“Money Doesn’t Grow On Trees… It Floats On The Ocean”

“There’s oil all over the oceans right now. That’s where they are storing oil; we have never seen anything like that,” Trump, rather oddly bringing up such an archaic topic, said this week from the podium of the White House.

“Every ship is now loaded to the gills.”

And he was right.

With oil demand in freefall, traders are resorting like never before to using the world’s fleet of supertankers as temporary floating storage facilities, filling them with millions of unsold barrels until better times.

As Bloomberg’s Javier Blas notes, it’s an unusual trade, but one that’s among the most lucrative around right now, just when everyone on Wall Street struggles to make money.

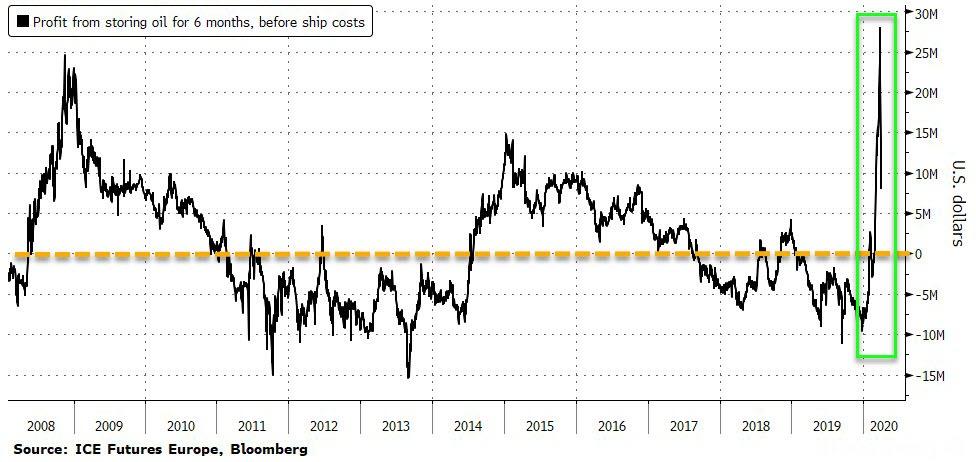

What Trump didn’t say is that the most intriguing facet of the floating storage trade is just how profitable it is. In the industry, it’s often described as a money printing press: traders buy oil on the cheap, and immediately sell their cargo forward in the futures market, locking in a chunky profit – with very little risk.

Before oil prices rallied on Thursday on talk of an OPEC+ output cut, traders were easily able to lock-in a 20% annualized return on their money.

In fact the profits from storing oil at sea have soared massively in March as money no longer grows on Wall Street trees, but lives on the oceans…

In fact, a week ago, Harris Kupperman, CIO and president of Praetorian Capital, that tankers “may be the greatest trade I’ve ever seen in my entire investing career,” going on to say there won’t be a better one in decades.

I have followed tankers for two decades now. Ever since 2009, every spike was short-lived as there was incessant oversupply. This one is truly different. No national leader wants to end lock-down too soon and then have people die. Instead, the incentive is to be as aggressive as possible with the lock-down, strangle the economy and look like they’re doing something to protect people from something terrifying that most people don’t understand. Which politician wouldn’t want to stand up there on national TV, flanked by important sounding people and talk about what they’re doing to protect you, while giving you free stimulus money? It’s the greatest election campaign ever. Even Trump is getting in on the act and we all know that he’s singularly focused on the stock market.

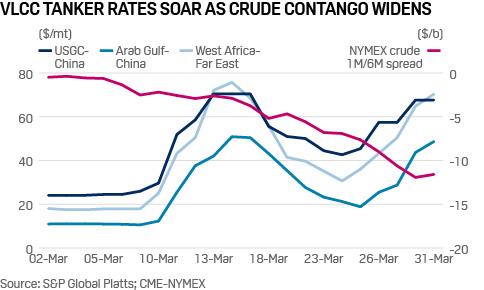

And sure enough, as Platts detailed earlier, some super tankers are being booked to store crude for up to three years – potentially the longest ever duration for floating storage – as traders seek to profit from hoarding oil to cope with the current oil demand and supply shocks. The race to secure floating storage has picked up significantly in recent weeks, with up to 40 VLCCs and 20 Suezmaxes already placed on long-term chartering, according to S&P Global Platts estimates.

“There’s been a huge interest in storage and that’s helped to lift freight rates,” said Halvor Ellefsen, a tanker broker at Fearnley’s A/S.

“The bottom line is that everybody in the shipping market is acutely aware of the contango, and the profits it can give traders.”

Freight rates and storage costs have ballooned as the market faces the prospect of more oil just as demand destruction due to the spread of coronavirus escalates.

This has raised the stakes over how the world’s biggest producers, the US, Russia and Saudi Arabia will confront the challenges of competition over market share, lower prices and potentially a lack of buyers for their crude.

“The world is overproducing oil at a historic rate,” said Robert Hvide MacLeod, the head of Frontline Management, one of the world’s largest operators of supertankers.

“Land-based storage is limited and selling out fast. Storage on ships will be the only solution.”

This tanker trade appears to have legs still, as Kupperman noted last week:

I know what the obvious next question is; what if the Saudis stop flooding the market? My response is, “who cares?” We’re all on lock-down. I’m watching out my window. Car traffic is down by half. Cruises aren’t going past my pool deck as frequently and air travel is down dramatically. We’ll eventually beat this flu, but by then, there will be billions of excess barrels to deal with.

The Saudis are a rounding error in all of this. Our government is saying this could go on for 18 months or longer. Are you kidding? Where will all the oil go? This is the time to be greedy on tankers.

Kupperman discloses that funds that he controls are long: DHT, EURN, LPG, STNG, TNK

Tyler Durden

Mon, 04/06/2020 – 13:25

via ZeroHedge News https://ift.tt/2XeqV0r Tyler Durden