Kudlow Claims Fed Still Has “Ultimate Bazooka”

Having increased its balance sheet by the most ever, directly monetizing Treasury issuance, unleashing unlimited swap lines, and started buying everything from bond ETFs to personal loan paper, and promised implicitly to do the now-proverbial ‘whatever it takes’ to save the world (markets), it appears The Fed has something else under its Kimono that it’s not quite ready to share

As senior Trump Administration officials fanned out across the major market-news channels to try and keep the market’s fire burning this morning with some well-timed and appropriately un-subtle jawboning, one comment stood out by far.

While both Treasury Secretary Steven Mnuchin and Larry Kudlow have insisted that President Trump is looking to re-open the US economy “as quickly as possible” – though not before health officials have had their say – Kudlow took things a step further by dismissing worries about another drop to new lows by saying the Fed is sitting pretty with what he called – “the ultimate bazooka.”

While it is not completely clear as to what Kudlow is alluding, many suspect – especially following former Fed Chair Yellen’s comments yesterday on the need for Congress to address The Fed’s ability to “buy more things” – including stocks – as the ‘Ultimate bazooka’.

This is something we have long warned about, warnings which have occasionally been dismissed as “conspiracy theories.” Of course, speculating about CBs buying equities is anything but a ‘conspiracy’, as the BoJ has shown us. And now, some very credible people are talking about the Fed buying stocks after the central bank already took the unprecedented step of buying corporate debt (ETFs).

As Bob Rodriguez recently noted, this is the end of the capital markets as we have known them.

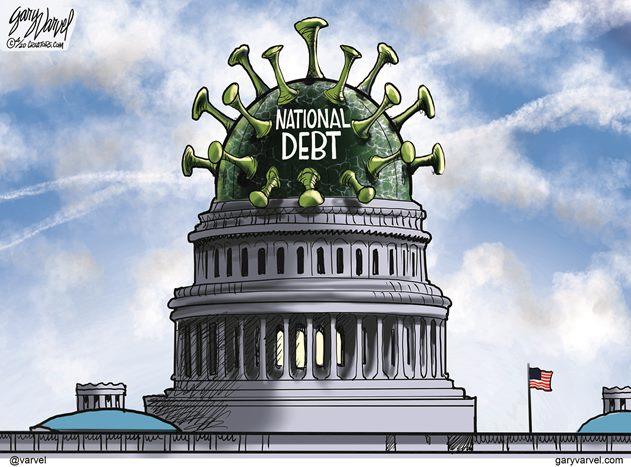

We have now entered unlimited QE and MMT where there is no escape.

It is the Roach Motel all over again.

In Chairman Bernanke‘s 2010 Washington Post op-ed, he argued that QE would lead to a virtuous economic cycle; therefore, the Fed would eventually be able to exit from its QE operations. I argued that once initiated, a reversal would be impossible. It would be like the Roach Motel, “You can check in, but you cannot check out.”

With the initiation of the Fed’s complete takeover and control of the US financial economy, there is now absolutely no accurate pricing discovery in the capital markets and we have entered a period of total manipulation. In light of this, the only markets I have an interest in are those where the heavy hand of government is not involved or only minimally involved. This leads me to rare commodities and collectibles. The public equity and debt markets are now nothing more than greater fool markets that are led by the greatest fools of all, the Fed and the Congress. US capital markets, RIP!

Tyler Durden

Tue, 04/07/2020 – 09:30

via ZeroHedge News https://ift.tt/39NXJju Tyler Durden