Online Lender Suspends Redemptions, Shuts Down Amid Flood Of Defaults, Unemployment Surge

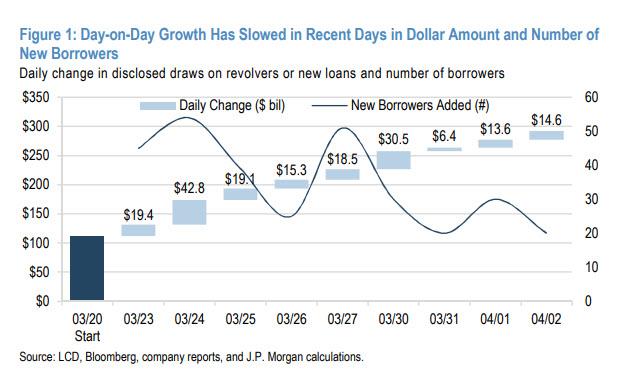

Over the weekend we explained just why there has been such an unprecedented scramble to use up bank revolvers over the past month, which according to JPM have seen drawdowns of roughly $300 billion so far in 2020.

The reason: as clients of online lender Kabbage (which just happens to be “backed” by SoftBank) found out the very hard way, their credit lines were suddenly and without any explanation pulled, leaving thousands of clients without any access to liquidity.

The borrowers, who range from software consultants to heavy-equipment contractors, told Bloomberg that Kabbage didn’t give them any notice, and that they learned their credit lines had been suspended only upon logging into their accounts. Some said they were counting on the money to get through the tough times ahead.

“This is very bad business ethics,” said Joydeep Paul, who runs Medserv Healthcare Solutions LLC, an emergency-medical training company in Princeton, New Jersey. He says his line of credit was cut from $22,000 to $0. “You just turn it off without saying a word — not an email, not a phone call, nothing.”

“They’ve left me high and dry when I needed them the most,” Rob Jacques, co-founder of theCodery, a software consulting company in Petaluma, California told Bloomberg. He said he was particularly galled to be cut off without notice because until recently – when times were good – Kabbage called him every day asking him to borrow more money.

* * *

The problem is not just the procyclical nature of the lending industry, it also has to do with the novelty of an economic downturn from the perspective of the entire online lending industry, which as a reminder did not exist during the financial crisis, and so it is forced to learn how to cope with a recession on the fly, even as its IRR and loan valuation models blowing up every single day.

For some, the shock that the economy can contract and that prices don’t only go up has been too much, and as Reuters reports, San Francisco-based Colchis Capital Management, a backer of online direct lending platforms and private credit, is winding down its main funds as disruptions caused by the novel coronavirus have started to hit its consumer and real estate loans, according to materials reviewed by Reuters.

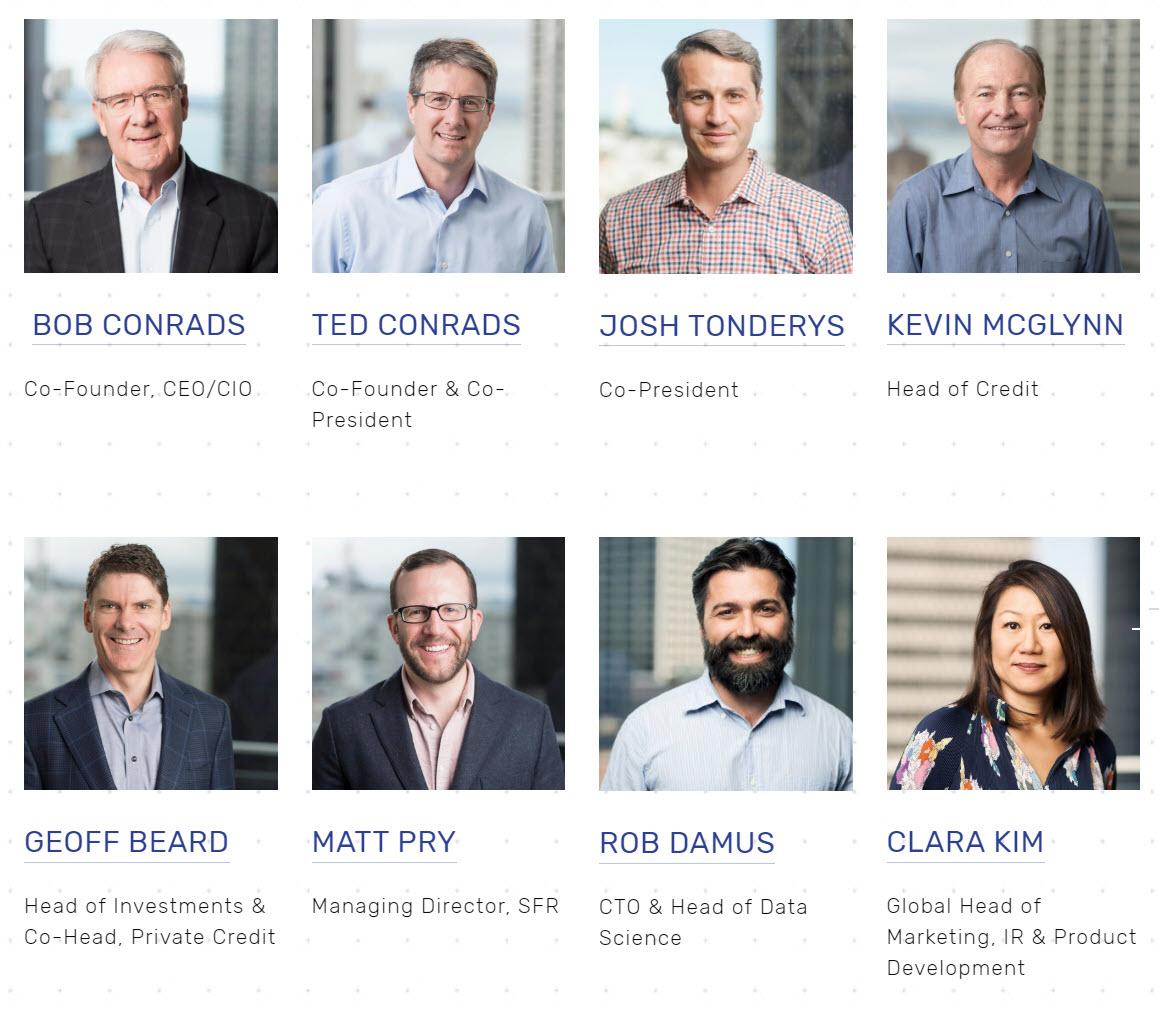

“The largest risk to the Colchis Income Funds is unemployment for our consumer loans and weakness in the housing market for our bridge real estate loans,” Colchis Chief Investment Officer Robert Conrads (a former McKinsey partner, naturally) wrote in a letter to investors on March 31 and seen by Reuters.

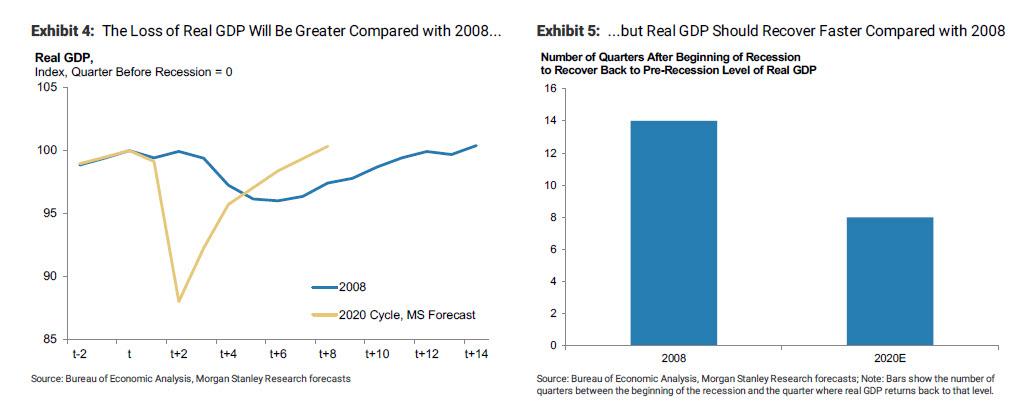

“Moreover, there is no consensus as to the timing or strength of the recovery in employment and economic conditions.” Well, there is consensus, but it is changing with every passing day, and what until last week was a V-shaped recovery is now seen as a W at best, it not an L.

It gets better: Conrads also wrote that the severe economic impact of the coronavirus pandemic was “difficult, if not impossible” to reflect in monthly valuations of Colchis’ loan portfolio, making it challenging to treat investors looking to cash out fairly. What he meant is that it is actually very easy to haircut the existing portfolio, the problem is that when one applies the necessary 50% haircuts to factor for the coming depression the results are… suboptimal.

Oh, and for those who thought that the brilliant management team shown below had any idea how to navigate an economic downturn…

… we have news: Colchis has also suspended withdrawals, and estimates a 19-month process to return all fund equity. Good luck collecting, naive LPs.

According to Reuters, Colchis told investors to anticipate annual returns of around minus 1.7% if U.S. unemployment rises to 10%, versus a return of 4.2% if unemployment dips to 4%. The official U.S. unemployment rate now stands at around 5.5%, but is likely to be at least twice that, according to economists.

Colchis, founded in 2005 and led by Conrads and his son Ted Conrads, managed nearly $1 billion as of Dec. 31, 2019, according to a filing with the U.S. Securities and Exchange Commission (SEC). The company invests in consumer and real estate loans and related securities and facilities, including relationships with online lenders Marlette Funding and PeerStreet, according to another document sent to investors last week.

Colchis has invested approximately $6 billion in more than 500,000 digital loans since 2011, according to its website.

But wait, the comedy does not end there, because after fucking over everyone, both investors and investments, Colchis – clearly unable to call time, “is considering the launch of a successor investment vehicle focused on more attractive distressed debt opportunities, such as asset-backed bonds and consumer loan portfolios.”

Yes, this disaster of a fund thinks that all will be forgiven and investors will just throw money at them just because they name their vehicle Colchis We Will Make It Better This Time Capital, LLP

* * *

Colchis was part of a wave of money managers that used high-tech loan platforms to fill a lending gap left by banks, which had retreated from riskier small loans in the wake of the 2008 financial crisis. It also benefited greatly from zero percent interest rates that allowed any idiot to pass off as a genius investor.

Which means that Colchis is just the start: Private debt funds managed a record $812 billion globally, more than double the amount in 2012. The surge in assets and managers increased risk and lowered returns, as Reuters reported here in 2017. It also means that in the coming weeks hundreds of billions of online-originated loans will quietly be pulled as an entire industry lives through its first ever recession, actually make that depression.

Tyler Durden

Tue, 04/07/2020 – 15:50

via ZeroHedge News https://ift.tt/34hHKJn Tyler Durden