Everything Is Broken: The Most Profitable Trade Since 1993 Is Now Upside Down

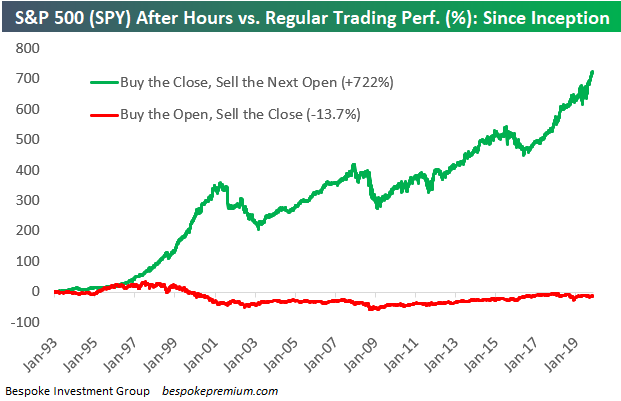

Ever since 1993, one of the most familiar and loved patterns by daytraders everywhere, was buying the overnight session and shorting the regular, or cash session, because as the Bespoke chart below shows, the cumulative returns on “buying the close and selling the open” were a whopping 722%, while being long only during regular hours has been a money losing proposition for the past 27 years, with a shocking -14% return (one can argue that this is where all those big market drops which crush long-term performance were to be found).

But now, together with virtually every other conventionally accepted aspect of trading, this most profitable trade of the past 30 years has been thrown out with the bathwater, and has been replaced by its mirror image.

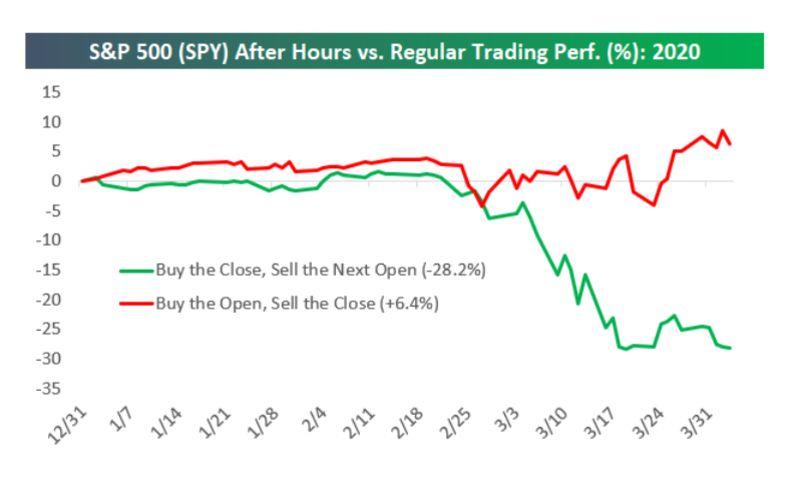

According to Bespoke, in this brave new world of VIX over 40, the lucrative “buy the overnight session, sell the regular session” has been flipped on its head, and instead buying stocks (in this case the SPY ETF) at the market open and selling it at the close would have resulted in a gain of more than 6% for the year. Meanwhile, piling into SPY, at the close and selling it at the next day’s open – as so many traders do instinctively – has led to losses of almost 30% for 2020 (the SPY ETF is down about 20% this year).

While the reversal in strategies clearly emerged around the time US equities responded to the combination of the coronavirus pandemic and the oil price war launched by Saudi Arabia which crashed the price of crude, it is unclear key market dynamic changed to result in such a diametric reversal in one of the market’s most popular strategist.

Some believe it has to do with asymmetric newsflow in the overnight session vs regular hours.

While normally, “Investors benefit from receiving as much information as possible, and there’s a lack of information outside of market hours,” Todd Rosenbluth, head of ETF and mutual fund research at CFRA told Bloomberg, it’s been different this year, with the virus outbreak starting in China before spreading around Asia and into Europe. That’s delivered a spate of negative headlines overnight, leading to wild trading. U.S. stock futures hit exchange-mandated barriers that prevent further gains or losses at least 10 times over the last month.

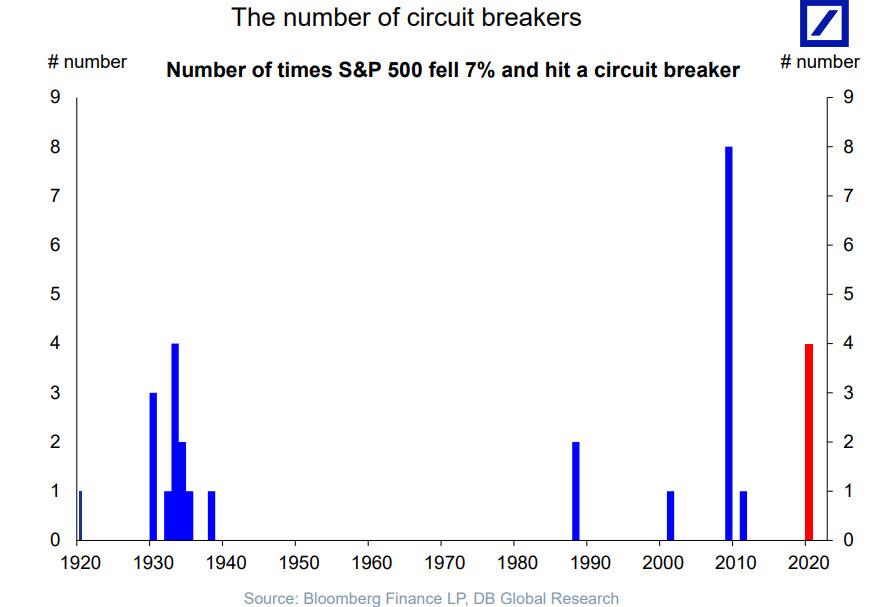

And since major market dislocations, most of which have taken place in the overnight session when circuit breakers are hit, destroy long-term performance, it makes sense that the session which contains the bulk of downside volatility would also be the most painful one.

“If it’s China, if it’s Europe, sometimes bad news may come more off-trading hours than on trading hours,” Penn Mutual CIO Mark Heppenstall told BLoomberg. “Generally, the trend has been for less favorable news on the spread of the virus.”

The S&P 500 was up 5.5% as of 12:43 p.m. in New York Monday after the reported death tolls in some of the world’s coronavirus hot spots showed signs of easing over the weekend.

Several days ago, ETF giant State Street had some advice for investorstrying to navigate the exchange-traded fund whiplash price action around the market opens and closes: don’t bother.

For smaller ETF investors and financial advisers, it’s better to sit out the frenzied moves before 10 a.m. and after 3:30 p.m., according to SSGA’s Matthew Bartolini. He also cautioned against the use of orders to buy or sell a security at the best available current price, known as a market order. While such trades secure speed of execution, investors may sacrifice price certainty in exchange at the start and end of the trading day, when liquidity in recent weeks has been lowest .

“You should really avoid trading at the open, trading at the close, using market orders,” said Bartolini, SSGA’s head of ETF research. “You take the volatility of the open and the close and you add the lack of price surety of what you can transact at, and for smaller investors and advisers, it’s not advantageous to transact in that environment.”

In other words, unless trading a “sure thing” on inside information (just don’t get caught), it may be best to avoid this broken, upside-down market altogether.

Tyler Durden

Tue, 04/07/2020 – 09:15

via ZeroHedge News https://ift.tt/3bZVFGm Tyler Durden