Welcome To “Project Zimbabwe”

Authored by Harris Kupperman via AdventuresInCapitalism.com,

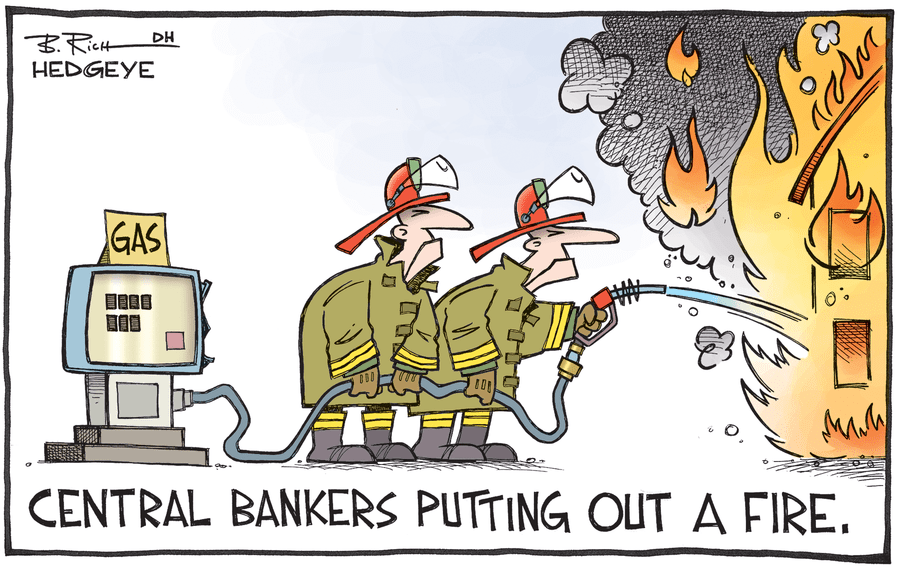

Roughly a month ago on the afternoon of Sunday, March 8th, Fed Chairman Powell had an emergency staff meeting.

Powell: I want the nuttiest money printing plan ever. What action plans do we have that are prepared and ready to initiate?

Admin: Well, we have this one named “GFC 2.0”

Powell: Sounds tame and sedate. Won’t impress anyone.

Admin: What about this one named “Whatever It Takes”

Powell: Lemme look… Meh… I want more shock and awe. This needs at least two more zeros.

Admin: Well, we have this other one named “Project Zimbabwe” but it’s so ridiculous that the Fed would forever lose all credibility…

Powell: hmmm… I like the sound of “Project Zimbabwe.” Just makes you want to turn dollars into toasters and washing machines to preserve wealth. This one will force guys so far out on the risk curve that they’ll think crypto-coins are value investments.

Admin: Yeah, it’s absolutely Wuhan-bat-shit nutty. We’d be criminally insane to unleash this on a population that isn’t prepared for hyperinflation…

Powell: Perfect!! Let’s have a press conference.

A few hours later…

Powell: Mr. President, I finally took rates to zero and launched QE infinity. Can you stop trolling me on twitter already? I can’t take any more of my wife cracking jokes about your tweets.

Trump: Be a man. You got it easy. Wait until you see what I do to Biden. He puts the “Dem in Dementia” haha…

Powell: Please, no more nasty tweets. Even my kids laugh at me.

Trump: Fine, but you’re thinking too small with “Project Zimbabwe.” Figure out how to print more aggressively. Look at what Mnuchin is doing with all his bailout programs. He’s gonna blow $10 trillion by early summer, then try to double that by election time. You better crank up that printing press of yours. I’ll stop tweeting if you keep monetizing the “Mnuchin Money.”

Look, everyone knows the bull thesis for gold, so I won’t wade into the weeds here.

It was never a question of if, but of when. I’d say that if not now, then when?

With every government and Central Bank in full-on Weimar-mode, gold’s potential upside will surprise people, especially as mines shut down from COVID-19 and limit supply. The best part is that margin calls and liquidations have capped the gold price, giving investors one last chance to get in before the run. As people catch their breath and realize what’s happening with simultaneous monetary and fiscal stimulus, gold will be going higher.

Never has a trade been this well telegraphed by this many government officials in my lifetime. Do you have enough gold to survive “Project Zimbabwe”…???

Disclosure: Funds that I control are long gold. I personally own gold.

Tyler Durden

Mon, 04/06/2020 – 14:10

via ZeroHedge News https://ift.tt/34cYq4E Tyler Durden