“They’ve Left Me High And Dry”: Here Is The Real Reason Companies Have Drawn Down A Record $293 Billion In Revolvers

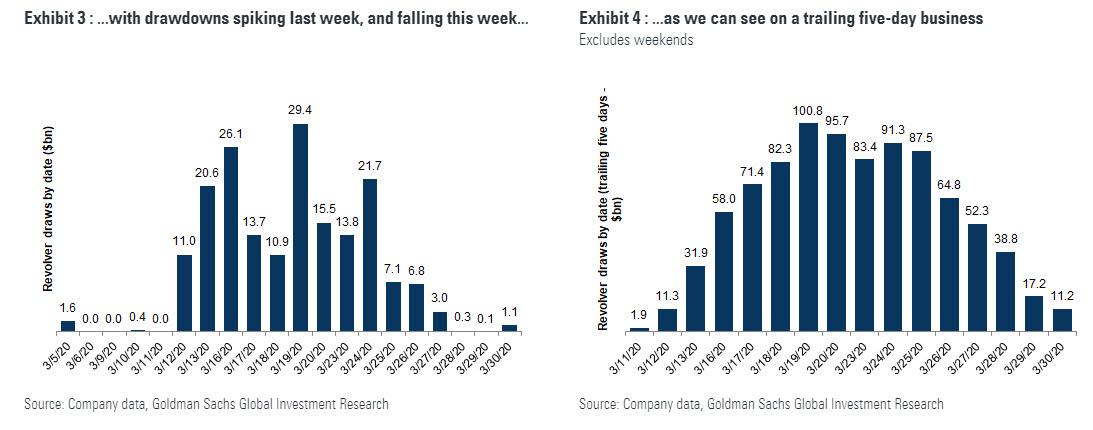

One week ago, we reported that starting exactly one month ago on March 5, an unprecedented wave of corporate revolver draws was unleashed, resulting in what JPMorgan calculated was a record $208BN in revolving credit facilities being fully drawn (for the full list of companies see here). A few days later, a report from Goldman Sachs observed that, contrary to JPM’s data of exponentially rising revolver draws, “the pace of revolver draws has slowed nearly 50% so far this week relative to last week, with only $40bn over the last 5 business days, relative to an average trailing 5 business days run rate last week of $75bn.”

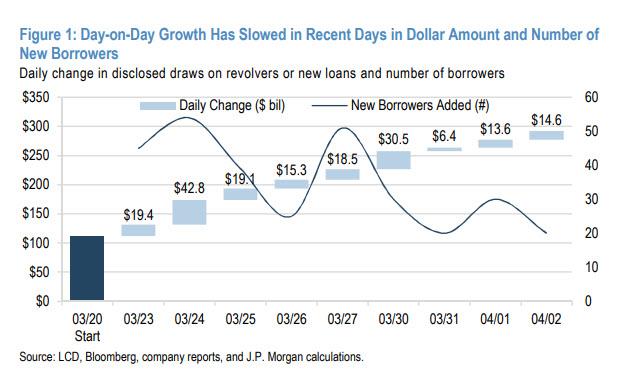

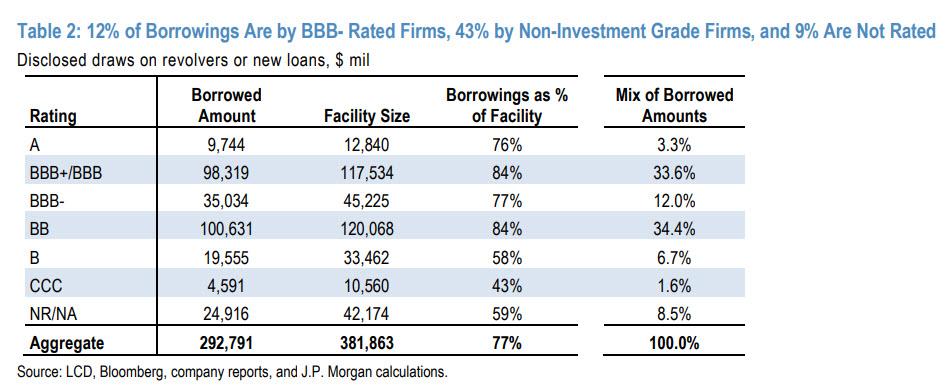

In retrospect, there may be reason to be skeptical about Goldman’s data because in JPM’s latest weekly revolver update, the bank’s tracker of companies that have tapped banks for funding rose to $293 billion to date (remarkably, $125 bil or 43% of total borrowings, are by junk-rated firms) an increase of over $80 billion in just one week, although just like Goldman, JPM notes that “while growth has continued, the pace seems to have slowed in the past three days, both in terms of amounts borrowed and number of borrowers (see Figure 1).”

In total, the nearly $300BN in borrowings represent 77% of their credit facilities, but as JPM notes, “some firms with asset-backed facilities may not have enough borrowing base to borrow the full committed amount.” Another observation: we are still seeing large draws but fewer mega-sized draws, which makes sense as by now most mega companies have already drawn down on their revolver.

That said, JPM cautions that the actual amount of borrowing is likely significantly greater than $293 bil, as it only reflects publicly disclosed amounts, mostly from larger companies, and likely excludes many middle market firms and privately owned companies.

Some more details on the ongoing drawdown flurry:

- $143 bil (49%) of announced borrowings are by investment grade firms, of which $35 bil (12%) are BBB- rated, $125 bil (43%) are by noninvestment grade firms, and $25 bil (9%) did not have available ratings.

- The $293 bil total excludes $48 bil of ongoing deals, rumored loans, and new facilities that are not clear if drawn for Airbus, AT&T, Daimler, Fiat Chrysler, Honeywell, Mondelez, and Simon Property Group. If these facilities are finalized and/or fully drawn, the known total would be $340 bil.

- In aggregate, the borrowings represent 77% of their credit facilities, but note that some firms with asset-backed facilities may not have enough borrowing base to borrow the full committed amount.

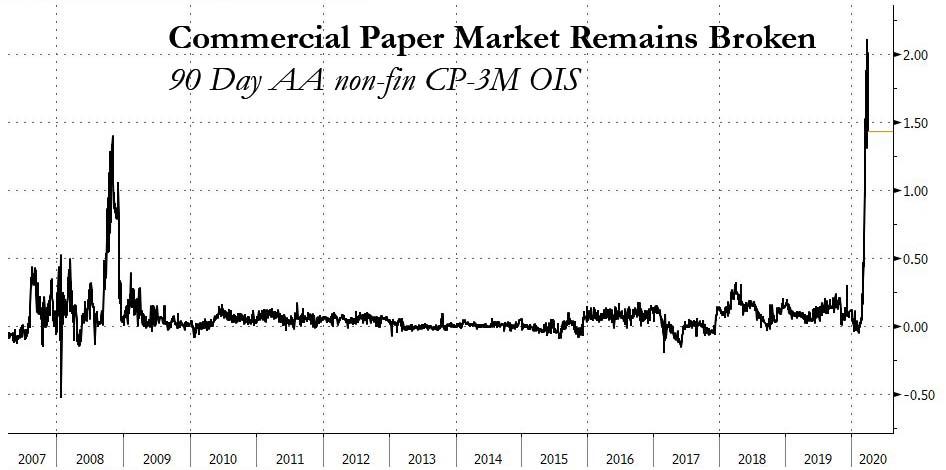

So why the continued rush to fully drawdown available facilities? The trivial, politically correct explanation is simply that the Commercial Paper market, where companies have traditionally gone to meet short-term funding needs, remains broken, and even though the Fed has already announced the launch of a Commercial Paper and Money Market backstop facilities, the Commercial Paper 90 Day AA non-fin spread to 3M OIS remains at levels well beyond the wides reached during the financial crisis.

In short, the Fed has much more work to normalize the CP market.

But rational as it may be, that’s not the reason for the panicked scramble to drain nearly $300BN in liquidity from the banks. Instead, the real reason is also the one that may well result from this drawdown panic as the banks themseleves suddenly find without liquidity and are forced to put themselves in quarantine from future liquidity demands: companies are increasingly worried their banks may shut them down and reneg on revolver contracts, refusing to give them access to facilities they have opened… or worse, banks may shut down period.

For a very vivid example of just that look no further than online lender Kabbage (backed, predictably, by the god of all catastrophic money-losing startups, Japan’s SoftBank whose implosion will be this bubble’s Enron and Lehman moment combined) which last week unexpectedly and without warning cut off credit to its small-business clients in the past week.

The borrowers, who range from software consultants to heavy-equipment contractors, told Bloomberg that Kabbage didn’t give them any notice, and that they learned their credit lines had been suspended only upon logging into their accounts. Some said they were counting on the money to get through the tough times ahead.

“This is very bad business ethics,” said Joydeep Paul, who runs Medserv Healthcare Solutions LLC, an emergency-medical training company in Princeton, New Jersey. He says his line of credit was cut from $22,000 to $0. “You just turn it off without saying a word — not an email, not a phone call, nothing.”

The irony is that just like countless “genius” investors who rode the biggest fake bull market in history – all on the bank of trillions and trillions in central bank backstops as the latest flurry of Fed actions has confirmed – online lenders spent the past decade touting themselves as the opposite of banks; however as soon as a real downturn hit and the gates came down. As Bloomberg reports, as the coronavirus pandemic ravages cities across the U.S., these nonbank lenders turned to a playbook that banks used during the last financial crisis more than a decade ago: reducing access to credit when the economy is contracting. Other lenders, including On Deck Capital Inc. and Fundbox Inc., have also tightened their underwriting standards or limited lines of credit.

“They’ve left me high and dry when I needed them the most,” Rob Jacques, co-founder of theCodery, a software consulting company in Petaluma, California told Bloomberg. He said he was particularly galled to be cut off without notice because until recently – when times were good – Kabbage called him every day asking him to borrow more money.

Oops.

Atlanta-based Kabbage, which got its start on Shark Tank, said it has loaned more than $9 billion to thousands of small businesses since it was founded in 2009. Ironically, the company now needs to lend money to itself most of all, having furloughed hundreds of its workers this week as it contends with a slowdown in spending at small businesses, which have suffered as consumers nationwide have been ordered to stay inside to slow the spread of the deadly coronavirus pandemic.

But wait, the idiocy get better: Kabbage – having failed at its primary mission of providing funding in times of need instead of cutting lines of credit – is now pivoting to becoming a middleman that will connect people with loans from the Small Business Administration. It has also started a website to help small businesses sell gift certificates to consumers.

One can only imagine just how the company will screw that up.

“Like many other fintechs, we have temporarily adjusted our lines of credit and are focused on supporting the SBA’s Paycheck Protection Program,” Paul Bernardini, a spokesman for Kabbage, said in a statement. By “adjusting” he meant “cut off.”

“Just as manufacturers have retooled their processes to build ventilators and masks, we’re doing the same to reallocate our resources to respond to the national emergency and provide financial products that small businesses need most.”

Rob Frohwein, Kabbage’s chief executive officer, was just a bit more honest in how he defined the company’s “pivot” in an email to employees on Friday, when he said the company would temporarily stop making loans: “As of last night, all lending has been turned off,” Frohwein wrote.

Hey Rob, while you are pivoting, here is an idea for Kabbage’s new motto: “we will give you money when you don’t need it, and cut you off when you need it most.” Catchy, right?

And then there is the old standby: Kantbage.

But wait, it gets better, because the company that gave the world the unbelievable pile of shit known as WeWork is also involved in… Kabbage. That’s right, in 2017 this pathetic excuse for a lender raised $250 million from SoftBank.

And the punchline: other SoftBank Vision Fund portfolio companies – including Indian startup Oyo Hotel, co-working giant WeWork and real estate brokerage Compass – have axed staff in recent weeks.

* * *

However none of this supreme irony is any comfort for those companies which naively entrusted this dog turd with their financial future, and as Bloomberg reports, the credit reductions come at a dire time for restaurants and shops across the country. In normal times, small businesses have about a month of cash on hand, according to a 2016 study by JPMorgan. That means they’re particularly vulnerable as major cities across the country continue to expand shelter-in-place orders.

On Deck began putting holds on customers’ ability to draw on their lines of credit if they hadn’t done so in the last 30 days. Customers affected by the holds have been asked to send the company recent bank statements to have the holds lifted. Jim Larkin, a spokesman for On Deck, said the firm will “continue to serve and support our existing customers and are selectively lending to new customers.”

Fundbox, a venture-capital backed small-business lender based in San Francisco, has also limited some customers’ ability to draw on their credit lines.

“Like many companies that serve small businesses, we’ve had to make changes that have affected some of our customers,” Tim Donovan, a spokesman for Fundbox, said in emailed statement. “While these decisions have not been easy, it will allow us to continue to serve the majority of our small-business customers now and in the future.”

Kabbage customers who called to ask what happened were told that their accounts were under review. An employee at Kabbage, who asked for anonymity to protect their job, said that customer-service agents were instructed not to tell borrowers that the company had suspended credit lines across the board.

Michael Figueroa, a security contractor in Fort Lauderdale, Florida, said the representative he talked with was apologetic. “Hey, I don’t even know if I’m going to be working here tomorrow,” he recalled the agent saying.

* * *

So far it’s only the non-banks that have taken the axe their existing loan commitments. The good news: the banks have so far been resilient and not a single prominent bank has left its clients in the cold. However, with the US economy entering a depression, hundreds of US companies have drawn $300BN just in case it’s only a matter of time before the banks go where the non-banks have so boldly gone in the past few days.

Tyler Durden

Sun, 04/05/2020 – 22:35

via ZeroHedge News https://ift.tt/3e0spkA Tyler Durden