COVID-19 To “Shock” US Economy Into Deep Contraction, 13% Unemployment By June, WSJ Survey Says

The Wall Street Journal published a new monthly survey that outlines the severe economic impact of shutting down cities across America to mitigate the spread of the COVID-19 pandemic.

The survey of 57 economists from April 3-7 includes 14.4 million job losses and a surge in unemployment through spring, with the possibility of a recovery in the second half of the year.

Economists told The WSJ that the U.S. labor market is in free fall, could see an unemployment rate as high as 13% in June, and roughly 10% by December. As of March, the jobless rate was elevated at 4.4%.

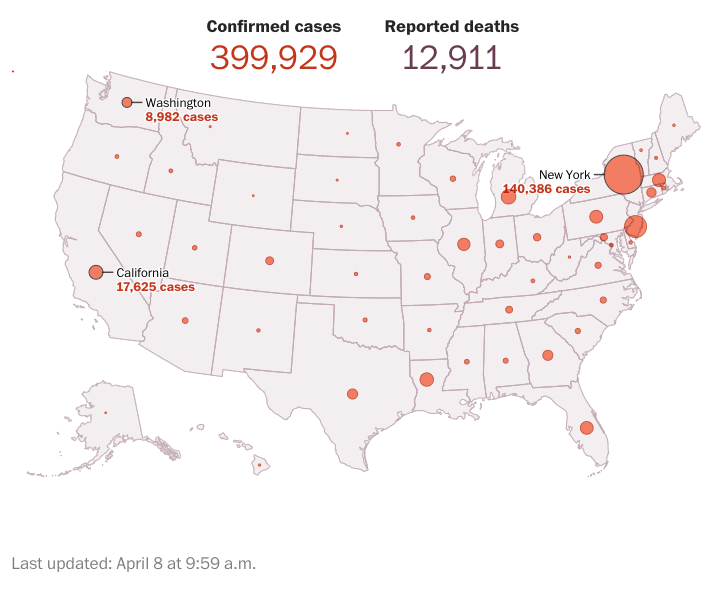

The outcome of the virus pandemic spreading across the country with 399,929 confirmed cases and 12,911 deaths, has turned into an economic and social crisis.

A depression will unfold in the second quarter, and the survey expects GDP to contract by at least 25% on an annual rate.

“This is the worst external shock in anyone’s living memory; it is as if a meteor hit the Earth and now we have to put it back on its axis,” said Grant Thornton economist Diane Swonk.

Most of the economists, or at least 85% that were surveyed, believe an economic recovery will be seen in the second half of the year. Their estimates are between annualized growth rates of 6.2% and 6.6% in the third and fourth quarters, respectively.

Here’s what they believe growth will be on the full year:

“For the full year, measured from the fourth quarter of 2019 to the fourth quarter of 2020, economists expect gross domestic product to shrink 4.9%. That compares with expectations of 1.2% growth just last month. Full-year growth was 2.3% in 2019. Economists now forecast full-year growth of 5.1% in 2021,” said The WSJ.

Many of the economists that were surveyed were split among the shape of the recovery in the second half.

“Can’t retire 20% of the economy and expect rapid rebound,” said economists Matthew Fienup and Dan Hamilton of California Lutheran University, who was part of the 45.1% of respondents expecting a U-shaped recovery.

The economists also said the Federal Reserve would hold interest rates on the zero lower bound through 2021. The average forecast in rate policy was a 25bps increase by the end of 2021.

The monthly survey showed 100% of economists thought the virus would be a “significant drag” on full-year economic growth in 2020,” up from 75% a month earlier.

“The economy will remain shellshocked at least this year,” said Loyola Marymount University economist Sung Won Sohn. “No time to raise rates.”

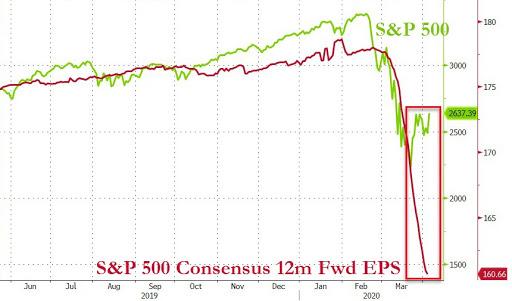

When it comes to corporate profits, economists expected earnings across companies in the S&P 500 to plunge 36% in the second quarter versus the same period last year. On an annualized basis, economists believed earnings would decline by at least 19%.

The WSJ notes, “One thing economists don’t see coming are further sharp selloffs in financial markets.”

Economists are making a bold statement in calling a possible bottom in markets as the economy plunges into depression.

Odd that almost every economist surveyed expects a recovery in the second half. What if that is not the case?

Maybe these economists need to read the latest WTO and OECD reports listed below. It would undoubtedly change their minds about recovery this year…

- “These Numbers Are Ugly” – WTO Forecasts Collapse In World Trade, Recovery For 2021

- Global Economies Suffer “Largest Drop On Record”: OECD

And a kindly reminder from Sven Henrich via NorthmanTrader.com, “January WSJ survey: 100% expect no recession in 2020.”

January WSJ survey: 100% expect no recession in 2020. https://t.co/SJLGLGvcCN

— Sven Henrich (@NorthmanTrader) April 8, 2020

It appears these so-called experts are blinder than bats…

Tyler Durden

Wed, 04/08/2020 – 17:20

via ZeroHedge News https://ift.tt/3bZIENd Tyler Durden