FOMC Minutes Signal “Profoundly Uncertain” Outlook, Feared Treasury Market Disfunction

Today’s minutes will provide detail on the Fed decisions announced on March 3 and March 15 after Fed Chair Jerome Powell convened emergency meetings as the scale of the pandemic and its risk to the U.S. economy became clear. The readout may also include their discussions of a slate of related actions that flowed from those two meetings.

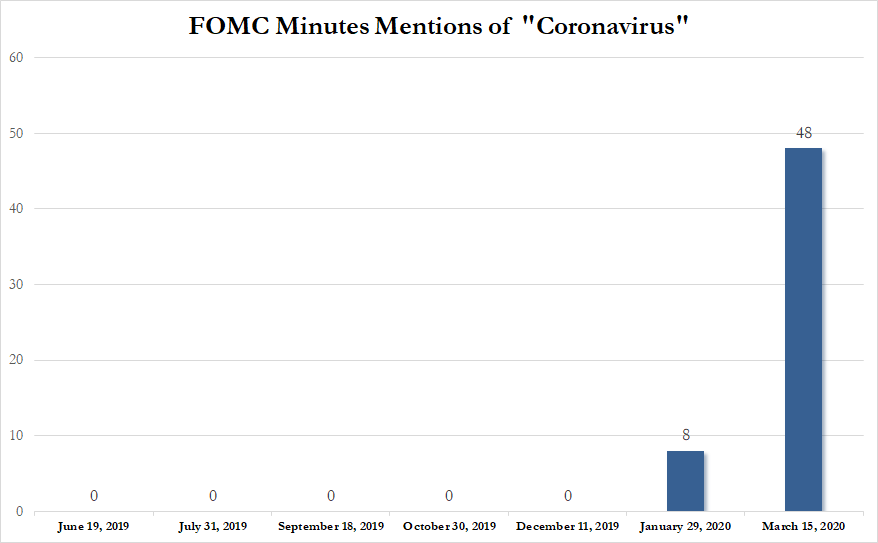

Amusingly, just five weeks before the surprise rate cut on March 3, Powell and his colleagues had wrapped up their first meeting of the year on Jan. 29 with an air of cautious optimism.

Since that emergency rate-cut (and the bazooka of all bazookas), The Dow is down around 9% and somewhat interestingly, the dollar, gold, and the long-bond are all up around 4%…

Source: Bloomberg

And at the same time, the volume of beta that The Fed will inevitably cut rates below zero has also surged…

Source: Bloomberg

As a reminder, today’s minutes may show just how dire a threat officials saw in those earliest moments and what spurred them to action.

The first move came on Feb. 28. With the S&P 500 Index tumbling 15% from its record high in just seven sessions and corporate credit spreads widening fast, Powell released an unscheduled statement at 2:30 p.m. pledging that Fed officials would “use our tools and act as appropriate to support the economy.”

The following Tuesday – March 3 – the Fed cut its benchmark lending rate by half a percentage point to a range of 1.00% to 1.25%.

“The fundamentals of the U.S. economy remain strong,” the U.S. central bank said.

“However, the coronavirus poses evolving risks to economic activity.”

One month later, the US economy was in a recession, or perhaps a depression.

That said, today’s minutes are unlikely to contain anything to spook markets, given that it has rolled-out measures to assuage market concerns, and will likely reiterate its pledge to support the financial system. Of most interest will be whether there was any discussion in the minutes of if, when and under what, the Fed would start buying stocks.

Despite all The Fed has done, financial conditions are extremely tight still…

Source: Bloomberg

So just how freaked out were they over those two hectic weeks…

The short answer is “very”!

Policy makers saw risks pointing to the downside and warranting a “forceful” response, according to a record of their emergency gathering Sunday, March 15.

“All participants viewed the near-term U.S. economic outlook as having deteriorated sharply in recent weeks and as having become profoundly uncertain,” minutes published Wednesday of the Federal Open Market Committee meeting showed.

At the unscheduled meeting, officials announced that they would cut their benchmark interest rate to nearly zero and relaunch massive bond-buying programs to pump cash into the financial system, as they sought to shelter the U.S. economy from the coronavirus pandemic.

Fed notes “extremely large degree of uncertainty” on outlook

In their consideration of monetary policy at this meeting, most participants judged that it would be appropriate to lower the target range for the federal funds rate by 100 basis points, to 0 to ¼ percent. In discussing the reasons for such a decision, these participants pointed to a likely decline in economic activity in the near term re-lated to the effects of the coronavirus outbreak and the extremely large degree of uncertainty regarding how long and severe such a decline in activity would be.

Fed advocated “forceful” monetary response

In light of the sharply increased downside risks to the economic outlook posed by the global coronavirus outbreak, these participants noted that risk-management considerations pointed toward a forceful monetary policy response, with the majority favoring a 100 basis point cut that would bring the target range to its effective lower bound (ELB). With regard to monetary policy beyond this meeting, these participants judged that it would be ap-propriate to maintain the target range for the federal funds rate at 0 to ¼ percent until policymakers were con-fident that the economy had weathered recent events and was on track to achieve the Committee’s maximum employment and price stability goals

Fed on the severe strain in bond markets:

Trading conditions across a range of markets were severely strained. In corporate bond markets, trading ac-tivity and liquidity were at very low levels, although not back to the low point reached in 2008. Market partici-pants expected that actions taken to slow the spread of the virus could have significant effects on the credit wor-thiness of certain borrowers, particularly those at the lower end of the credit spectrum. Market participants also increasingly pointed to concerns in other segments of the debt market. In securitized markets, including those for asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS), primary market is-suance slowed, and secondary market trading had be-come less orderly, with money managers selling short-dated liquid products to meet investor redemptions.

Fed on Treasury Markets

In the Treasury market, following several consecutive days of deteriorating conditions, market participants re-ported an acute decline in market liquidity. A number of primary dealers found it especially difficult to make markets in off-the-run Treasury securities and reported that this segment of the market had ceased to function effectively. This disruption in intermediation was at-tributed, in part, to sales of off-the-run Treasury securi-ties and flight-to-quality flows into the most liquid, on-the-run Treasury securities

Fed on short-term funding markets

Conditions in short-term funding markets also deterio-rated sharply amid a decline in market liquidity and chal-lenges in dealer intermediation. Over recent days, the premium paid to obtain dollars through the foreign ex-change swap market increased sharply, and the volumes in term repurchase agreement (repo) markets dropped significantly. Issuance of commercial paper (CP) matur-ing beyond one week reportedly almost dried up at the end of the week before the meeting, and primary- and secondary-market liquidity for financial and nonfinancial CP was described as nearly nonexistent at a time when investor concern about issuer credit risk was rising.

Fed on stress in the housing market

…social distancing, by financial uncertainty—including difficulties that households and businesses would face in meeting mortgage or rental payments—and by volatility in the market for MBS. Participants stressed the major down-side risk that the spread of the virus might intensify in those areas of the country currently less affected, thereby sidelining many more U.S. workers and further damping purchases by consumers. Participants expressed con-cern that households with low incomes had less of a sav-ings buffer with which to meet expenses during the in-terruption to economic activity. This situation made those households more vulnerable to a downturn in the economy and tended to magnify the reduction in aggre-gate demand associated with the nation’s response to the pandemic.

On ZIRP

“With regard to monetary policy beyond this meeting, these participants judged that it would be appropriate to maintain the target range for the federal funds rate at 0 to 1/4 percent until policymakers were confident that the economy had weathered recent events…”

On NIRP:

A few participants also remarked that lowering the target range to the ELB could increase the likelihood that some market interest rates would turn negative, or foster investor expectations of negative policy rates. Such expectations would run counter to participants’ previously expressed views that they would prefer to use other monetary pol-icy tools to provide further accommodation at the ELB.

On Bank buybacks:

“Several participants commented that banks should be discouraged from repurchasing shares from, or paying dividends to, their equity holders.”

Developing…

* * *

Full Minutes below:

Tyler Durden

Wed, 04/08/2020 – 14:07

via ZeroHedge News https://ift.tt/2RpXPaG Tyler Durden