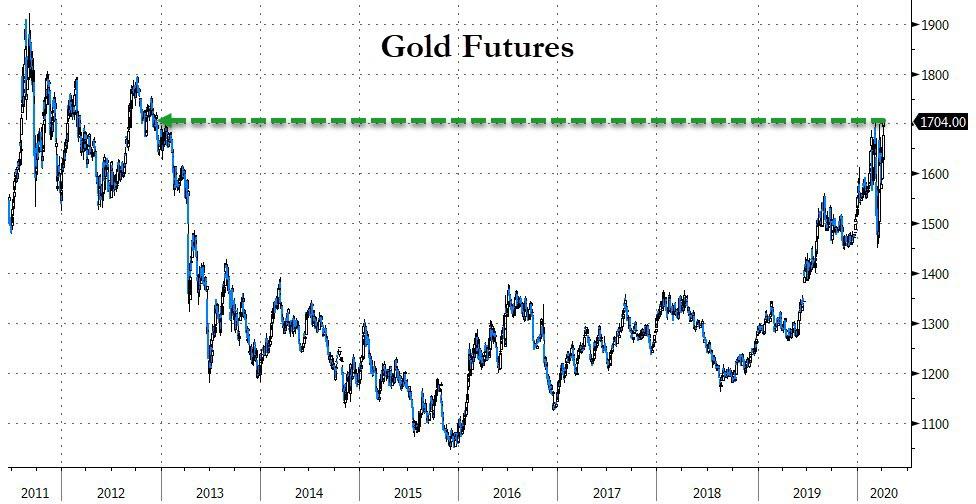

Gold Futures Extend Gains To 8 Year Highs After Pelosi’s Trillion-Dollar Promise

COVID-19 appears to have impacted the deep fiscally-conservative regions of the brains of politicians more than many suspected possible as left, right, and center seem to be coalescing around the fact that moar spending is better, moar helicopter money is even better-er, and moar zeros in the national debt is better-est!

Live look at Dow futures pic.twitter.com/kLWZySZUu0

— Quoth the Raven (@QTRResearch) April 6, 2020

Tonight’s latest utterance/demands from Speaker Pelosi – that the next, fourth, round of virus-relief stimulus must be at least $1 trillion – appears to have confirmed one thing (as @hkuppy notes so pointedly):

” Glad to see both parties supporting gold $10k…”

And sure enough, gold is soaring after hours following this headline…

Back to Dec 2012 highs…

And once again futures are decoupling from spot as that physical (geographical) shortage rears its ugly head once again…

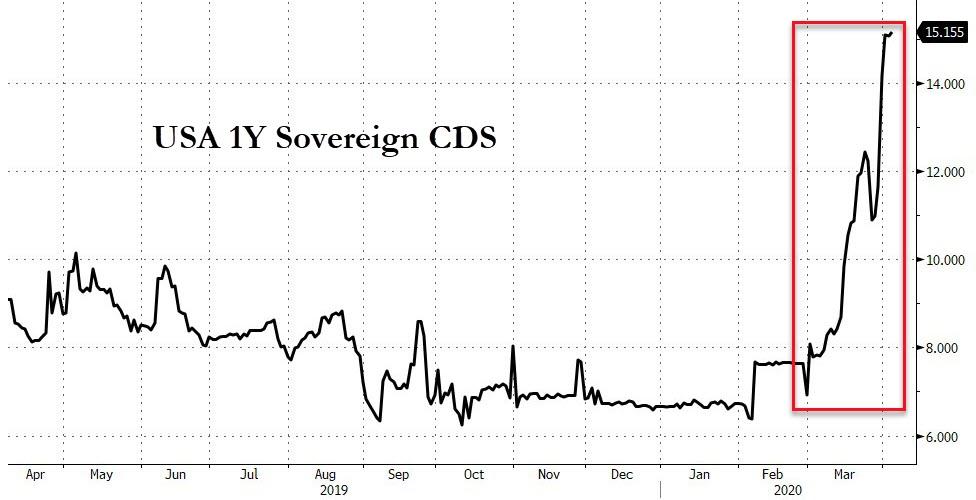

One thing is for sure, not only is gold signaling systemic risk is soaring, sovereign credit markets are starting to leak information…

Referring to his institutional market research at Global Macro Investor, we give the last word to Raoul Pal and his most recent thoughts (excerpted) on “A Dollar Standard Crisis” are

….

Don’t forget – the $13tn short dollar positions (foreign dollar debt held mainly by foreign corporation and investment vehicles) is the largest position ever taken in the history of global financial markets.

It can only mean a massive, uncontrolled dollar rally.

QE will not fix this. Swap lines will not fix this. A debt jubilee would fix this or multiple trillions of dollars in write-downs and defaults.

It is the dollar strength that brings to world to its nadir (just like the 1930s). It is the dollar system that is the really big problem.

The dollar has eaten all of its competitors and now it is going to eat itself.

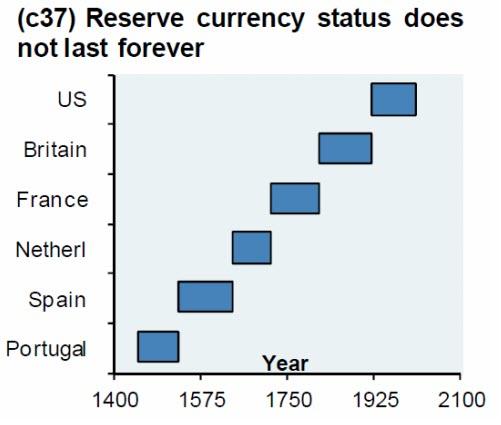

This eventually breaks the dollar after a super-spike as global central banks are forced to find alternatives.

Remember, nothing lasts forever…

The world’s elite have long wanted to replace the US dollar with a single global super-currency, as The World Bank’s former chief economist said in 2014, it will create a more stable global financial system.

“The dominance of the greenback is the root cause of global financial and economic crises,” Justin Yifu Lin told Bruegel, a Brussels-based policy-research think tank.

“The solution to this is to replace the national currency with a global currency.”

Tyler Durden

Mon, 04/06/2020 – 20:02

via ZeroHedge News https://ift.tt/39Jky7H Tyler Durden