Nomura: This Is Nothing More Than A Giant “Bear Squeeze” Rally

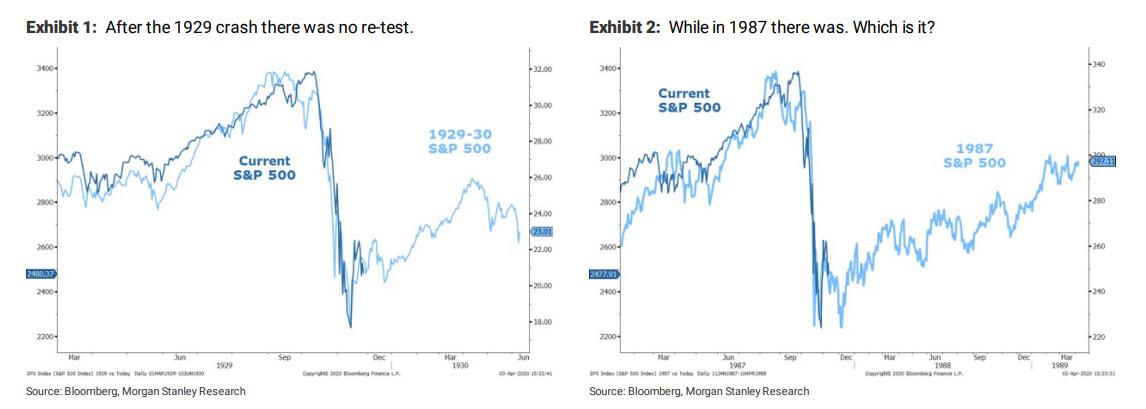

For two weeks in a row the clients of top Wall Street firms – first Goldman then Morgan Stanley – had just one question for their highly paid financial advisors: was March 23, the day the Fed went all in and announced unlimited QE and corporate bond buying, the market bottom, similar to the start of the Great Depression or in a repeat of 1987, will stocks stage another sharp drop – similar to the events after Black Monday – only to recover faster?

The truth is that for all the highly convicted debate – especially among the bulls none of whom foresaw this crash but are now absolutely certain it is ending – nobody knows what happens next, especially since following the Fed’s latest barrage of market bailouts, any link between asset prices and underlying fundamentals has been completely severed and replaced with Fed promises, backstops and excess liqiudity which is keeping all risk assets propped up artificially at least until a new round of questions about Fed credibility emerges.

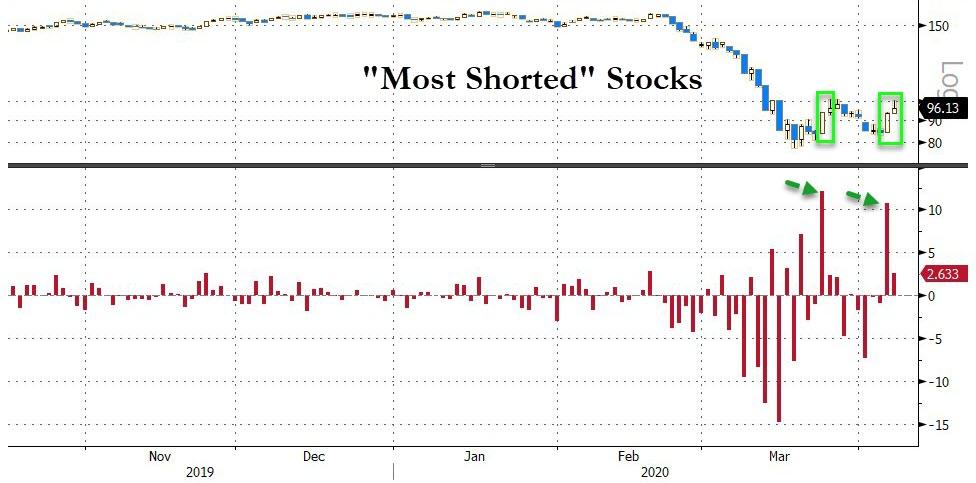

As such the most probable answer for what is behind the violent rebound in the past two weeks belongs to Nomura quant Masanari Takada, who writes this morning that the steep rally in global equities is nothing more than a giant “bear squeeze” rally, driven by panicked exits from shorts that investors accumulated during the downturn, something we pointed out yesterday when we showed that Monday’s action was the 2nd biggest marketwide short-squeeze in history.

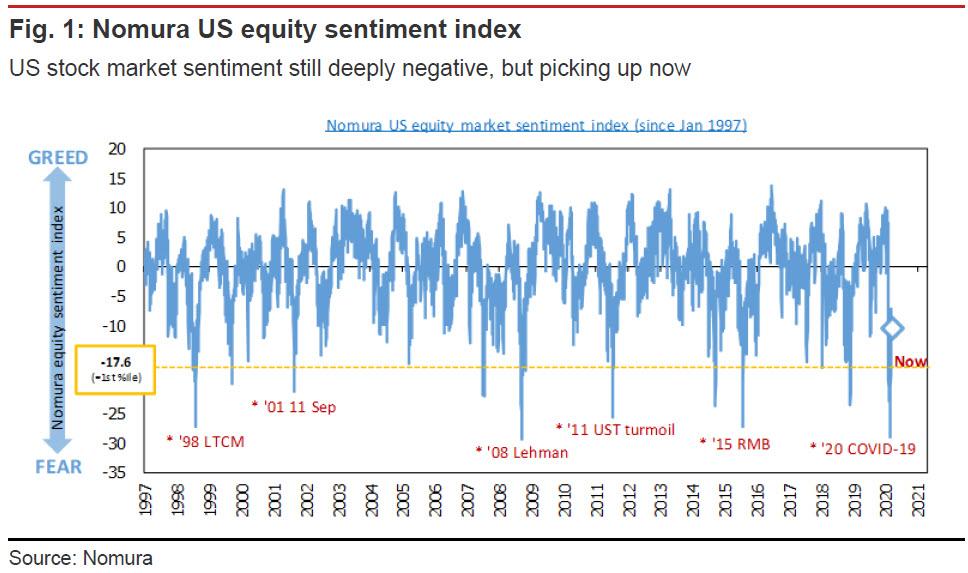

As Takada notes, “it is not as though worry over the coronavirus pandemic has been swept away” but since investor sentiment was finding support in signs that the virus’s spread in Europe and the US is on course to peak and start slowing, “this was already set to be a week in which CTAs were likely to back out of short positions in US equity futures,” so Nomura thinks “it is best to assume that the rally is largely technically driven.”

If indeed this is nothing more than short profit-taking, Nomura cautions that it is very much unclear whether the market gains will hold up once the bear squeeze has run its course, and notes that “projecting scenarios based on longer-term fundamentals onto the present market is something best avoided.”

Here are some additional details on who was squeezed most from Takada:

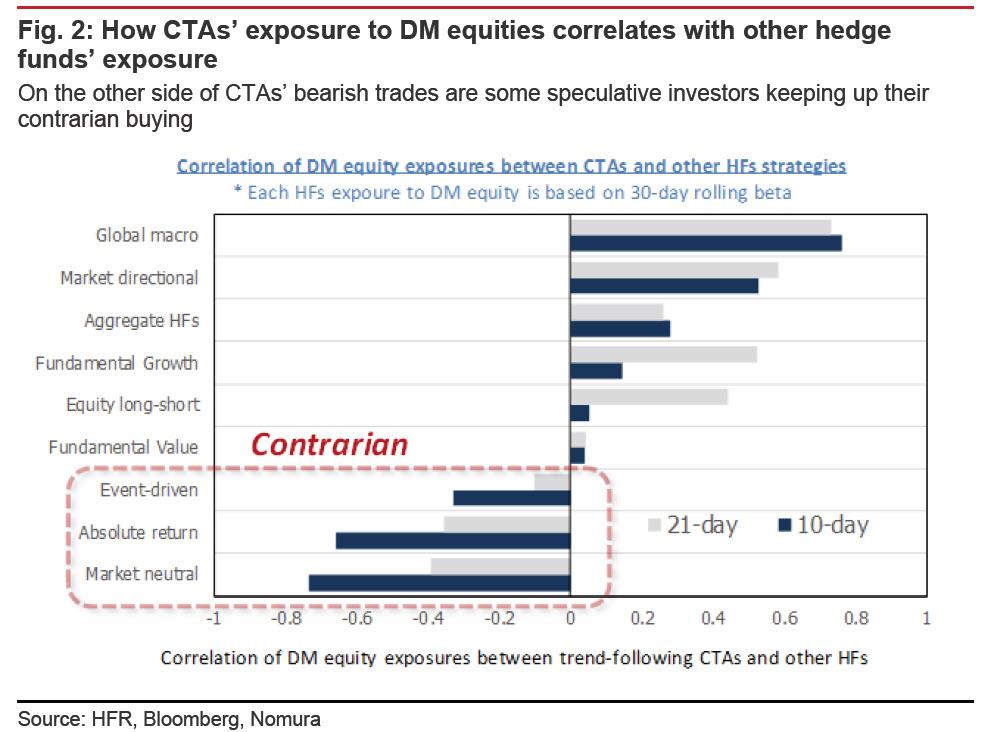

The squeeze on CTAs’ short positions has been led by speculative investors recently making contrarian trades, and here we would single out absolute return funds and event-driven funds, both of which favor short-term trades with a strong element of seizing on opportunities.

It appears to us that a powerful wave of contrarian trades by quick-moving investors such as these has left trend-chasing CTAs without an incentive to stick with their short-term bear trades.”

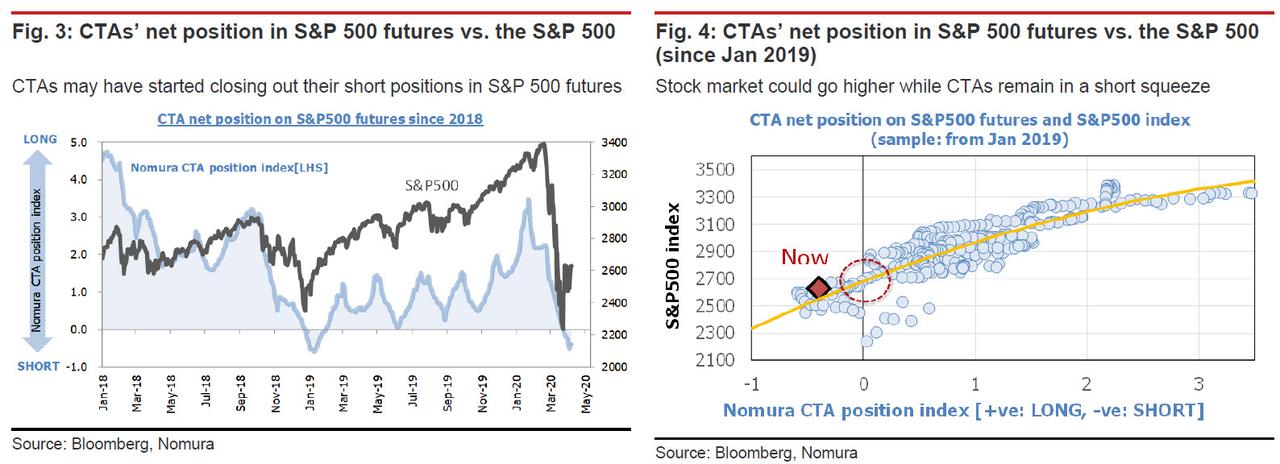

As Nomura suggests, it may help here to look in detail at CTAs’ positions in US equity futures markets. The Japanese bank estimates that CTAs’ net short position as in S&P 500 futures is now about 20% smaller than it was at its 3 April peak. Given how volatile the market has been, it makes sense to think in terms of broad ranges rather than precise numbers, but

the bank thinks that the S&P 500 could rise to around 2,700 if CTAs were to exit their short position in its entirety. And with the S&P now trading well above that as of Tuesday morning, one can argue that the CTA short squeeze is over and no more forced liquidations are coming.

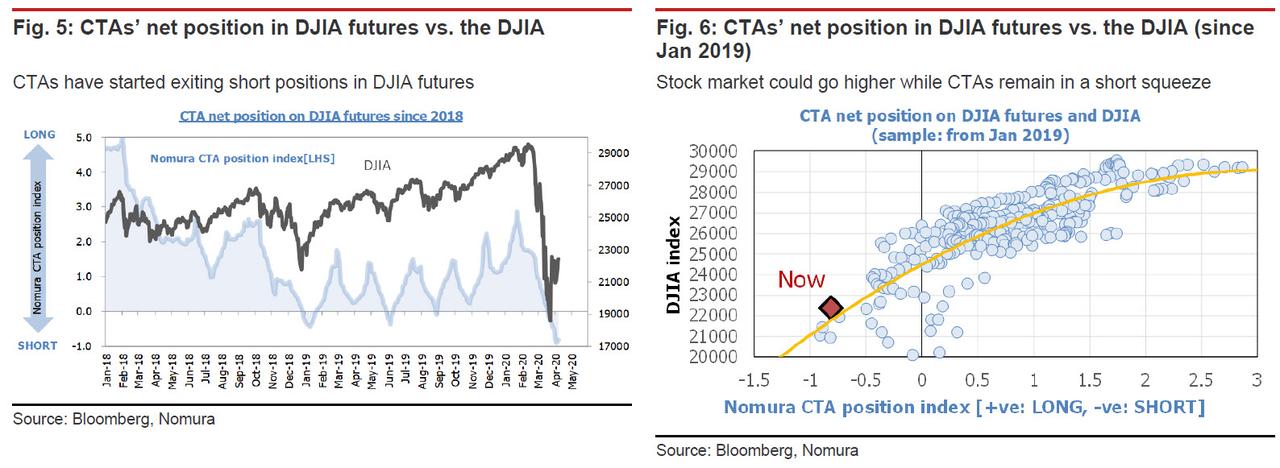

In DJIA futures, meanwhile, CTAs in the aggregate had built up a fairly substantial net short position, but as with S&P 500 futures, Takada estimates that the short position shrank by about 11% amid the market’s gains yesterday (6 April). Should CTAs continue being squeezed out of their short positions, the DJIA could rise to around 24,000.

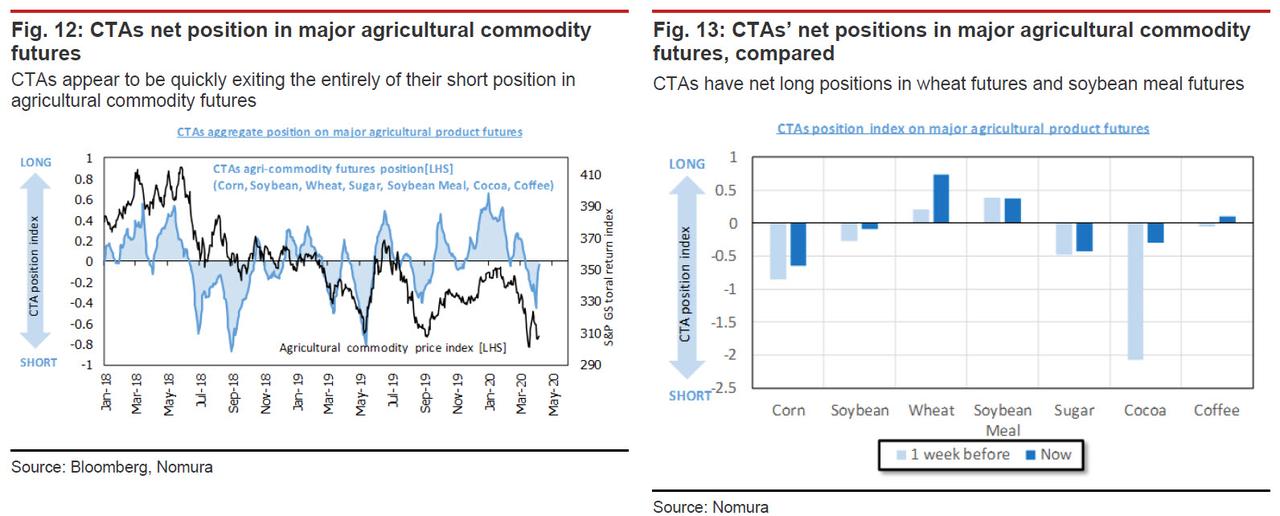

Finally, while of secondary importance to the broader market, Nomura also estimates that CTAs are in the process of covering short positions in most major agricultural commodity futures markets, and have in fact already swung net long on CBT wheat futures and CBT soybean meal futures. Why does this matter? Because as Takada says, As far as wheat prices and soybean meal prices are concerned, then, we think attention should be given not only to the impact of fundamentals but also to the activity of trend-following investors in futures markets

d

Tyler Durden

Tue, 04/07/2020 – 11:15

via ZeroHedge News https://ift.tt/2RhXJBV Tyler Durden