Container Lines Face “Profound” Threat As COVID-19 Sparks Unprecedented Surge Of ‘Blank’ Sailings

The global economy is unlikely to experience a V-shaped recovery for the second half of the year as the containerized shipping industry is quickly sinking, and the fallout could persist into 2021.

Copenhagen-based Sea-Intelligence reported on Monday that 212 sailings over the last three months had been canceled in response to major shipping lines reducing capacity along routes in developed and emerging markets. The total number of “bank” (canceled) sailings has quadrupled over the last week, reported American Shipper.

Sea-Intelligence CEO Alan Murphy said earlier this week that container carriers started cutting service as China’s economy ground to a halt in February to mitigate the spread of COVOID-19.

“It is clear that the primary purpose of the capacity reductions [is] to prevent a catastrophic drop in rate levels,” Murphy said on Monday. “The cost savings are also important, as they too are measured in the billions, but they pale in comparison to the impact declining rate levels will have.”

Murphy said the virus shocked global supply chains and could soon produce “profound” financial impacts on carriers. He said his best-case scenario is a 10% decline in volume, and container rates hold steady, that would result in carriers losing upwards of $800 million this year. As for the worst-case scenario, volumes and rates crash as they did a decade ago, carriers would lose a mind-boggling $23 billion this year.

We noted last month that undeliverable goods began piling up at Chinese ports, which has also started to happen at US ports, indicating that global trade remains depressed. This all suggests that distress in the shipping industry could persist into 2021.

As the full devastation of the virus depression emerges, Lars Jensen, CEO of SeaIntelligence Consulting, said: “it is clear that carriers are highly likely to blank far more sailings [if] we begin to see rates slide too far.”

Jensen said the increase in bank sailings could lead to balance sheet deterioration for top carriers.

“Carriers’ survivability in the coming months hinges on the depth of their current liquid reserves, their ability to attract additional liquid reserves [and the extent they are] able to postpone larger payments and potentially refinance debts.”

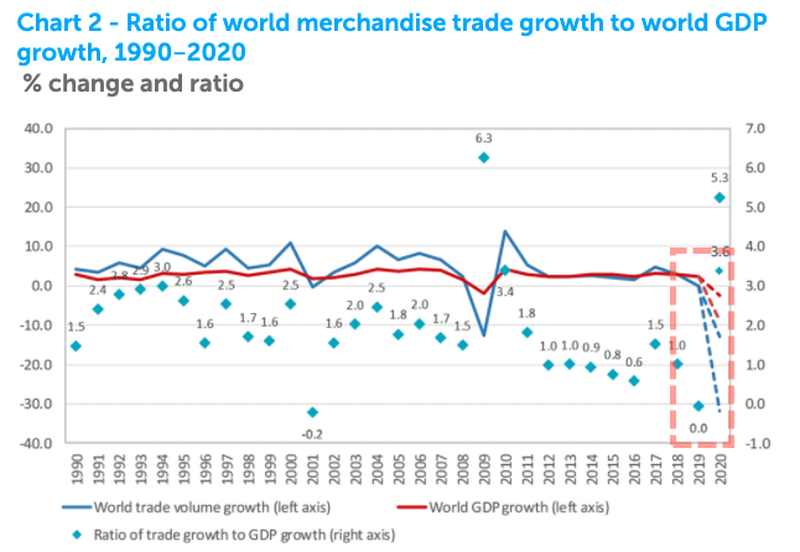

And for some proof that a V-shape recovery in the global economy is a distant dream. The World Trade Organization (WTO) published a new report on Wednesday that offered some truly apocalyptic estimates for global growth:

“World trade is expected to fall by between 13% and 32% in 2020 as the COVID 19 pandemic disrupts normal economic activity and life around the world.”

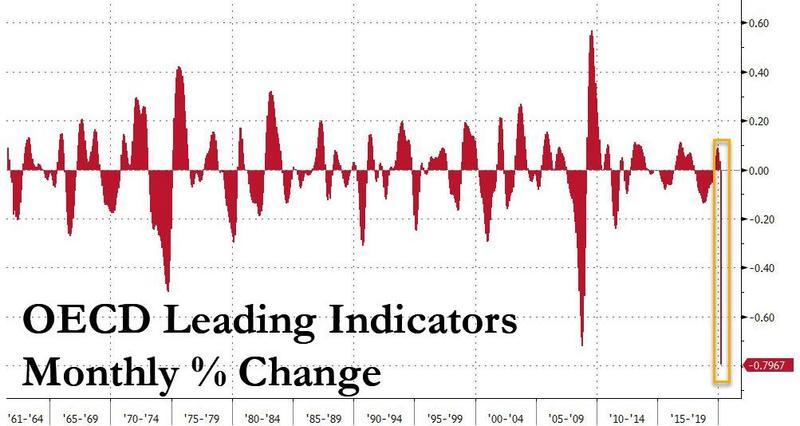

And if that wasn’t enough, the Organization for Economic Co-operation and Development (OECD) also released a report that suggested all major economies had plunged into a “sharp slowdown.”

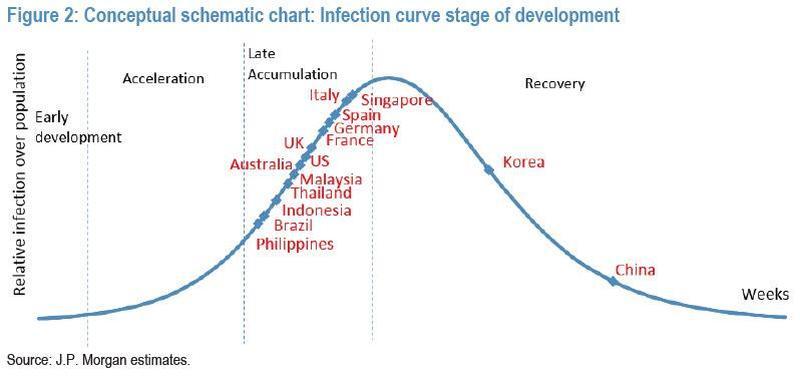

And determining when the global economy recovers depends on the duration of the virus outbreak. The virologists at JPMorgan show that much of the world is still in the late accumulation cycle:

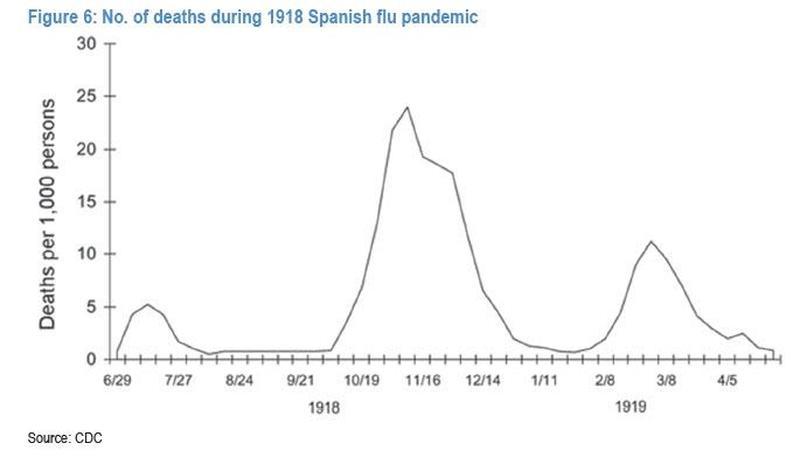

And here’s the bad news, the virus could return in a second or third wave, just as the Spanish Flu pandemic did.

Signs of recovery were hopeful in China over the last month as Wuhan’s lockdown recently ended, and it appeared people were getting back to work. But now fears of a second virus wave appear imminent, dashing any hope that an economic recovery in the country could be seen in the first half.

To sum up, probabilities are increasing that a V-shaped recovery will not be seen this year in the global economy as container vessel operators should start realizing the “worst-case scenario” with global depression unfolding across the world.

Tyler Durden

Thu, 04/09/2020 – 04:55

via ZeroHedge News https://ift.tt/3e8kDW4 Tyler Durden