“…More Still To Endure, But Better Days Will Return…”

Authored by Bill Blain via MorningPorridge.com,

It took less than 5 minutes for Her Majesty to put us right last night:

“..we may have more still to endure, better days will return, we will be with our friends again; we will be with our families again, we will meet again.”

As is becoming normal, the coming week holds out the prospect of good and bad news.

Despite the crisis point of virus being upon us over the Easter Break, authorities sound increasingly confident. Lockdowns look to have worked. It’s likely the numbers have peaked in Spain and Italy, and may even be topping out in London and New York. Over the next few days the narrative is going to start to shift from the immediate crisis to recovery. We will start to hear talk about relaxing lockdowns, selective reopening, and easing social distancing to start economies working again.

That’s the hope.

There is the likelihood of exuberant markets on the improving outlook – there is already a feeding frenzy going on in corporate debt on the back of the billions of Central Bank monetary QE infinity. There is a story in Bberg about accounts switching wholly into investment grade debt: Top Fund Manager is “Hoovering Up” Hugh Amounts of Cheap Credit.

The fiscal support packages announced by Governments are creating the illusion anything can be done to maintain the status quo. On top of them – markets are likely to read any positive news on containing the virus as a screaming buy signal.

Authorities acted fast to preserve jobs, keep the structure of economies together, avoid bankruptcies deepening the shock and addressed the many of the consequences of the shock including economic slowdown and individual misery and misfortune. There will be problems and delays in policy deliverables, but it was a fine effort by government.

However, the reality of the virus tragedy seems to have become completely detached from the euphoric world of financial assets. And that can’t be a good thing.

Despite the negative newsflow from overcrowded hospitals, and still rising death tolls, the market is likely to accentuate any immediately positive news while ignoring the long-term economic consequences of 10 million unemployed Americans? Massive job losses and slowdowns across Europe? Companies ending the stock buybacks that drove the last 8 years of rally? Dividends stopped around the globe? Rising risks around EM economies? Oil prices? Whole sectors of the global economy stopped?

Any rally at this point will simply be markets arbitraging the policy interventions and gorging on ever greater amounts of government support.

Cynical, but that’s pretty much what markets do now. Fundamentals don’t count when policy speaks louder and offers opportunities.

If all that monetary policy interventions have done is keep markets artificially high, and kept investors from suffering losses, while maintaining massive income inequality – then you have wonder if they are the right policies…

Someone in government might just realise…

Fire up the helicopters. Time for a new approach….

Going back to the virus and the real world: How quickly can we reopen?

The reality of how quickly economies reopen depends on what (often inadequate) testing shows, the experience of second wave infections, and how politicians respond to the changing public mood.

I suspect there will still be loads of assumptions made, but these will switch from a slowing the virus bias, to getting economies functional again. For instance, don’t be surprised if the UK decides to assume far higher infection levels occurred in the general population despite our lack of random testing, and makes assumptions such as UK rates being in line with observed rates in countries, like Germany, that did test.

Also expect more reliance on anecdotal data. A few weeks ago my Economic modeller chum, Robert Hillman of Neuron Capital asked why can’t the government mobilise a mobile phone app to get a better idea of the infection spread? If the nation can vote for X-Factor and Strictly on our phones, then why act on reported symptoms widely across the networks. (I understand apps are there to do so, but they are not being pushed at the population through mainstream media like the BBC.) Apps to improve contact tracing are also likely to come to the fore, despite civil liberty concerns.

There will still be virus trouble ahead. The threat of second waves remains, it has re-emerged in guest-worker dorms in Singapore, and the rising doubts about how honest China is being sharing data – whatever really happened in China, it does look like they got the transmission rate down close to zero.

Whatever the CIA accuse China of doing, the real picture in The Middle Kingdom is probably one of balancing a cautious reopening against an urgent imperative to get the economy open again, but leaving all the mechanisms in place to quickly test, isolate, contact track and quarantine any new blooms quickly (and quietly, to demonstrate the party’s wisdom).

Whatever the Chinese are, they ain’t daft.

Let’s be brutally honest:

we’re getting away with strict social distancing in the West because the public has been persuaded its virtuous. If the mood changes, in the light of further testing delays, how the news flow develops, then perhaps the mood changes. The very last thing the Authorities need will be a warm hot summer while the lockdown continues.

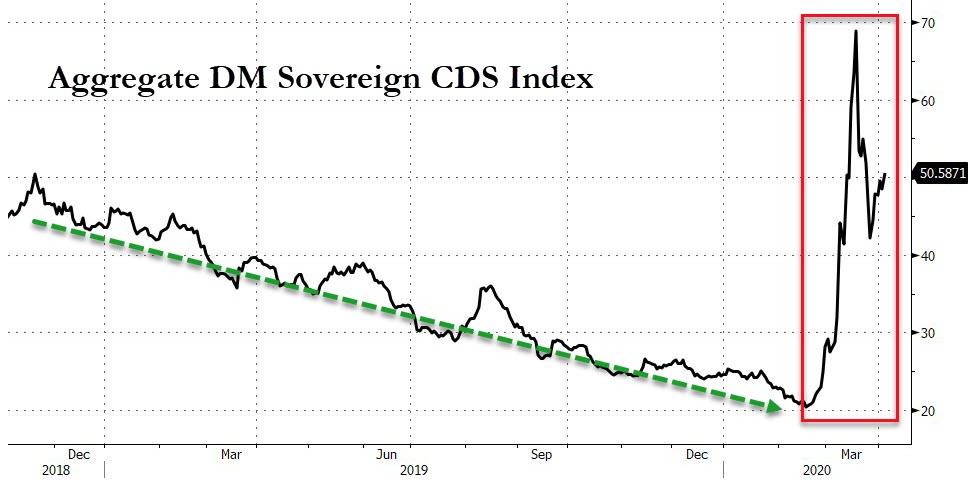

European Sovereign Credit

Back in 2010 the World Bank produced a report on sovereign debt to GDP. It theorised that a “tipping point” existed around 77% debt to GDP, where additional point of debt would cause a fall in growth. Low debt equals higher growth. At some point rising state debt starts to strangle real growth.

If you believe in Modern Monetary Theory, then that’s not going to be a problem. Countries should just print more and more money – with the important caveat they have to be able to print money.

All around the globe, we are going to see Debt to GDP levels rise in coming months. Most countries will deal with the crisis by printing money – playing off the threat of rising inflation against the massive deflationary shock the virus has caused. They will then hope to demonstrate growth and credibility to avoid money printing degenerating into a debt crisis or hyperinflation.

It’s not so simple in Europe

Members of the Euro don’t have that fundamental right to print money. They don’t hold the keys to the Euro printing presses. The ECB can collectively decide to allow members to borrow (but is effectively a political body), and has reluctantly agreed some effective transfers, but for all the talk of “ever closer union” there is no prospect of debt mutualisation or joint and severality for ECB borrowers. Even the much heralded Coronabonds now look unlikely to find agreement.

The ECB is buying members’ debt at incredible rates, but largely pretending it’s just market, and not de-facto money printing.

Despite the ECB dither, European Debt To GDP levels are going to rise dramatically in coming months.

-

Italy – 2019 Debt/GDP 135.6%. Estimate for 2020: 157%

-

Spain – 2019 Debt/GDP 96%. Estimate for 2020: 113.5%

-

France – 2019 Debt/GDP 99.2%. Estimate for 2020: 114.4%

-

Germany – 2019 Debt/GDP 59.2%. Estimate for 2020: 68.3%

Germany can afford to borrow (not print) more, which could help rest of Yoorp. The rest are clearly in trouble. How will Spain recover when 12% of its economy depends on tourism? Italy looks headed for a social bustup.

Let’s spice it up with European banking weakness. There is a great article by Elisa Martinuzzi of Bloomberg: Bankers are Sitting on a Vast Mountain of Risky Trades. It examines the billions/trillions of dollars European banks are holding in highly risky, unclear and illiquid lending. Is that a story you have heard before? Read the story, and figure out just how wobbly European banks are…

Put the following factors together and decide if you are a buyer of European debt: Rising Debt. Rising Unemployment. Banking System in Crisis. Reliance on Someone Else’s Currency. Prospects for Growth. Political Stalemate.

Do I have to spell it out?

OK then.

European Sovereign Debt crisis looming.

Tyler Durden

Mon, 04/06/2020 – 11:20

via ZeroHedge News https://ift.tt/34hh3UR Tyler Durden