Nomura: “This Unenthusiastic, Inorganic Bear Market Rally” Faces An April 22 Day Of Reckoning

Just in case Nomura’s quant Masanari Takada wasn’t clear enough yesterday when he said that the current rally, which pushed the S&P back into a bull market from its March 24 lows was nothing more than a giant “bear squeeze” rally, driven by panicked exits from shorts that investors accumulated during the downturn, he doubled down today when in a note published overnight, he said that “the present rally should best be viewed as an unenthusiastic, inorganic bear market rally” and that “the stock market rebound across major world markets is being led by exits from bearish trades, including a squeeze on short positions held by systematic traders.“

Echoing Morgan Stanley which found that virtually nobody is participating in the current bear market rally, the Nomura quant writes that global equity market remain jittery as “most investors (apart from some with short investment horizons) are still in standby mode“, and in fact, “some may be inclined to sell whatever rallies come along.”

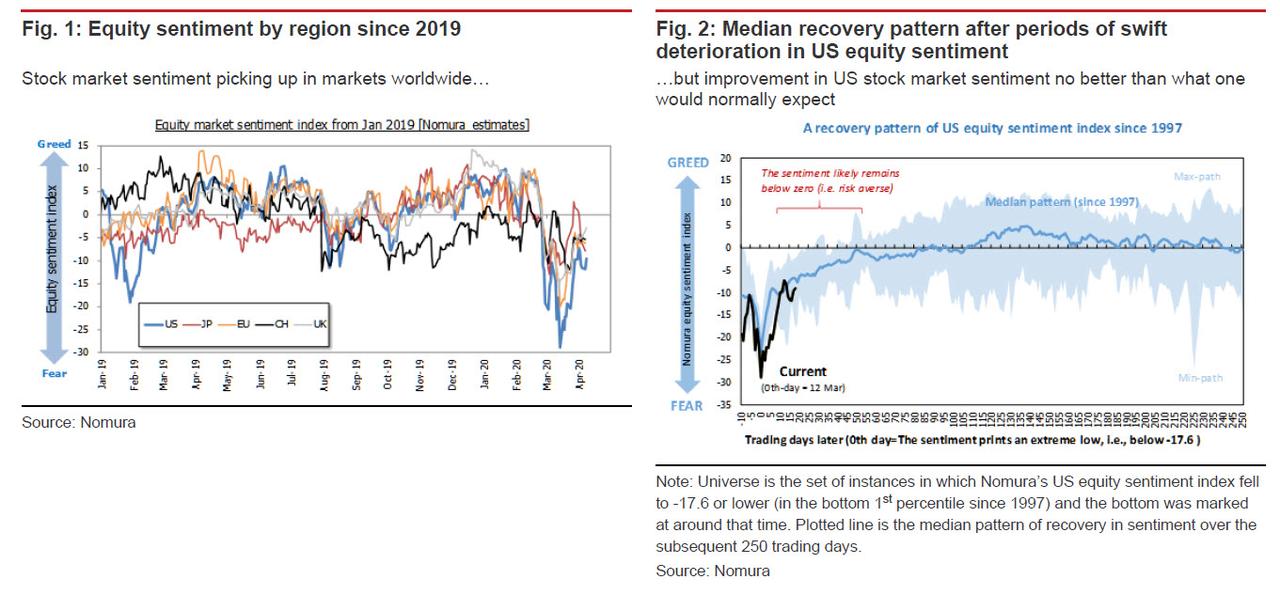

Meanwhile, as Takada shows in the charts below, the pick-up in investor sentiment looks like no more than the sort of spontaneous rebound in sentiment that one would normally expect under the circumstances.

As a reminder, looking at investor flows, Morgan Stanley was surprised that in the recent surge higher, there had been virtually no participation on the buy side, and even more perplexing, almost no short covering either, especially in the latest leg higher:

- ZERO HF re-grossing (fundamental or systematic)

- ZERO covering of the $33bn net short in Futures (and volumes falling)

- ZERO new build in call ownership (and volumes falling).

Yet while there is nothing explicitly new in the above which we had presented previously, where Takada did provide a new perspective was his estimate of how long this bear market rally will last. To do that, he analyzed the transition in the bullish flows “baton” between CTA and fundamental investors, warning that “should the baton get dropped, we would expect

CTAs’ net buying of NASDAQ 100 futures to wind down by 22 April.”

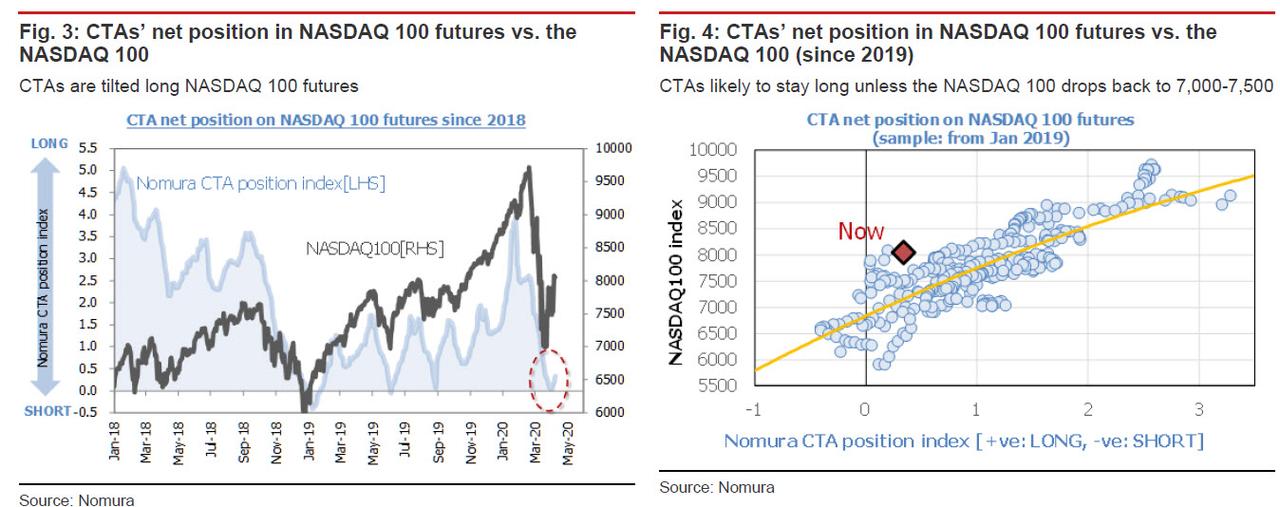

We think that periodically checking CTAs’ net position in NASDAQ 100 futures may give investors a sense of how long the bear market rally might last… It appears that CTAs were quick to swing long on NASDAQ 100 futures. To anyone looking to gauge the strength of technical investors’ inclination to buy, CTAs’ net position in NASDAQ 100 futures can be read as a leading indicator of what may happen in other equity futures markets.

Nomura expects CTAs to continue “tentatively chasing the market up for the moment, with a push from the decline in stock market volatility.” Futures prices have increased more quickly than the pace of growth in CTAs’ net long position would suggest, but even when adjusting for this, CTAs should remain inclined to buy unless the NASDAQ 100 drops down into the 7,000-7,500 range.

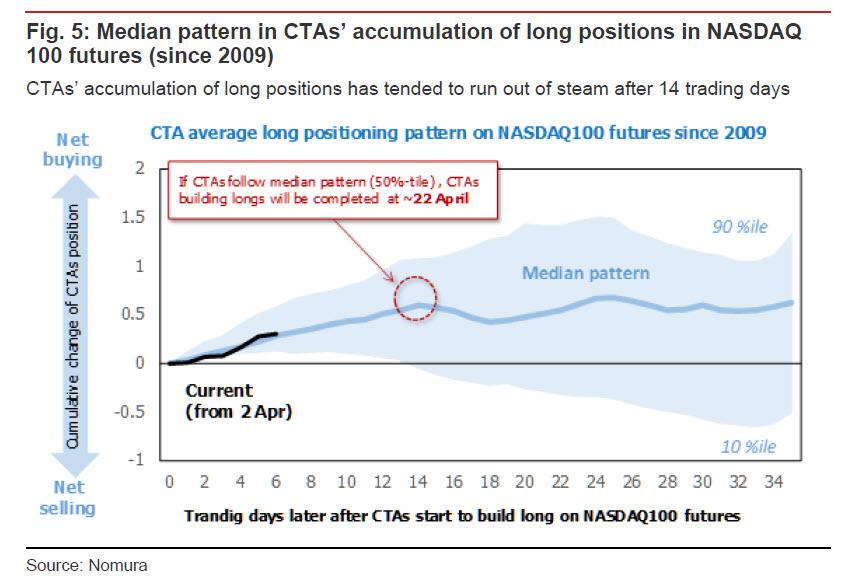

However, as Takada shows next, the record of periods in which CTAs have accumulated long positions in NASDAQ 100 futures since 2009 shows that on average, net buying by trend-following investors has tended to mark an initial peak about 14 trading days after the net buying started. This time around, we estimate that CTAs started going long on 2 April (or around then), so if precedent is any guide, Nomura expects the systematic buying to fizzle out by April 22 at the latest.

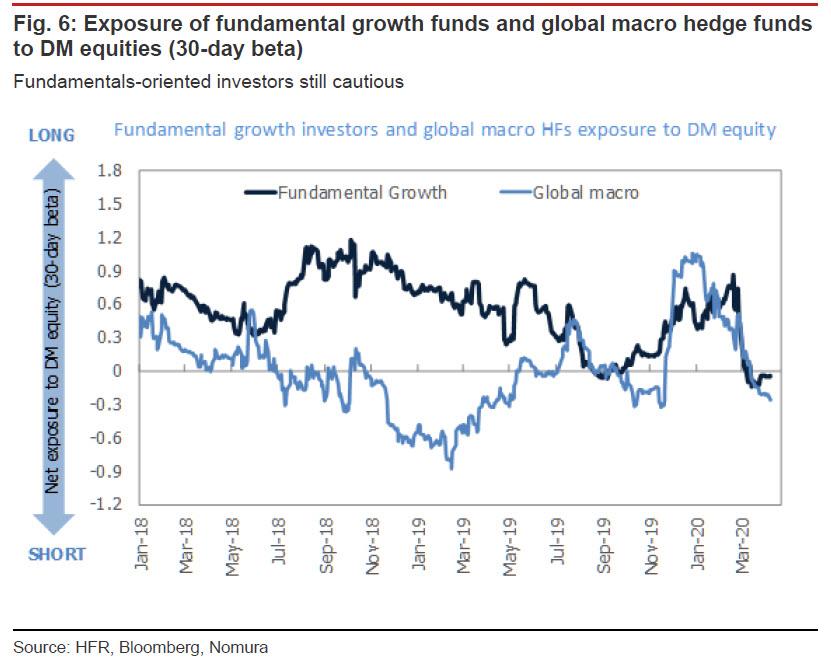

But while CTAs may have already gone long, fundamentals-oriented growth funds and macro funds are far more cautious, and as we showed earlier today, still have a negative net exposure. This is important, because the upward momentum behind a technical rally tends not to stabilize until heavyweight fundamentals-oriented investors like these start chasing the market up.

For the coming week or two, then, the critical thing to look out for is whether the CTAs that are currently driving the rally manage to smoothly pass the baton to fundamentals-oriented investors without anyone dropping it. And, as Nomura concludes, “should the baton get dropped, we would expect CTAs’ net buying of NASDAQ 100 futures to wind down by 22 April.”

Tyler Durden

Wed, 04/08/2020 – 18:40

via ZeroHedge News https://ift.tt/2xeHT46 Tyler Durden