Pelosi Tells Democrats Next Stimulus To Be At Least $1 Trillion As Goldman Predicts Explosion In US Debt

The SBA and the Treasury have yet to figure out how to distribute the hundreds of billions small business funds from the recently passed $2.2 trillion Phase 3 coronavirus rescue aid, and the US government is already planning its next, Phase 4 fiscal stimulus.

Earlier this morning, Goldman’s chief economist Jan Hatzius wrote that after Congress enacted three fiscal relief measures over the last few weeks – which provide aid to unemployed workers and state governments, payments to individuals, and loans and tax benefits to businesses – “further fiscal support for the economy looks likely to be needed”, and Goldman’s fiscal forecast assumes that Congress “enacts at least one more fiscal package” because the measures enacted to date, “are not yet equal to the lost income due to COVID-19 that we expect.”

In further explaining the need for a new stimulus round, Goldman said that “Congress might need to provide further funding for small business loans (and the related loan forgiveness program to subsidize wage payments), unemployment benefits, and fiscal aid to state and local governments” which face a substantial near-term revenue hit, as well as some additional funding for aid to small businesses. Another round of payments to individuals is also a possibility. That said, in most cases Goldman “would expect that many of the “Phase 3” policies that Congress might renew or expand will not be as large the second time around. For example, while there might be additional funding for small business loans, we doubt that Congress would provide as much in “Phase 4” as the $350bn it enacted in “Phase 3.”

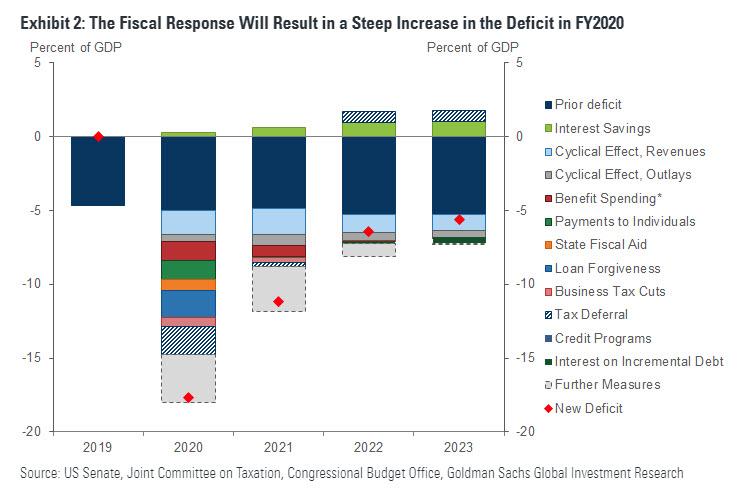

Altogether, Goldman expects this could add another $500bn (2.4% of GDP) to the deficit in the current fiscal year, and as much as $1.5 trillion (7%) more over the next couple of years.”

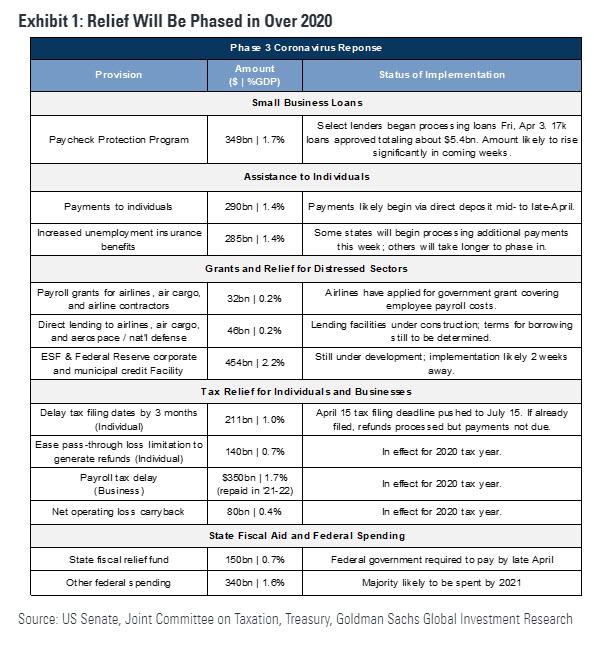

The total amount of fiscal relief that has been and will be passed, is summarized on the Goldman table below.

Perhaps more importantly, Goldman concludes that a new “Phase 4” fiscal stimulus round “is likely to face greater political friction than the recent legislation. Congress enacted the earlier measures on an emergency basis in a very short amount of time—by congressional standards—and without a full estimate of the likely fiscal costs.” As such the bank believes that future legislation “seems likely to take longer and we expect lawmakers to be somewhat more sensitive to further expanding the budget deficit.” That said, according to Goldman it is nevertheless very likely that Congress will pass additional fiscal measures; it would be politically unsustainable, in our view, for lawmakers to stay on the sidelines while the unemployment rate rises dramatically over the next few months. In terms of timing, since Congress will be on recess through late April, so enactment looks unlikely before May, at earliest.

And while few care about numbers, here is the bottom line: total fiscal stimulus will amount to an unprecedented 18% of GDP in 2020, and another 11% in 2021.

And, after all, why not? Now that the US is officially in helicopter money territory with the Fed monetizing whatever debt the Treasury will issue, trillions will soon become quadrillions.

And as if hearing Goldman, and its modest $500BN forecast for a Phase 4, on Monday House Speaker Nancy Pelosi told Democrats on a private conference call that the next stimulus bill will be at least another $1 trillion,

According to people on the call, the next stimulus package – never mind getting the current package in the hands of Americans – would be to replenish funds for programs established in Congress’s $2.2 trillion virus relief bill. And echoing Goldman, Pelosi said there should be additional direct payments to individuals, extended unemployment insurance, more resources for food stamps and more funds for the Payroll Protection Plan that provides loans to small businesses.

As Bloomberg report, Pelosi also said the bill will assist state and local governments, with an emphasis on smaller municipalities with fewer than 500,000 residents, one lawmaker said.

And while Pelosi said she wants the next stimulus bill to be passed this month, this doesn’t seem feasible as the House isn’t scheduled to be back in session until April 20 at the earliest. That said, it is possible to pass legislation with most members out of town, as long as no one objects.

Other sources such as Fox Business News’ Charlie Gasparino, report that the Phase 4 stimulus would be even bigger, “somewhere in the $1.5 trillion neighborhood.”

SCOOP: Wall Street sources briefed by Congressional leaders and @WhiteHouse say expect next round of #virus stimulus by May, and somewhere in the $1.5 trillion neighborhood. PLUS: IPOs have dried up and may not come back this year, exchange officials tell @FoxBusiness more now

— Charles Gasparino (@CGasparino) April 6, 2020

Meanwhile, confirming that bipartisan support is effectively assured, President Trump said Saturday he’ll ask Congress for more money for small business loans if the $349 billion already designated for the program runs out.

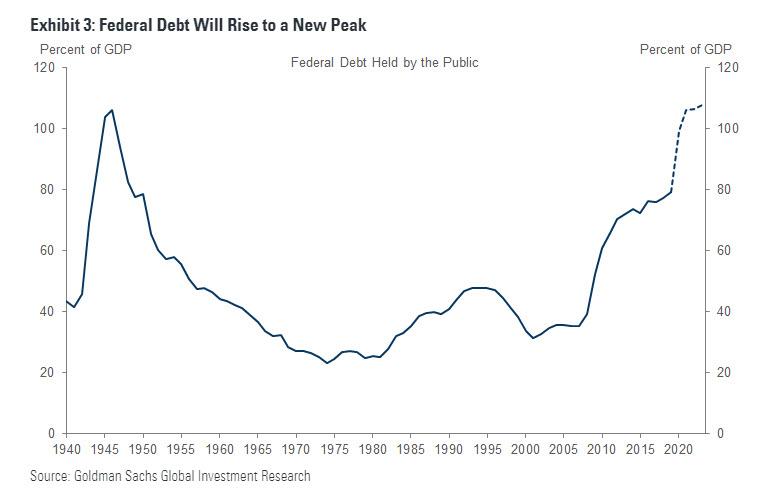

So who pays for all this generosity? Why future generations of Americans of course. As Goldman concludes, “the substantial increase in the budget deficit resulting from the economic downturn and enacted and expected policy measures will increase federal debt held by the public from 79% of GDP in FY2019 to 99% by the end of FY2020 and to 108% of GDP by 2023, just above the prior peak level reached in 1946.”

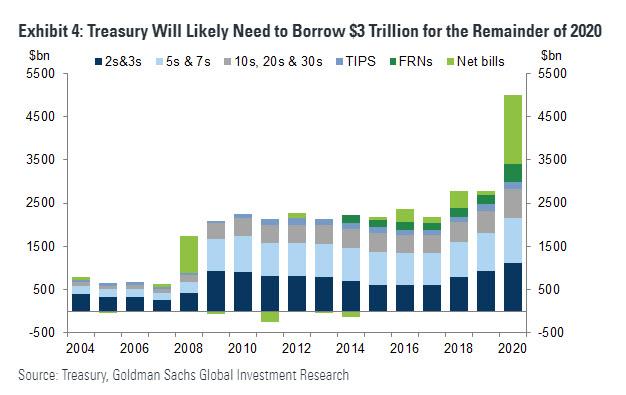

Said otherwise, when it comes to the US debt, the country is now under war footing as the Treasury will now have to borrow an additional $3 trillion for the remainder of 2020…

… amounts that are only conceivable if the US were currently under a state of war.

Finally, for those wondering how to trade the fiscal insanity that is currently being unleashed, well…

Glad to see both parties supporting gold $10k… https://t.co/LbCtc2b7Wb

— Kuppy (@hkuppy) April 6, 2020

Tyler Durden

Mon, 04/06/2020 – 19:34

via ZeroHedge News https://ift.tt/3aPdaJw Tyler Durden