The Worst Economic Collapse Ever?

Authored by Tuomas Malinen via GnSEconomics.com,

Country after country has reported extremely dark economic numbers. The gigantic jobless claims, 6.6 million from the U.S. last week, are just the tip of the iceberg. For example, the service sector PMIs have been simply ghastly across the globe. We are now in a crisis of epic proportions.

But, how massive can the crisis eventually get? Since our inception, in 2012, we have contemplated three scenarios as a part of our quarterly forecasts. While we have not referred to them in each report, we have repeated them periodically. They are: the optimistic, the most probable and the pessimistic.

But at this point our main worry is the approaching realization of the pessimistic, or the worst, scenario. It’s likelihood, while still low, is increasing fast in our estimate.

Underpinning its severity is not the virus, but the fragility of the global economy.

Breeding chaos: failed clean-ups and bad policies

The Global Financial Crisis (GFC) was considered a Black Swan event to many. However, it was no such thing. It was a massive failure of hedging and diversification within the global banking system, most notably in the U.S., and a number of prominent analysts saw it coming. See our blog, 10 years from Lehman. And nothing has been fixed, for an insight view on that crisis.

While banks were wound down and recapitalized in the U.S. after the GFC, an equivalent restructuring did not happen in Europe. Stricken European banks were left to linger in a state of permanent financial distress.

“Outright Monetary Transactions” or “OMT”, negative interest rates, and ECB’s QE program all aggravated the predicament of European banks. The failure to resolve the 2008 crisis ‘zombified’ the European banking sector, a situation which persists today. (See Q-Review 3/2019 for a detailed account).

Another pivotal moment for the world economy came in March of 2009, when the Fed vastly expanded its asset purchase program of U.S. Treasuries and mortgage-backed securities. This became known as the notorious Quantitative Easing or “QE” program, and has persisted in one form or another ever since. (See Q-Review 1/2018 for a detailed explanation.)

Central banks quickly assumed the role of “lender of first resort” in the capital markets, and their balance sheets ballooned. Asset prices rose to never-before-seen heights. Continuous market bailouts, culminating in the ‘pivot’ of the Fed in early January 2019 and its repo-bailout in September, removed all market discipline and incentivized investors to wild speculation (see Q-Review 4/2019 for details).

The giant with (debt) clay feet

Chinese leaders also reacted quickly when the financial crash of 2008 precipitated a global recession.

China initiated a massive infrastructure programs that jump-started the world economy to a renewed upward trajectory. These programs were financed by credit issued by state-controlled banks, which Beijing can compel to lend, and the banks responded by doubling the volume of loans YoY. Between 2007 and 2015, 63% of all new money created globally came from China, and most of this increase was created by commercial banks.

During 2016, China unleashed a never-before-seen credit bonanza, tripling the size of the “shadow banking sector” as a response to a slump in the Chinese housing market, which had become the backbone of the Chinese economy over the past two decades.

By the end of 2017, the assets of the shadow banking sector stood at a mind-boggling 367% of GDP. The commercial banking sector has also become extremely levered, posting over 500% growth in credit since 2008.

Alas, the Chinese banking sector is now totally incapable of coping with any significant shock, and these Chinese economy became riddled with unprofitable investments.

Into the Abyss

These fragilities, combined with the massive economic impact of the coronavirus, leads us to our most pessimistic scenario.

In it we assume that

-

Many governments will not be prudent enough in suppression measures, which will lead to severe global pandemic peaking in summer.

-

Due to the worsening outbreak and delays in containment, suppression measures will eventually be prolonged and they become draconian (“Wuhan style”).

-

The massive stimulus measures enacted by governments and central banks will be ineffective in providing support for the economy, as the tardy application of draconian suppression measures lock people at home in several key countries of the global economy for a prolonged period of time.

-

Global economic activity plunges to never-before-seen lows.

-

European banking sector breaks.

-

Eurozone unravels violently.

-

China ‘lands hard’.

-

Global financial system collapses.

-

A systemic crisis engulfs the world.

A systemic crisis simply means that the banking sector and financial markets collapse. In practice, this implies that most banking services will stop and funding through financial markets will cease. This also means that the monetary system is likely to collapse (see Q-Review 4/2019 for a detailed explanation).

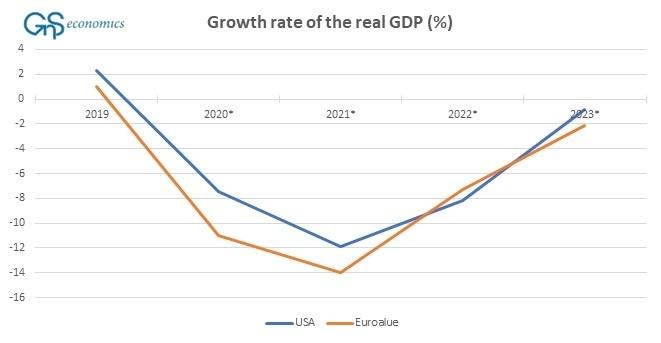

It should be acknowledged that we have never faced such a scenario on a global scale (though the collapse of the Soviet Union could certainly be classified as “systemic meltdown”). That is why the sheer scale of such an apocalyptic scenario will be horrifying. They are presented in the Figure below.

Figure. The forecasted (Y-to-Y) GDP growth rates in the U.S. and in the Eurozone in 2020 – 2023. Source: GnS Economics, OECD

Fragilities laid bare

The Covid-19 pandemic will reveal all the fragilities of the world economy. The near collapse of the U.S. capital markets in mid-March was averted only through unprecedented socialization of the financial markets. However, when the Flood of corporate bankruptcies begins, central banks will not be able to withstand the onslaught. Then we will face only extreme economic options.

The global collapse scenario, presented above, would bring in its wake massive unemployment, poverty, misery and the eventual re-structuring of our whole social and economic order. The world would be utterly and permanently changed as a result.

This is something we absolutely need to be prepared for, even though its likelihood is still relatively low.

But it is increasing fast, and that should worry us all.

Tyler Durden

Wed, 04/08/2020 – 14:45

via ZeroHedge News https://ift.tt/2x2Oj6p Tyler Durden