Gold Soars To 8-Year Highs As Stocks Melt-Up On Massive Short-Squeeze

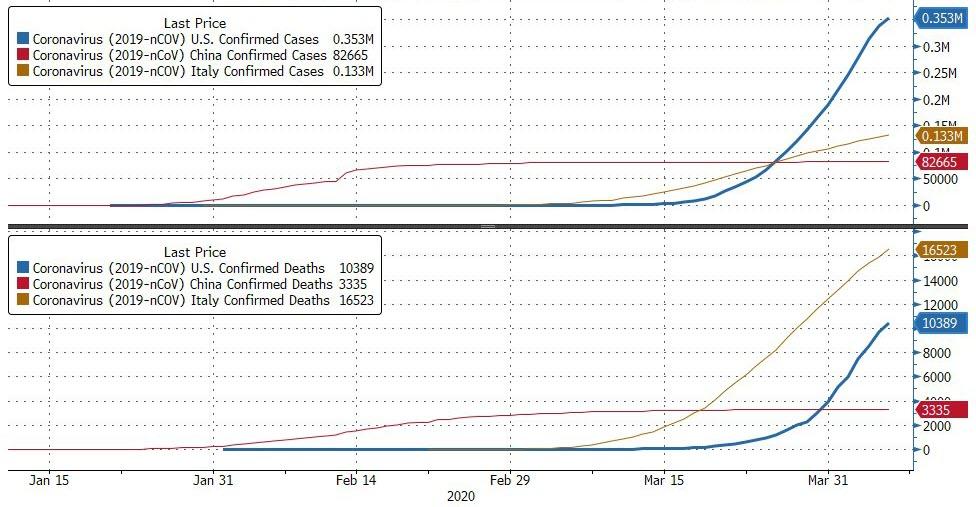

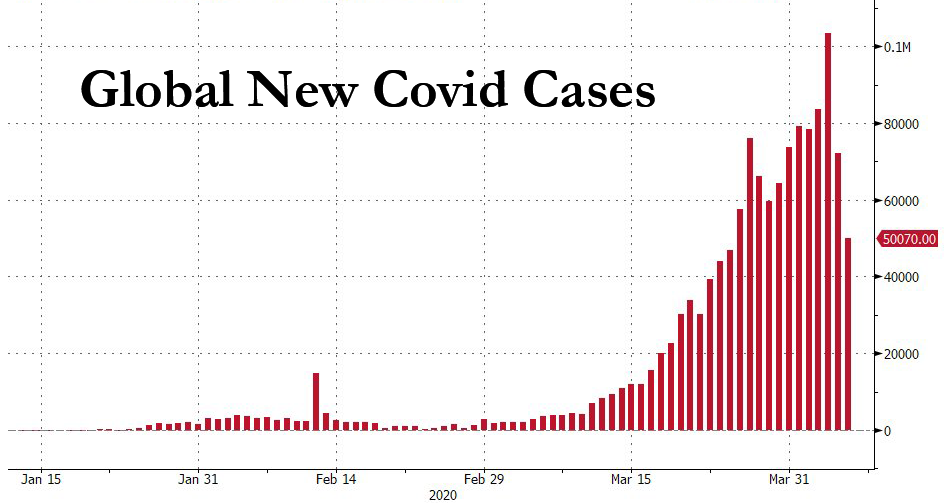

Some positive second-derivatives in various state and nation case- and death-count-curves appeared to spark hope in stocks…

Source: Bloomberg

Do you believe in miracles…

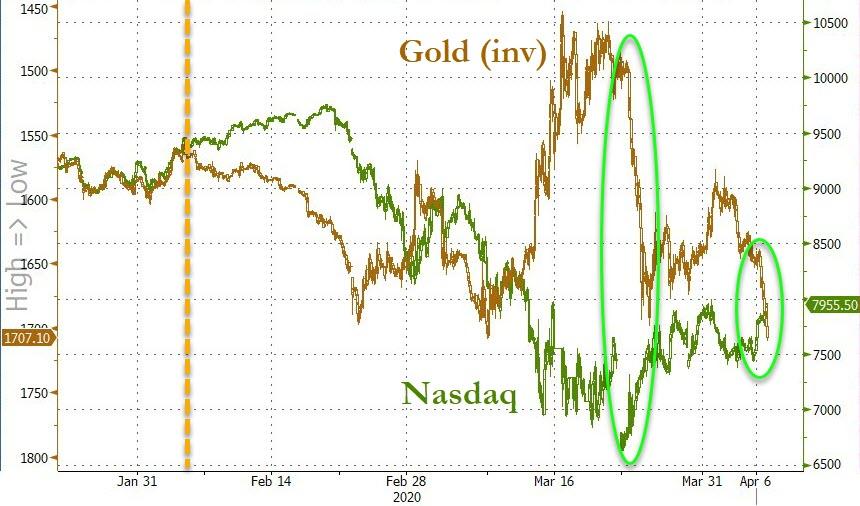

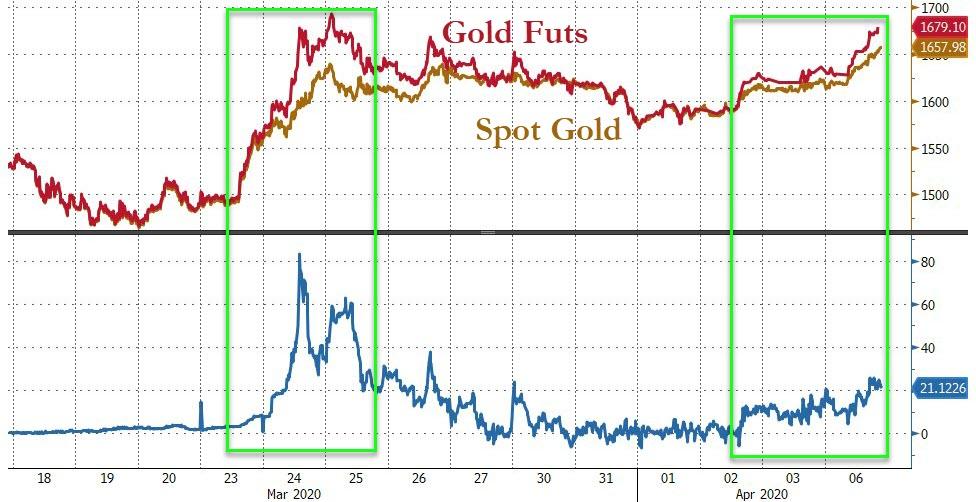

…but gold’s surge suggests more fear than hope (or more helicopter money)…

Source: Bloomberg

Live look at Dow futures pic.twitter.com/kLWZySZUu0

— Quoth the Raven (@QTRResearch) April 6, 2020

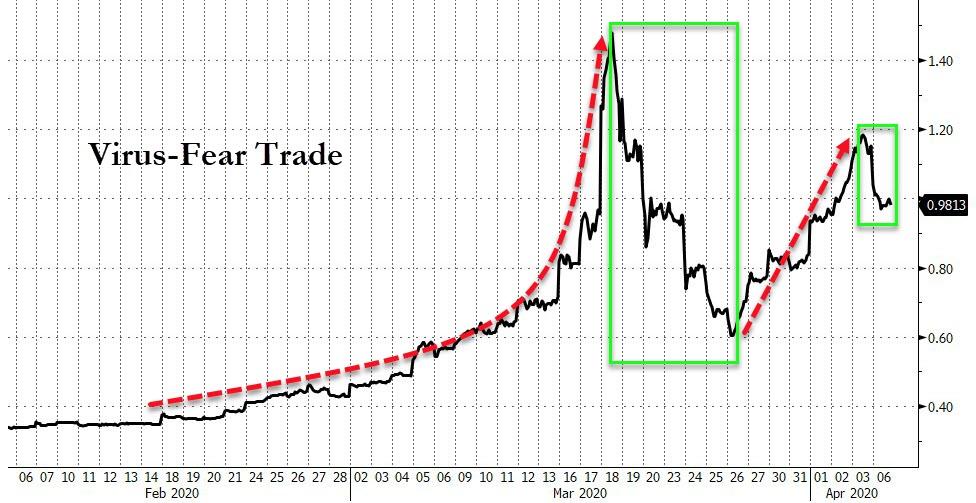

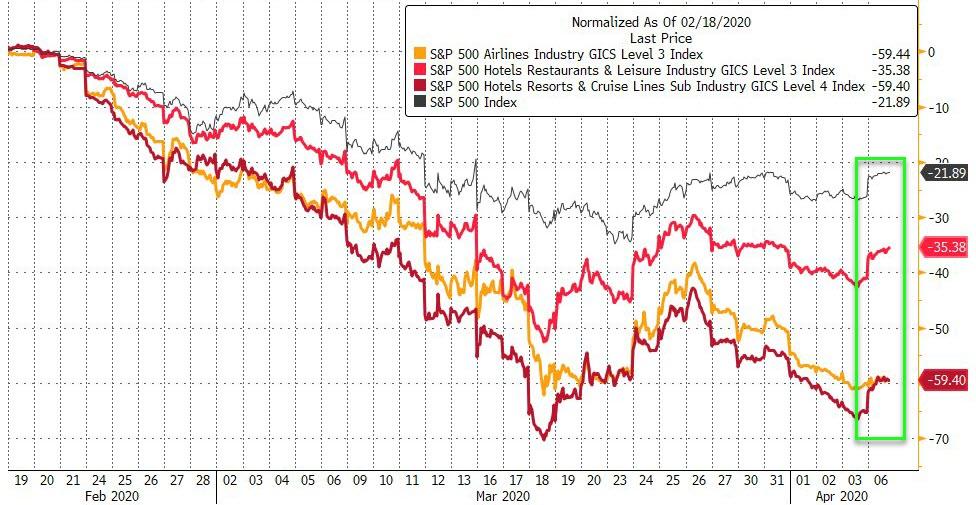

The ‘Virus Fear’ trade eased modestly today

Source: Bloomberg

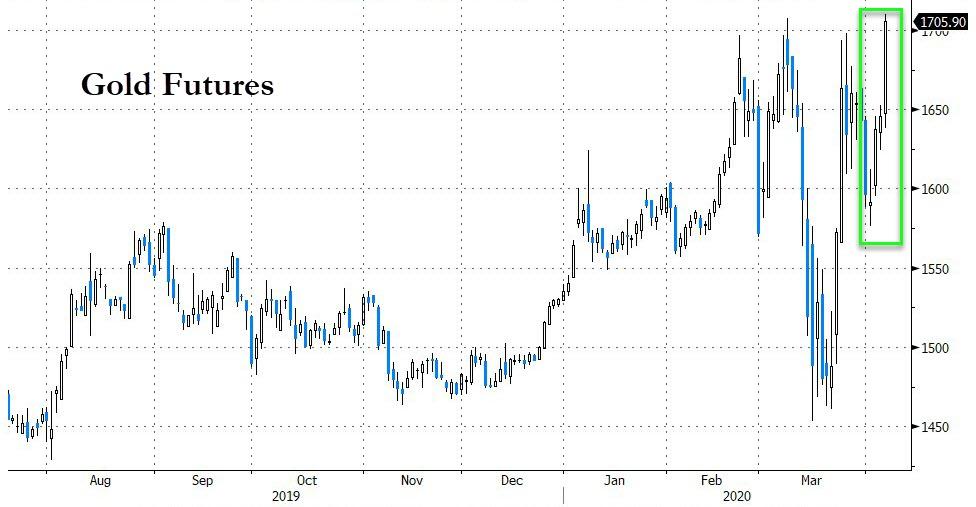

Gold futures finally broke above (and held above) $1700 today…

This is the highest gold futures price since Dec 2012…

Source: Bloomberg

“The virus is continuing to spread unchecked, especially in the US. US President Trump has warned that the population should prepare itself for two very tough weeks. This will further delay any normalisation of public life,” Carsten Fritsch, an analyst as Commerzbank, said in a note.

“The economic impact is already very serious … It is hardly surprising that gold is in demand against this backdrop.”

Rather notably, futures are leading spot once again and the markets are decoupling over physical shortages stress…

Source: Bloomberg

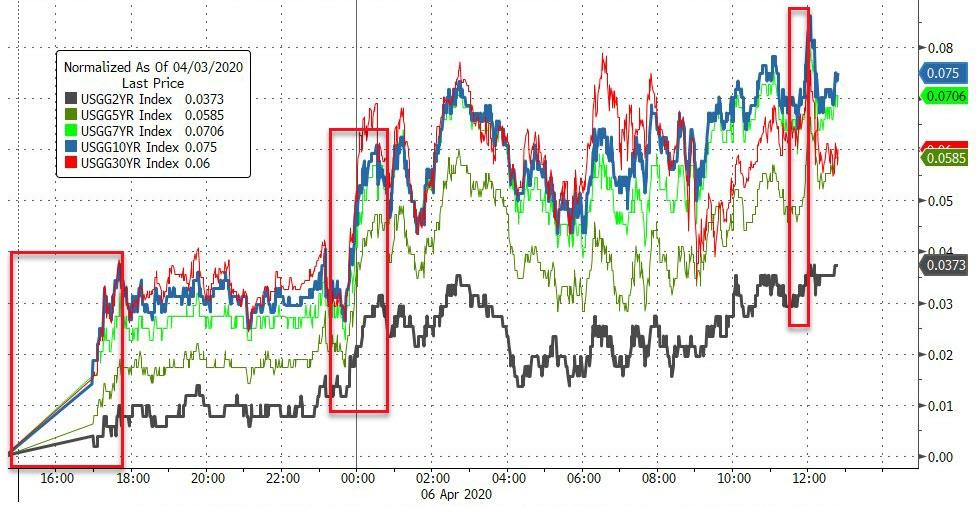

Treasuries were sold today (no safe haven bid) as stocks soared…

Source: Bloomberg

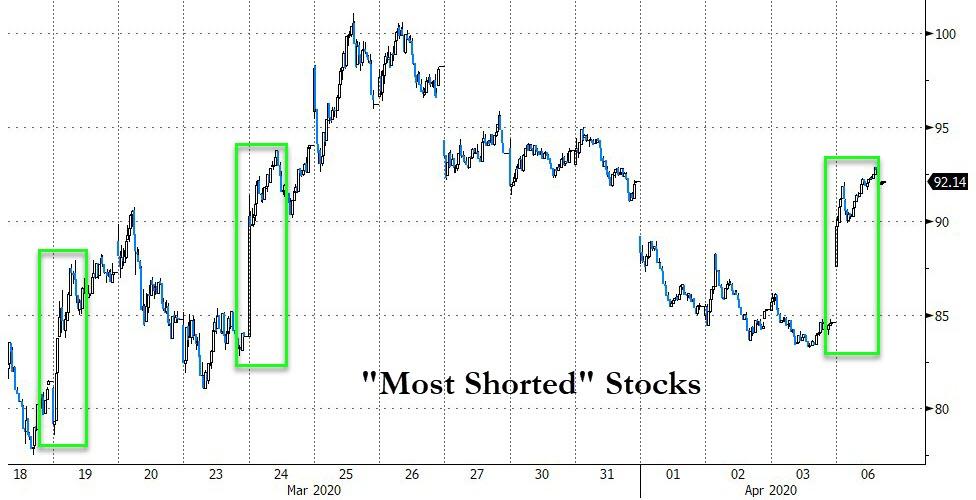

And today was a massive day for US stocks… all up around 8% with a mind-numbingly stupid meltup into the close on a $6.5bn MoC headline…

On the back of the second biggest short-squeeze ever…

Source: Bloomberg

Dow Futures (up 1700 points) perhaps show the algos’ preferences best as recent high stops were run…

Virus-impacted sectors bounced…

Source: Bloomberg

Banks also surged on the day…

Source: Bloomberg

VIX fell to a one-month low…

Treasury yields were higher across the curve today with 10Y yields up most (+7.5bps) and the short-end relatively outperforming…

Source: Bloomberg

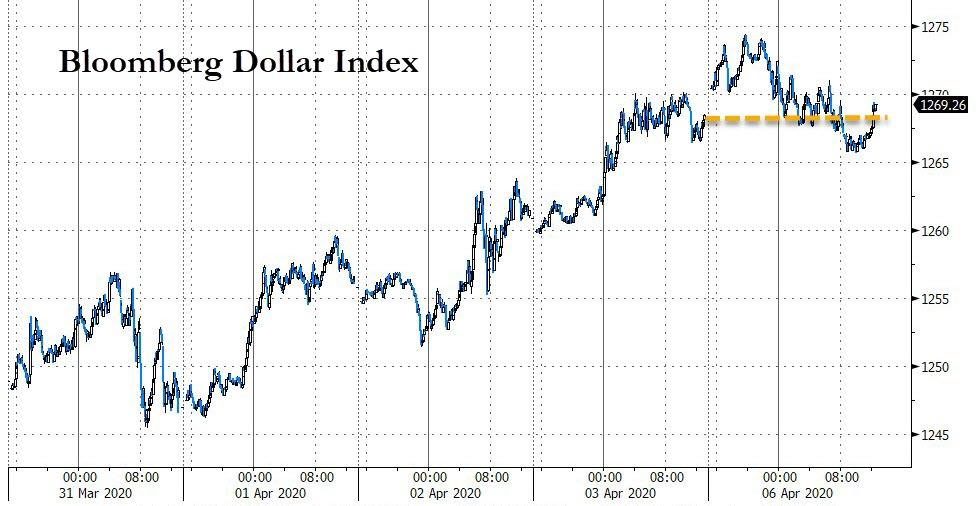

The dollar drifted lower to end unchanged from overnight gains…

Source: Bloomberg

Cable tumbled on news that BoJo was moved to ICU as his condition worsened…

Source: Bloomberg

With BoJo down (but not out), this seemed appropriate…

Cryptos screamed higher today, led by Ethereum…

Source: Bloomberg

Commodities were mixed with opil down hard, copper gaining and PMs strong…

Source: Bloomberg

WTI tried to rebound after the disappointing delay for the OPEC+ meeting sent prices sharply lower…

As Gold topped $1700, Silver surged back above $15

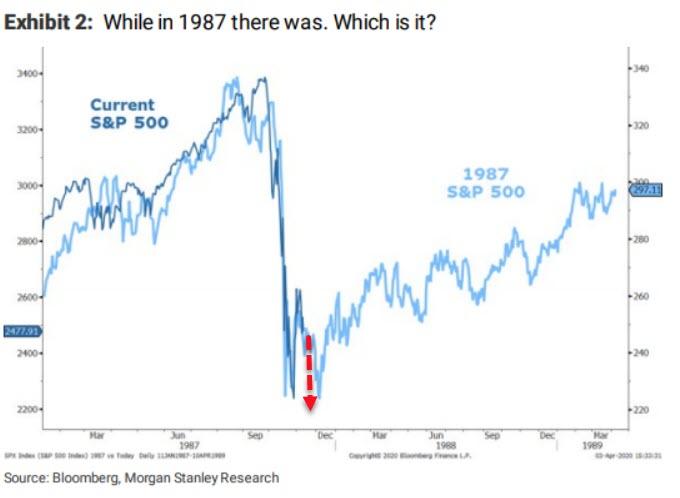

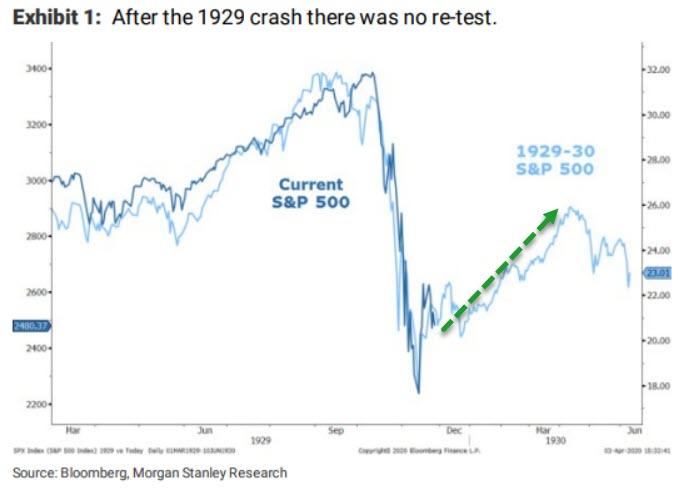

Finally, as we asked earlier – is it a retest of the lows?

Or no retest?

But an ugly ending…

Source: Bloomberg

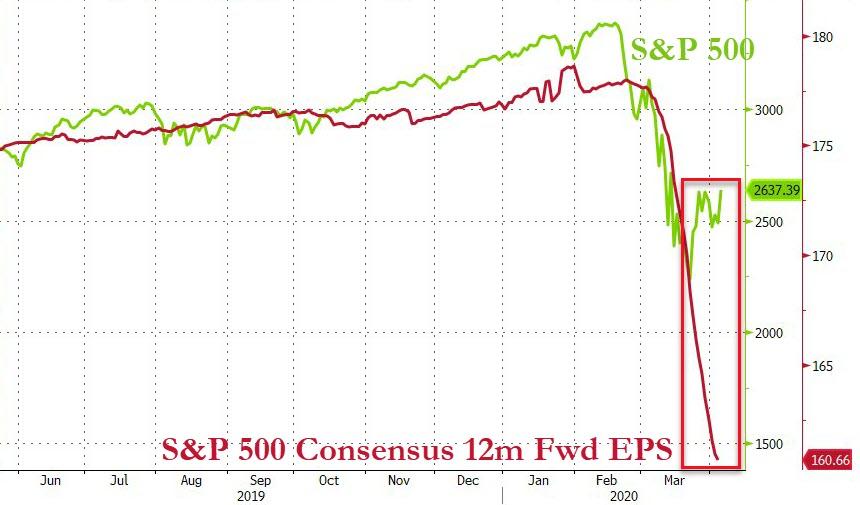

Of course, this is once again not about fun-durr-mentals…

Source: Bloomberg

Trade accordingly.

Tyler Durden

Mon, 04/06/2020 – 16:01

via ZeroHedge News https://ift.tt/2XgmW3w Tyler Durden