Fed Foray Into High Yield Sparks Biggest Junk Bond Spike In Over A Decade

HYG – the largest, $15 billion high yield bond ETF – is up a stunning 8% this morning the most since January 2009, after the Fed surprised the market with its new “we’ll buy any old crap” policy, or specifically expanded its corporate bond buying program to include debt from companies that recently lost their investment-grade rating. The announcement also gave a boost of the same magnitude to the $8.5 billion SPDR Bloomberg Barclays High Yield Bond ETF, or JNK.

This is the biggest daily jump since Oct 2008…

Echoing what we said previously, Seema Shah, chief strategist at Principal Global Investors said that “Fears about how the high-yield market would absorb the likely wave of oncoming ‘fallen angels’ has been weighing heavily on the market. The announcement is a significant relief, as reflected in the HY market’s response.”

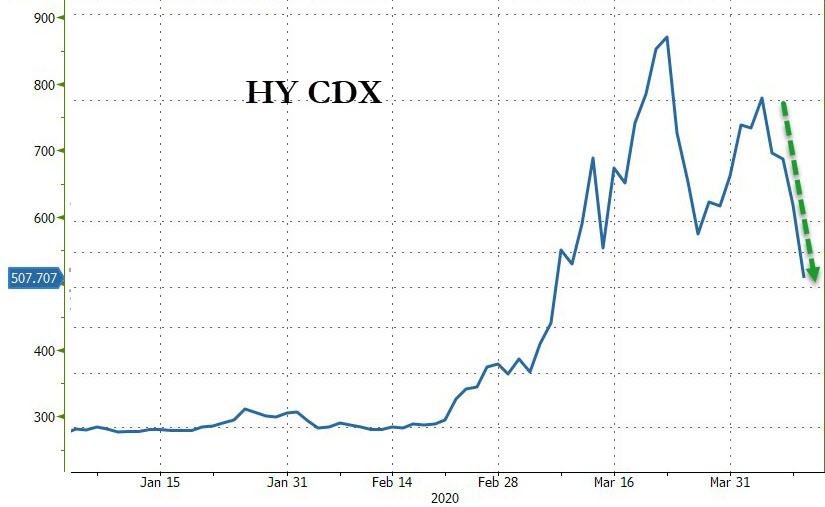

The broad credit market is seeing massive spread compression…

As we noted earlier, with this intervention in the equity-like junk bonds, there are no more free markets as what today’s action means is that the Fed’s nationalization of stocks ust now just a matter of time.

Tyler Durden

Thu, 04/09/2020 – 10:01

via ZeroHedge News https://ift.tt/2xZUJ6f Tyler Durden