Ray Dalio Still Thinks “Cash Is Trash”, But…

A brief history of the world’s largest hedge fund manager’s worst…call…ever…

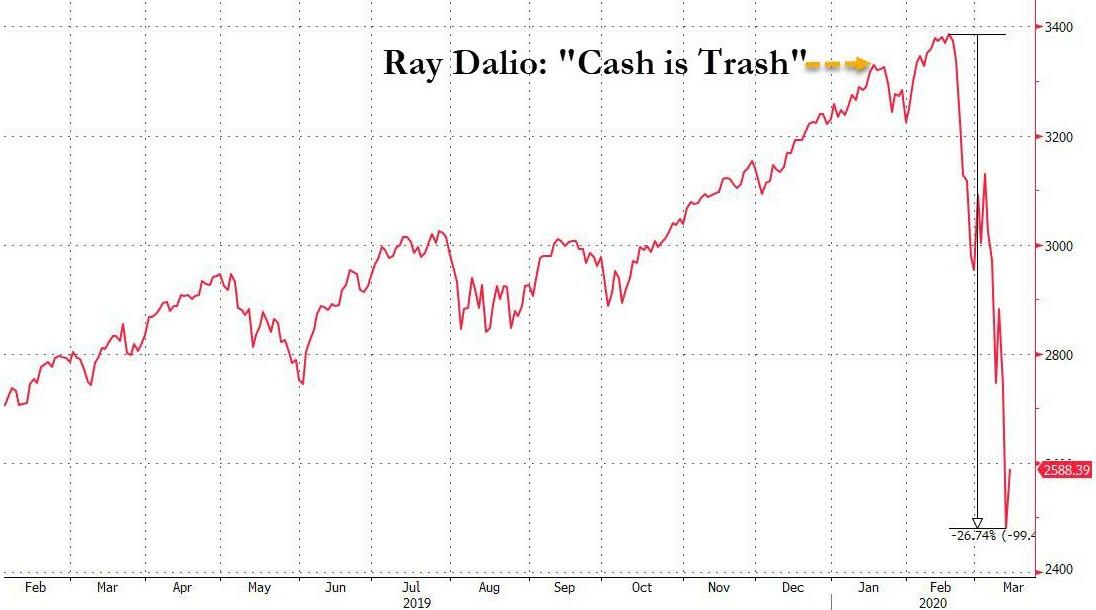

On a cold January day in Davos in 2020, billionaire hedge fund manager Ray Dalio made the now infamous three word statement that “cash is trash.”

Ray Dalio: “You can’t jump into cash. Cash is trash.” pic.twitter.com/4noJ7CFHha

— Gualestrit (@gualestrit) January 30, 2020

Six weeks later, the stock market had suffered the fastest loss of market-capitalization in its history, “cash” was the best-performing asset in the world (as gold had suffered some forced liquidation selling pressure) and cash inflows exploded at their fastest pace ever.

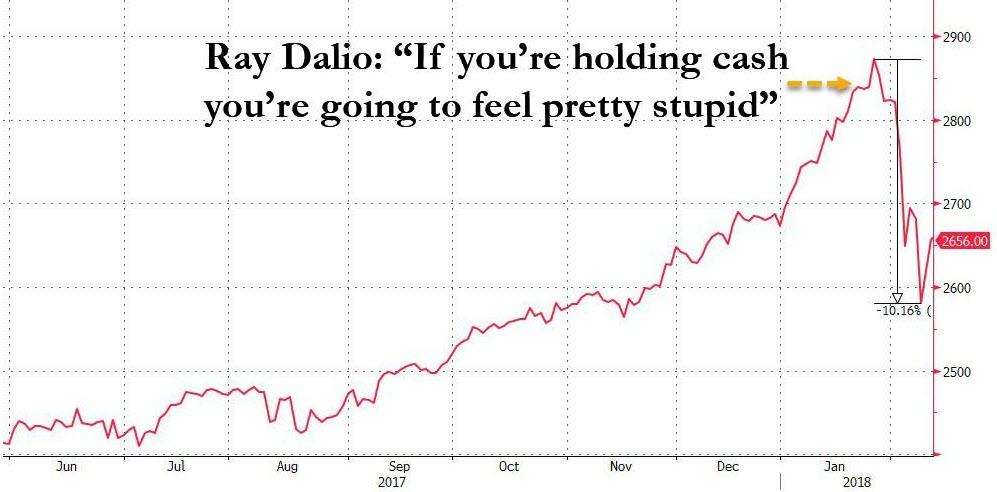

That was not the first time Dalio used Davos as a platform to accuse cash of being a terrible asset: back in 2018, he said that “if you’re holding cash, you’re going to feel pretty stupid.”

On Dec 31 of that year, cash would end up being the best-performing asset of the year.

By mid-March of 2020, Dalio had flip-flopped back to fearmongery, estimating that the virus will cost the economy and US corporations up to $4 trillion, or roughly 5% of the US $21 trillion GDP. Worldwide, Dalio estimates $12 trillion in corporate losses due to the pandemic. The hardest hit industries are taking catastrophic losses, with the business travel sector expected to lose an astonishing $820 billion and the restaurant industry slated to lose $225 billion.

And now, as Bloomberg reports, Dalio is back to his “cash is trash” theme again, clarifying this time that there are better assets to hold as central banks go all-in on printing money in response to the COVID-19 pandemic.

During a Reddit Ask Me Anything event on Tuesday, Dalio was asked, rather pointedly, “A few months ago, you said ‘cash is trash’; but now’ cash is king’ – what gives?”

Dalio responded “I still think that cash is trash” but this time added some more “clarification” to his call…

“I’m glad you asked so that I can clarify...

Back then, and still now, I believe that central banks will print a lot of money and keep cash interest rates at such low levels that they will have negative real returns and negative returns relative to assets that behave well in times of reflation.

When the virus hit and it had its negative impact on earnings and balance sheets, asset values plummeted which made cash look comparatively attractive.

However, what did the central banks do? They created a ton more cash to buy debt and push interest rates lower which is having the effect of pushing those assets that will be better suited for the new environment up.

When you think about what assets are safe to own, and you think of cash, please remember that while it doesn’t move around in value as much as other assets, there is a costly negative return to it in relation to goods and services and other financial assets that amounts to about a couple of percent a year, which adds up.

So I still think that cash is trash relative to other alternatives, particularly those that will retain their value or increase their value during reflationary periods (e.g., some gold and some stocks).“

While much of what Dalio’s “clarification” says makes sense, the responses to the headlines summed things up rather well, epitomized best by the following…

How long before new lows now? pic.twitter.com/9ollcAPOpE

— Hipster (@Hipster_Trader) April 8, 2020

Tyler Durden

Wed, 04/08/2020 – 09:40

via ZeroHedge News https://ift.tt/39WMPYC Tyler Durden