“Black Swan” Hedge Fund Advised By Nassim Taleb Returns 3,612% In March

During the financial crisis, when most hedge funds suffered catastrophic returns forcing many to gate their investors, Mark Spitznagel, who is perhaps best known for the phrase “I spend all my time thinking about looming disaster”, made what the WSJ reported was “huge gains” with his “black swan” targeting hedge fund Universa Investments, which not incidentally is advised by Nassim Taleb. Then, in August 2015 during the infamous ETFlash crash, his fund reportedly made a gain of about $1 billion, or 20%, during a single, turbulent day when the VIX briefly broke and ETF trading went haywire for several hours.

Fast forward to March when the biggest “looming disaster” in decades finally struck, and when Universa struck the historic payday it was waiting for ever since the inception of its tail-hedge fund – which is basically deep out of the money puts which roll every month – in March 2008.

“It is a good time to reflect again on how we have performed for you as a risk mitigation strategy, if for no other reason than to give you some reassurance and even solace following one of the scariest months for markets on record” Spitznagel writes in his investor letter sent out to clients earlier today, and then delivers the good news: the fund generated a 3,612% return on invested capital in March, and a phenomenal 4,144% year to date.

“These returns likely surpass any other investment that you can think of over the period you have been invested with us. Kudos to you for such a sound “tactical” allocation to Universa”, Spitznagel said, taking a well-deserved victory lap, adding that the fund was able to monetize the bulk of the spikes in P&L that it experienced in March, “while keeping downside protection in place throughout, should the market continue lower—one of our tricks of the trade.”

Spitznagel went on: “the standalone Universa tail hedge strategy’s life-to-date mean annual net return on invested capital (expressed as returns on a standardized capital investment since inception in March 2008, and using yours from your start date) has been +76% per year. (During this period, as a reminder, the SPX has gained 151%. Are we really such an “über-bearish” strategy?).

In explaining how the Universa fund adds fat-tail protection to a diversified portfolio, Spitznagel writes that:

We have managed to consistently achieve our aim of raising our risk mitigated portfolio CAGRs by lowering risk, pandemic or no pandemic. And, as I have said many times before, it has worked so well simply because of the mathematics of compounding: the big losses are essentially ALL that matter to your rate of compounding, not the small losses—and not even the big or small gains. The big losses literally destroy your geometric returns and, equivalently, your wealth, through what I have called the “volatility tax.” For risk mitigation to be effective, it therefore must focus primarily on mitigating those big, rare losses (the tails). More specifically, risk mitigation must have a very high “bang-for-the buck” in a portfolio when the chips are down in a crash, relative to the portfolio cost of that “buck” the rest of the time—a very “convex” (tail) hedge. None of these other competing strategies have shown that.

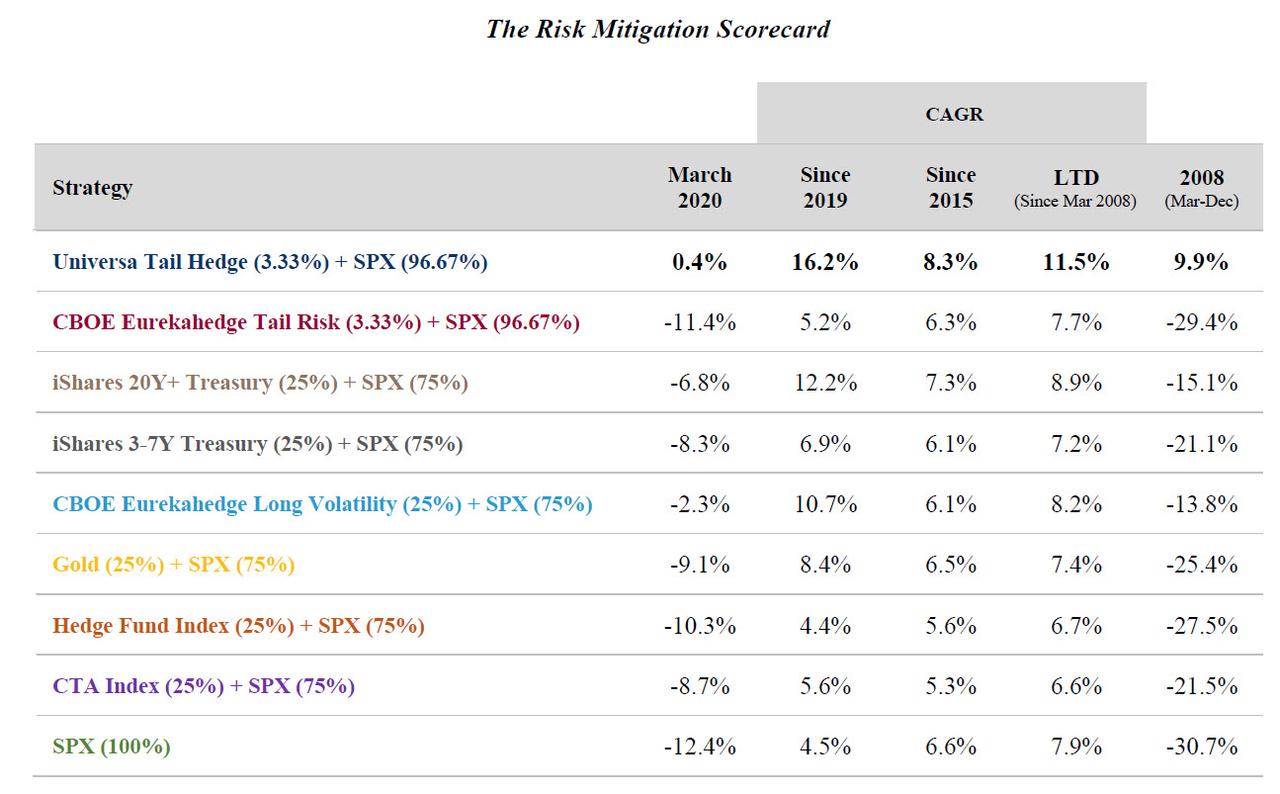

Spitznagel also included a performance scorecard, which showed that a portfolio invested 96.7% in the S&P500 and just 3.3% in Universa’s Tail Hedge fund, would have had a positive return in March, a month when the S&P dropped 12.4%. The same portfolio – which eliminates the adverse effect on compounding from downside shocks – would have produced a 11.5% CAGR since inception in March 2008 versus 7.9% for the S&P500.

“To put this in perspective, that value-added to the SPX portfolio CAGR life-to-date from a 3.33% allocation to the Universa tail hedge is mathematically equivalent to a 3.33% allocation to an annuity over that same period yielding 102% per year. Let that one simmer for a minute. We are not just another little incremental source of alpha within your portfolio; nor are we just some exotic alternative to a fixed income allocation”, the Universa CIO wrote explaining his risk management philosophy.

“Remember, anyone can make money in a crash; it’s what they do the rest of the time that matters. The totality of the payoff is what creates the portfolio effect.”

There is more on how Universa’s “risk-mitigation” strategy worked to offset the sharp March losses in the pdf attached below, but what we found more interesting was the brief outlook on markets and the global economy from the Universa CIO, which while pithy, is sufficient concise to recap everything one needs to know about the “market” in the years to come:

Looking ahead, the world remains very much trapped in the mother of all global financial bubbles. This is obvious, a given. Markets were priced for “perfection,” and now, following even more of the greatest monetary stimulus in human history (much of it in the span of just the last few weeks), they’re still priced for “really good”—still very expensive.

So this is far from over; the current pandemic is merely threatening to pop the bubble. (And, as we all can plainly see, the powers that be are likely running out of ways to keep the bubble inflated.) Make no mistake, it’s the systemic vulnerabilities created by this unprecedented central-bank-fueled bubble, and the crazy, naïve risk-taking and leverage that accompanies it, that makes this pandemic so potentially destructive to the financial markets and the economy.

Is the bubble now popping? When I look deep into my magic crystal ball, it clearly says to me, “There are no magic crystal balls!” And, moreover, those who grandiosely tout their crystal balls need to be avoided in the interest of preservation of capital. Whose crystal ball saw this past quarter coming? Sure, the global pandemic risks were there for all to see (as our colleague Nassim Nicholas Taleb pointed out in his book The Black Swan, some 13 years ago), but no one can ever really see what’s next, what lies around the corner. Despite our performance, that has included us. One’s risk mitigation strategy must reflect that reality.

But if history and economic logic are any guide, if the pandemic doesn’t pop this bubble then, of course, it will be something else that eventually accomplishes this. That’s my Cassandra speech (again).

Full Universa letter below:

Tyler Durden

Wed, 04/08/2020 – 16:40

via ZeroHedge News https://ift.tt/39NAlm8 Tyler Durden