Just How “Cheap” Is The Market? Here Is The Shocking Answer

Two weeks ago, when stocks had plunged as lows as 2,250 and staged a modest rebound after the Fed went all in with its “nuclear” intervention, one emerging narrative used by the bulls to justify buying stocks was that equities had dropped to a much cheaper level from a valuation perspective.

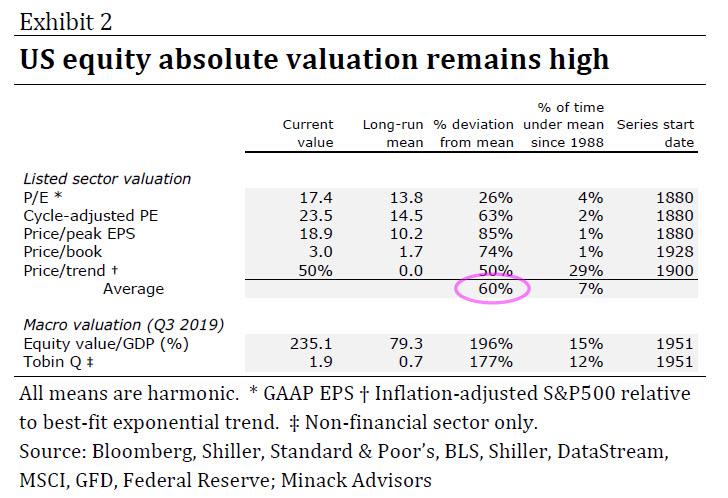

However, as Gerry Minack from Minack Advisors wrote at the time, that was hardly the case, and while equities were indeed cheaper, they were hardly “cheap.” As Minack wrote in a daily note from March 25, “while US equities are cheaper now than they were, they are not cheap relative to long-run averages. That is true for all the absolute valuation measures I follow”

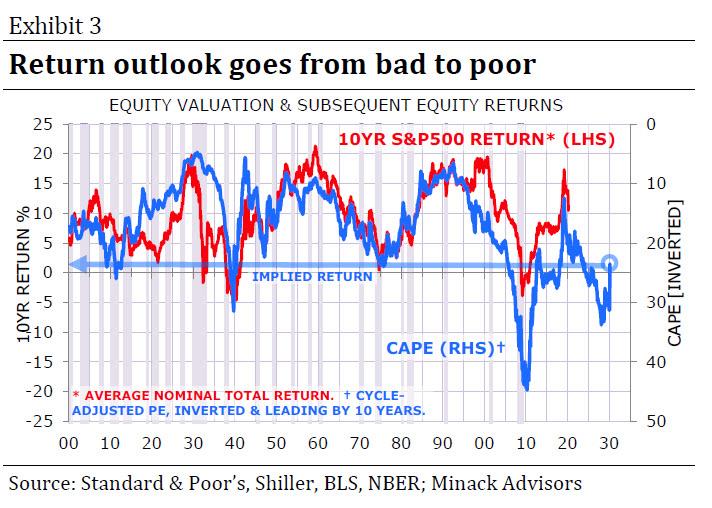

One also has to consider the context: in January the absolute valuation measures were, on average, 111% above their long-run averages. Consequently, as Minack wrote, “the return outlook was terrible. Now valuations point to higher, but still poor, returns. Exhibit 3 shows one example.”

Another problem: nobody has any idea where earnings will end up as a result of the coronavirus “coma”, which has ground the global economy to a halt. Yet even if one assumes a material drop in S&P EPS, one also has to shrink P/E multiples as the US economy is entering a recession, if not depression.

Which is why, as Minack wrotes, “valuation is rarely a good timing guide for investors. But cheap markets generally generate above-average returns over the medium term, and therefore provide investors with a margin of safety when they do buy an asset. However, equities now are not very cheap. US equities are expensive. Prospective returns on US equities remain poor and they now offer very little margin of safety.”

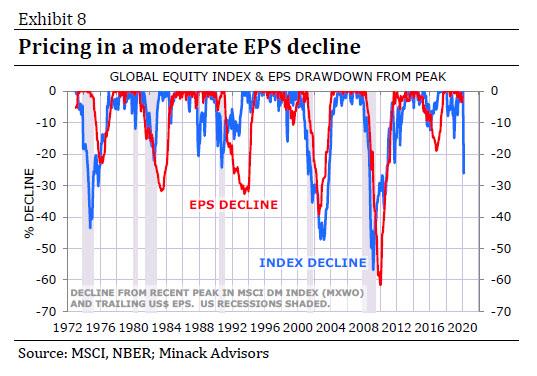

Adding to the confusion is that as of late March, stock markets were expecting only a relatively modest EPS decline.

Looking at the chart above, the former Morgan Stanley strategist, said that the it “seems optimistic” predicting that “there is likely to be a Depression-like decline in activity in the near term” and concluding that “the risk-reward tilts towards buying equities if, say, the S&P500 is 40-50% down from its recent peak, which is 20-30% below its latest close.

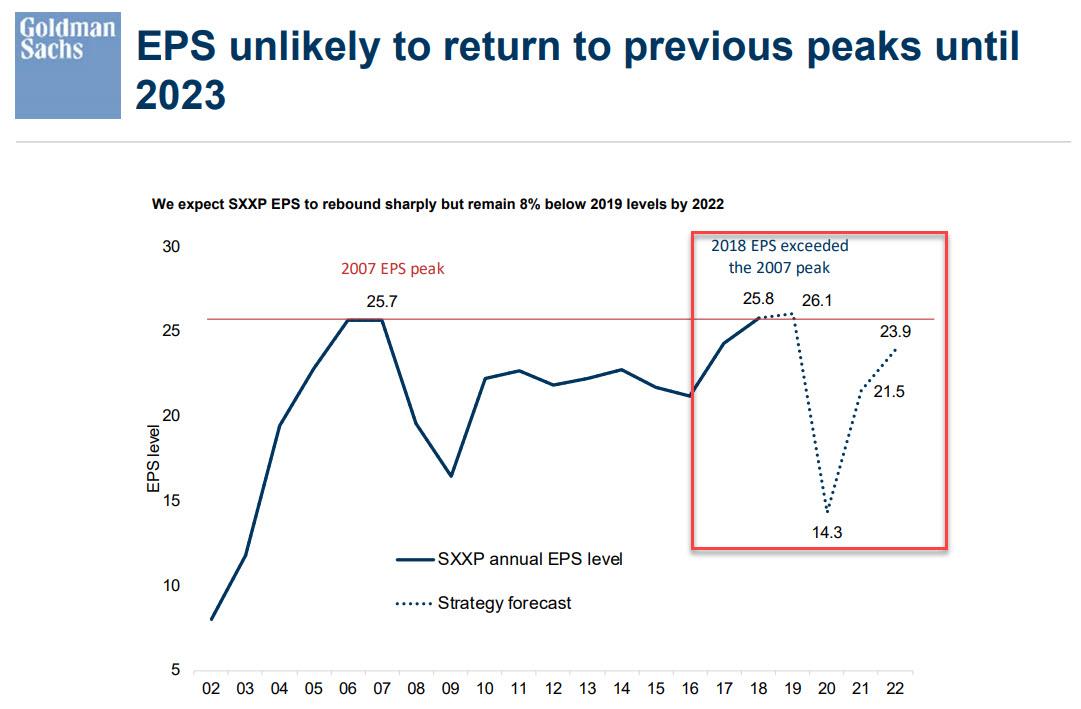

In retrospect he was right, because just a few days later Goldman predicted a drop of up to 45% in 2021, which meant that earnings would not return to prior peaks until 2023 (assuming everything worked out as expected).

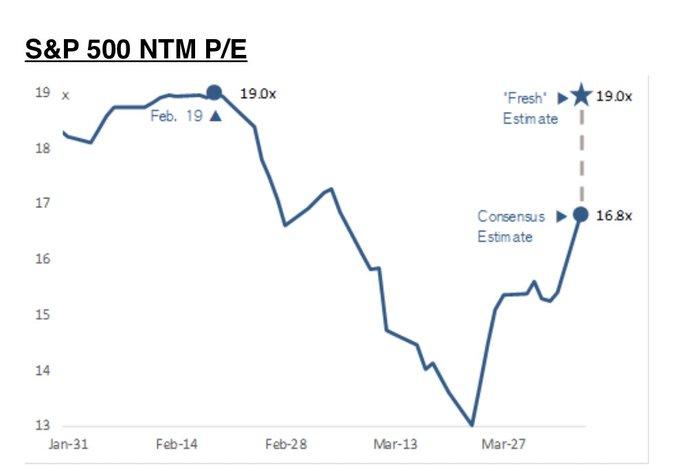

Fast forward to today, when Credit Suisse chief equity strategist Jonathan Golub – usually one of the most bullish Wall Streeters – posted a quick observation suggesting that any “temporary” cheapness in stocks hit in late March was long gone for the simple reason that forward earnings have plunged. As a result, as of noon when the S&P 500 had risen as much as 22% from March 23 lows, forward stock multiples had surged right back 19.0x.

Why is this notable? Because as Golub writes, “this is the same level the S&P500 held on Feb 19, the all-time high.”

In other words, anyone buying stocks today, at least before the violent last hour swoon, was paying for the earnings multiple one could buy in late February, when stocks were at all time high above 3,330. And that, in a nutshell, is how cheap stocks are today ahead of the imminent breathtaking plunge in corporate profits which will be revealed next week when companies report Q1 earnings and reveal their expectations for the second quarter and rest of the year.

Tyler Durden

Tue, 04/07/2020 – 17:34

via ZeroHedge News https://ift.tt/2JPKoMO Tyler Durden