Expect (At Least) Another 6.5 Million In Jobless Claims

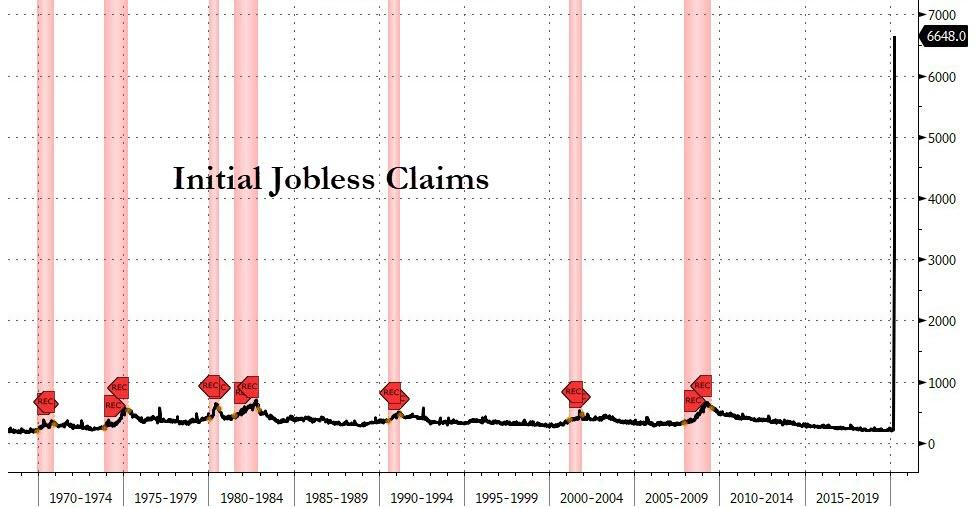

Two weeks ago it was a record 3.3 million initial claims; last week it was an additional 6.6 million in initial claims for a two-week total of 10 million Americans having just lost their jobs.

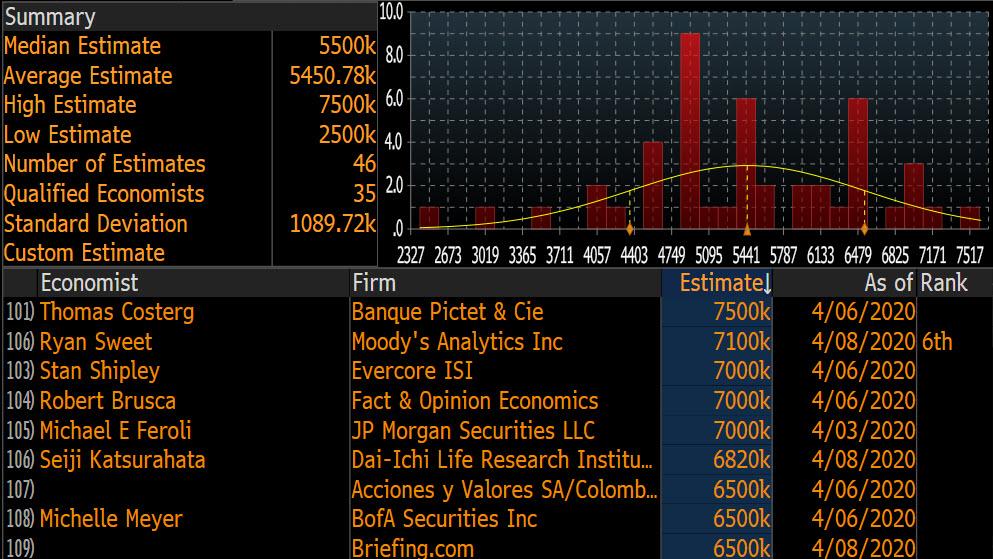

Tomorrow, Wall Street consensus expects another 5.5 million in initial claims to have been filed although the truth is that nobody has any idea how to quantify and estimate what is essentially the US economy sliding into an economic depression (supposedly a short one, but again, who knows). For the second week in a row, Pictet analyst Thomas Costerg remains the most bearish with a 7.5 million forecast, which if accurate would mean that approximately 18 million Americans – 11% of the labor force – have filed for unemployment benefits in the past three weeks.

Drilling down into the number we use BofA’s forecast which is inbetween the median and the high at 6.5 million. According to the bank, “local news covering developments in various states point to national claims remaining near record levels” although as the bank notes, “risks are tilted to the upside given Google Trends data and the CARES Act. Seasonal adjustment will be a negative offset.”

Some more details:

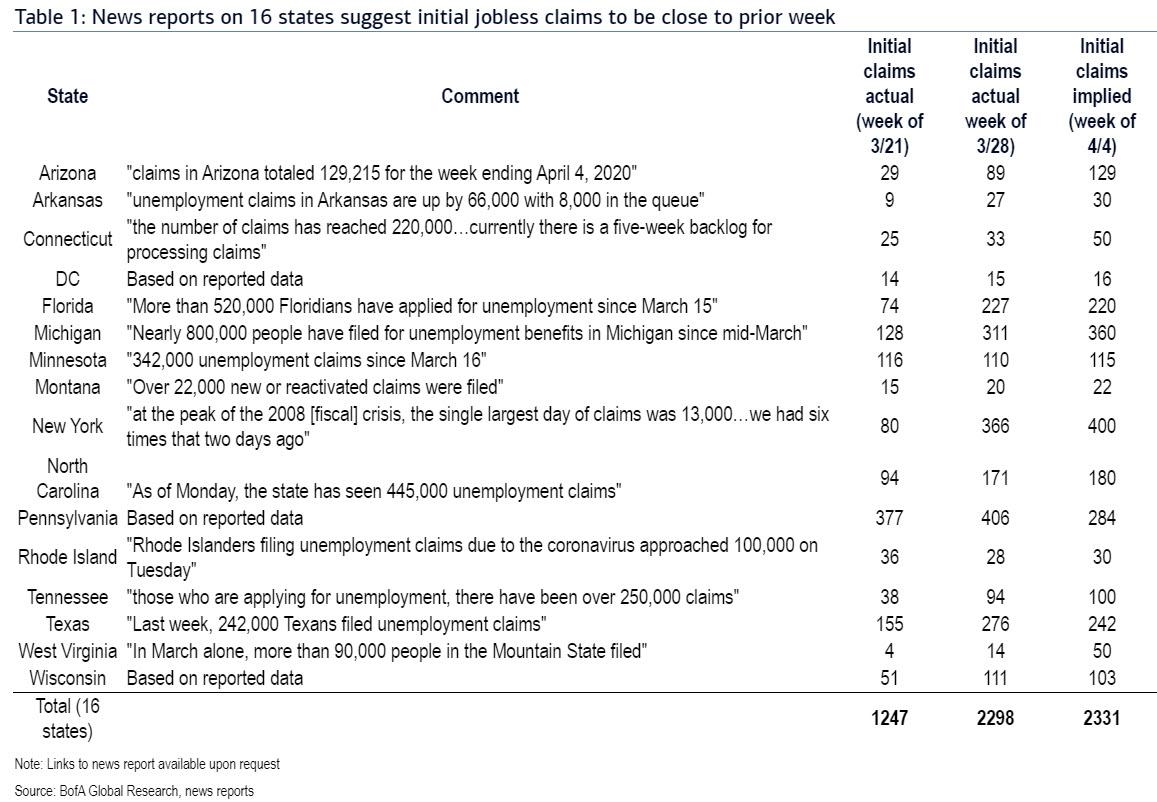

After reviewing data from local news reports to gather an assessment by state, BofA thinks that 6.5 million claims is a reasonable forecast. For 16 states, the bank found either specific information or enough to back out an implied number, calculating a total of 2.3mn for the upcoming report which matches the week ending March 28 for these 16 states.

Assuming the other states come in similar to the week prior, we are on track for close to 6.5 million jobless claims.

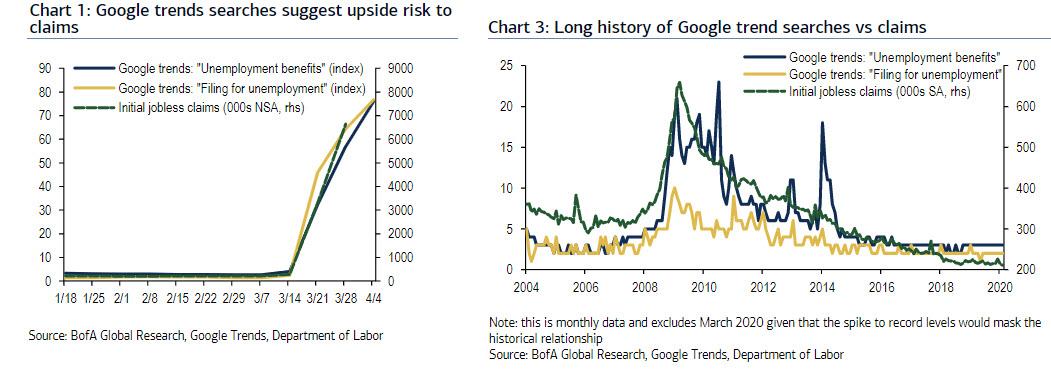

That said, the risks are clearly tilted to the upside (i.e., a much higher claims print). There were broad signs that state governments were increasing hiring or shifting resources to better process filings for unemployment benefits given the deluge in recent weeks. Some states believed the worst was yet to come. Picking up on our analysis from last week, BofA notes that data from Google Trends reveals further pickup in searches for “unemployment benefits” and “filing for unemployment,” which could argue for upside.

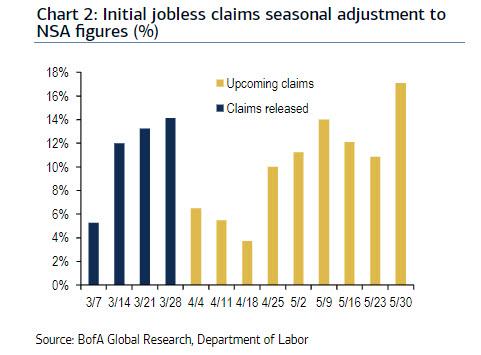

There is one potential negative offset: seasonal adjustment. The Bureau of Labor Statistics releases seasonal factors in advance and for the week ending April 4 there is a 6.5% positive adjustment to non-seasonally adjusted claims, which is 7.7pp lower than the +14.2% seasonal adjustment in the last report.

To put this in context, combining last week’s non-seasonally adjusted figure of 5.8mn with this week’s lower seasonal factor would result in seasonally adjusted claims of 6.2mn instead of 6.6mn that was actually reported.

That said, the actualy number will likely be even higher due to the bailout itself: as a reminder, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed on March 27, could contribute to new records being reached in coming weeks as it increases eligibility for jobless claims to self-employed and gig workers, extends the maximum number of weeks that one can receive benefits, and provides an additional $600 per week until July 31. A recent WSJ article noted that this has created incentives for some businesses to temporarily furlough their employees, knowing that they will be covered financially as the economy is shutdown. Meanwhile, those making below $50k will generally be made whole and possibly be better off on unemployment benefits.

Tyler Durden

Wed, 04/08/2020 – 23:20

via ZeroHedge News https://ift.tt/3aQh2Kd Tyler Durden