Consumer Credit Soared In February, Just Before The Economy Shut Down

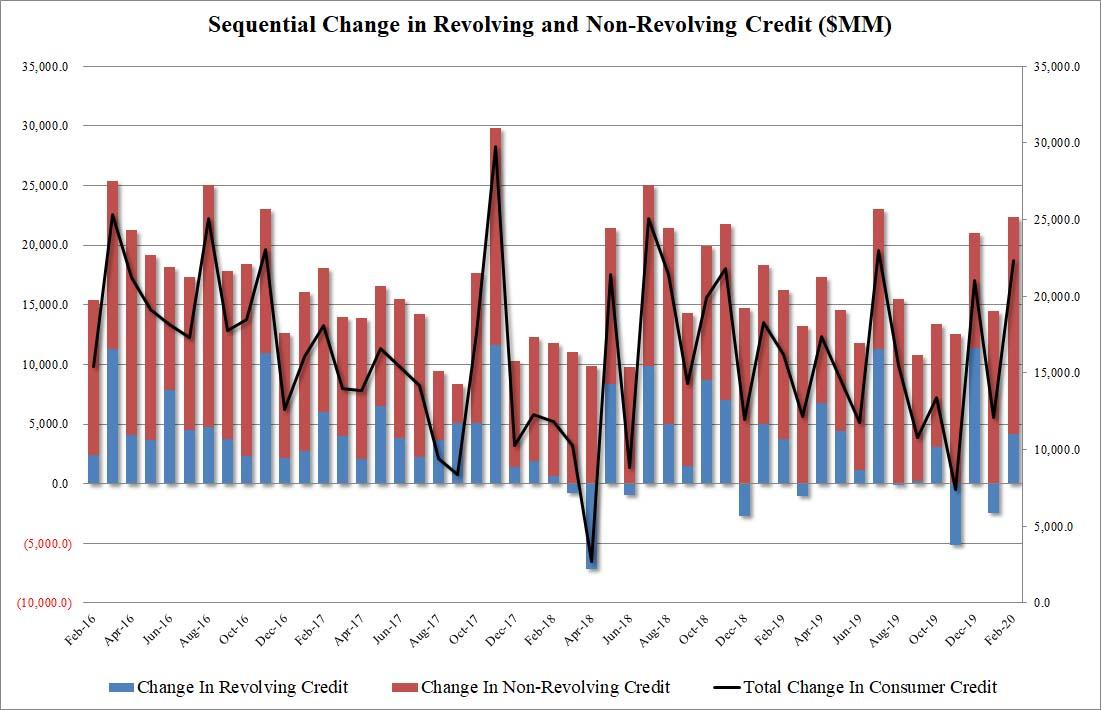

Just like today’s JOLTS report, which as we reported earlier came in far stronger than expected, so today’s consumer credit report was largely meaningless, covering the month of February which unfortunately represented a different world. That said, coming in at $22.331BN this number also shattered expectations of a modest increase in consumer credit from $12BN to $14BN in February, printing nearly twice as high as expected. Whether or not one sees a higher number compared to expectations as a beat or a miss will depend on whether one is a Keynesian or Austrian economist.

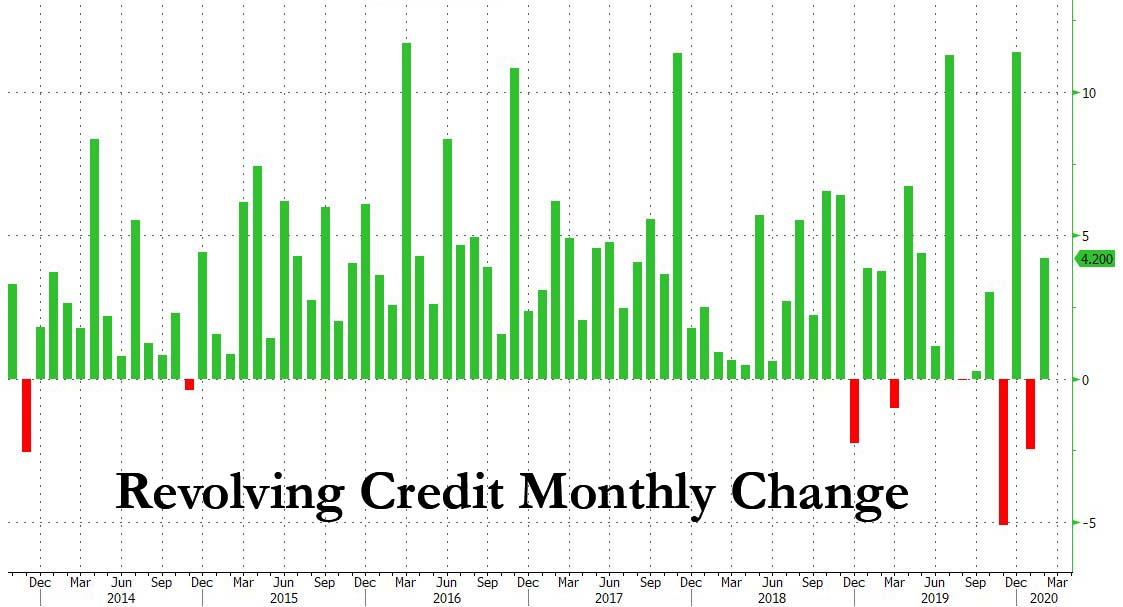

Specifically, in February, Revolving credit rose by $4.2BN to a record $1.096 trillion, after shrinking by $2.5 billion the month prior.

At the same time, nonrevolving credit – mostly auto and student loans – rose $18.1BN, also hitting a new all time high of $3.129 trillion.

Alas, as noted above, none of this matters as the world was flipped upside down in March, however next month’s data will be extremely interesting, as it will show whether when faced with an upcoming economic crisis, American households splurged and used their credit card to buy everything they could, or conversely, they hunkered down and entered a savings hibernation. Needless to say, the former could be catastrophic for an economy where 70% of GDP is a function of consumer spending.

One thing however is certain: non-revolving debt, which is incurred mostly when purchasing cars, will plunge in March and may stay at or near zero for a long, long time.

Tyler Durden

Tue, 04/07/2020 – 15:20

via ZeroHedge News https://ift.tt/2V6cXLg Tyler Durden