses through the government’s coronavirus stimulus program.

“To facilitate lending to small businesses via the Small Business Administration’s Paycheck Protection Program (PPP), the Federal Reserve will establish a facility to provide term financing backed by PPP loans. Additional details will be announced this week”, the Fed said in a brief statement. “Additional details will be announced this week.”

Effectively, the Fed will establish a secondary market for loans guaranteed by the Small Business Administration’s Payroll Protection Program, and where the end buyer will be the Fed itself.

And so, what was supposed to be a no string attached rescue of America’s small business, the PPP program has now mutated in yet another massive handout to the big banks, who will collect servicing costs ranging from 5% for small loans to 1% for larger ones, using Treasury capital (no origination risk) and then immediately selling these loans to the Fed if they turn sour (no balance sheet risk).

While the Fed buying to loans would certainly free up bank balance sheet space to issue more loans (who in their right mind would be taking on more non-guaranteed debt, or debt that does not turn into a grant as the PPP loans do, just as the US economy slides into depression), the Fed’s involvement whereby Powell takes on all the balance sheet risk, begs a question: why are banks intermediating this process at all if all they do is convert Treasury capital into loans which they then sell to the Fed, and why doesn’t the Fed simply hand out the loans itself?

The answer is obvious: this is just another multi-billion dollar handout to the big banks, something which we discussed last week in “Banks To Make Billions On Small Business Bailout“:

The fees will vary with loan size: 5% for loans under $350,000, 3% for loans under $2MM, and 1% for loans greater than $2MM. The loans will not incur a capital charge.

This means that banks stand to earn as much as $17.5 billion – and $10 billion if one assumes an average rate of 3% – for doing something the government is incapable of doing: handing out hundreds of billions in loans/grants to America’s businesses in the shortest possible time.

However, back then banks would at least hold the loans on their balance sheet so they were providing a modest service. Now, they no longer taking any risk whatsoever, and are still going to collect up to $10 billion for what – having a website where people can apply for loans that will be sold right back to the Fed?

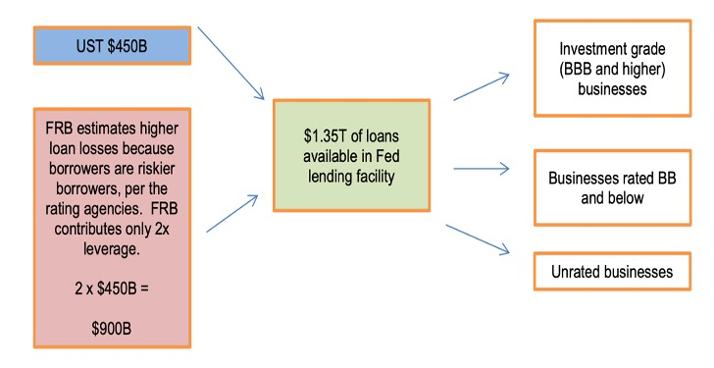

As for the Fed, recall that as we explained previously, it can issue as much as $4.5 trillion in loans direct based on how the fiscal stimulus package was structured, whereby the Treasury gives the Fed $454BN in “equity” which is then levered up to 10x in what Bloomberg defined as “A Multitrillion Dollar Helicopter Credit Drop“

It also means that the Fed will be tapped to buy hundreds of billions more in PPP loans as the current $350BN small business program will be woefully insufficient to cover the needs of America’s small businesses. Finally even assuming the full $350BN is entirely purchased by the Fed, that’s just a tiny 6% of the Fed’s $6 trillion balance sheet as of Friday.

That said, banks no longer have any reason to delay disbursement of loans as they can just be dumped to the Fed which is now a rescuer of first and last resort for America’s small and medium, and if for some reason the delays which prevent countless companies from operating, continue then America’s anger at the big banks will be fully justified.

Tyler Durden

Mon, 04/06/2020 – 14:20

via ZeroHedge News https://ift.tt/2JLE3Ci Tyler Durden