Wall Street’s Formerly Biggest Bear Goes All-In Ahead Of The Coming Runaway Inflation

Last week we reported that Morgan Stanley’s Michael Wilson, who for most of 2018 and 2019 had dominated the league tables as the biggest bear among Wall Street’s big banks (this of course excludes such outlier bears as SocGen’s Albert Edwards who has for years been warning about what is coming), turned bullish and last Monday said that he is a “buyer of dips” since “2400-2600 on the S&P 500 will prove to be very good entry points for those with a time horizon of 6-12 months.”

Over the weekend, Wilson was also the author of Morgan Stanley’s influential Sunday Start weekly which sets the narrative not only for the key bank themes over the rest of the week, but also is a signpost for Morgan Stanley’s clients, and perhaps not surprisingly, Wilson used the podium to expand why on such short notice, he has U-turned from Wall Street’s de facto uber bear to one of the biggest, if not most vocal, bulls.

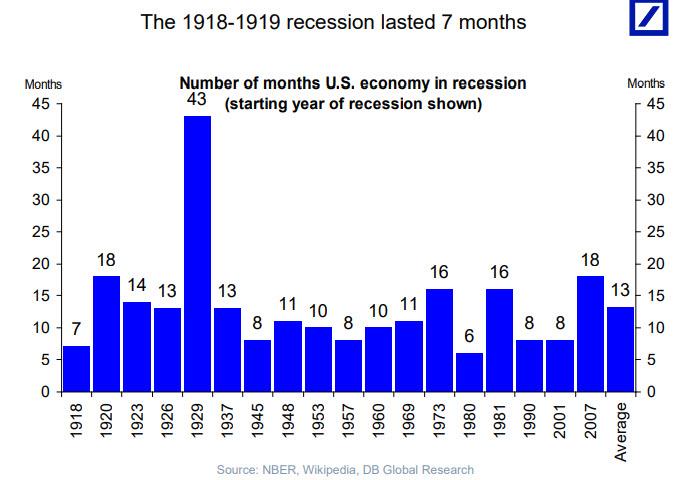

In a nutshell, what follows is his explanation why “Bear Markets END with Recessions“, which in theory is correct, but one wonders what happens if instead of a recession we are looking at a depression. And if so, the real question is when will the bear market end, because as a reminder the recession of 1929, which of course was much more than just a recession, lasted 43 months. If we are indeed entering another D-word phase, are we looking at another 43 months before the market stabilizes?

In any case, here is Wilson with a dose of – rather rare these days – bullishness, and not only that, but a rather somber assessment of what is really coming down the line – runaway inflation and a sharply lower dollar:

In the past month, we’ve experienced a full bear market, down 20%, and a full bull market, up 20%. Of course, this extreme volatility follows a period of extreme calm that saw some of the lowest volatility readings in history. As the famed economist Hyman Minsky observed, a market collapse can be brought on by the speculative activity that defines an unsustainable bullish period – the Minsky Moment. If you accept that 4Q19 resembled a speculative frenzy driven more by liquidity than fundamentals, the Minsky Moment diagnosis is not only compelling but hard to refute.

In my Sunday Start last month (Unfinished Business), I suggested the US economy was finally headed toward a recession but, once over, it could usher in the second leg of the secular bull market. Since then, whatever debate remained on the recession has been conclusively resolved, with the discussion quickly shifting to who can come up with the most negative forecasts.

That’s the bad news. The good news is that crises lead to bailouts, and this time is no different. Since this is a public health crisis, the response has been extreme. There are literally no governors on the amount of monetary or fiscal stimulus that will be used in this fight. As evidence, our economists now estimate a US fiscal deficit of 18% this year, a level last seen during World War II. While the struggle against Covid-19 is a war, the amount of money being thrown at this enemy may be excessive, given that this conflict will be shorter and the outcome more certain – we will win. The destruction of productive assets will undoubtedly be much less severe than in WWII, leaving potential GDP intact once the recession is over even though the recovery path is uncertain.

Recessions require a trigger, and the conditions must be in place for that trigger to work. Every expansion leads to excessive credit creation, and this time it took place in corporate credit and the shadow banks, among other areas. A recession always creates the most pain where credit and leverage had reached excess. However, given the extreme response from the Fed and Congress, we envision less pain than normal for these bad actors. This is one reason why we have been getting more bullish in the past few weeks, though the economic and earnings data are likely to remain bad and even get worse.

My longer-term secular bull market view has always assumed a cyclical bear market in the middle punctuated by a recession – like today. I’ve argued further that the next leg of the secular bull would see the long-awaited appearance of inflation, which would require a transition from monetary to fiscal policy dominance. Cue the steepest recession since the 1940s accompanied by a health crisis.

The old adage of “never let a good crisis go to waste” could not be more apropos today. Not only are we likely to get the largest peacetime fiscal deficit in history, but the stimulus targets the parts of the economy with a higher propensity to spend. The first experiment with QE after the financial crisis was accompanied by fiscal austerity and bank regulation – a deflationary combination. This time, we have a potentially much more inflationary combination of an unprecedented targeted fiscal stimulus and possible deregulation of the banks to get the cash into the hands of lower income individuals and small businesses that are inclined to spend it. Such a dramatic shift in US fiscal and monetary policy relative to other regions should lead to a materially weaker dollar, which is ultimately the easiest path to reflation not only for the US, but also the world.

Finally, let’s not forget some of the other inflationary developments of the past five years – populism, which has driven minimum wage legislation, and nationalism, which has led to tariffs and a trend toward de-globalization. Now a pandemic will likely further disrupt and permanently add costs to global supply chains.

To summarize, with the forced liquidation of assets in the past month largely behind us, unprecedented and unbridled monetary and fiscal intervention led by the US, and the most attractive valuation we have seen since 2011, we stick to our recent view that the worst is behind us for this cyclical bear market that began two years ago, not last month.

Therefore, current levels in equity and credit markets should prove to be good entry points on a 6-12-month horizon. Bear markets end with recessions, they don’t begin with them, making the risk/reward more attractive today than it’s been in years; with the twist that the next leg of the bull market could look much different than the last and the unthinkable – inflation – begins to appear.

Tyler Durden

Sun, 04/05/2020 – 23:04

via ZeroHedge News https://ift.tt/2yugxqP Tyler Durden