Free Markets Are Dead: Fed To Start Buying Junk Bonds, Junk ETFs

Back on March 23, when the Fed unveiled it would start buying investment grade corporate bonds, we said “now that the Fed is effectively all in, it will buy stocks and junk bonds next.”

Two weeks later, we were right and this morning the Fed announced it would, as expected, start buying junk bonds (we have to wait for the next crash before the Fed goes literally all in and starts buying stocks and pretty much anything else).

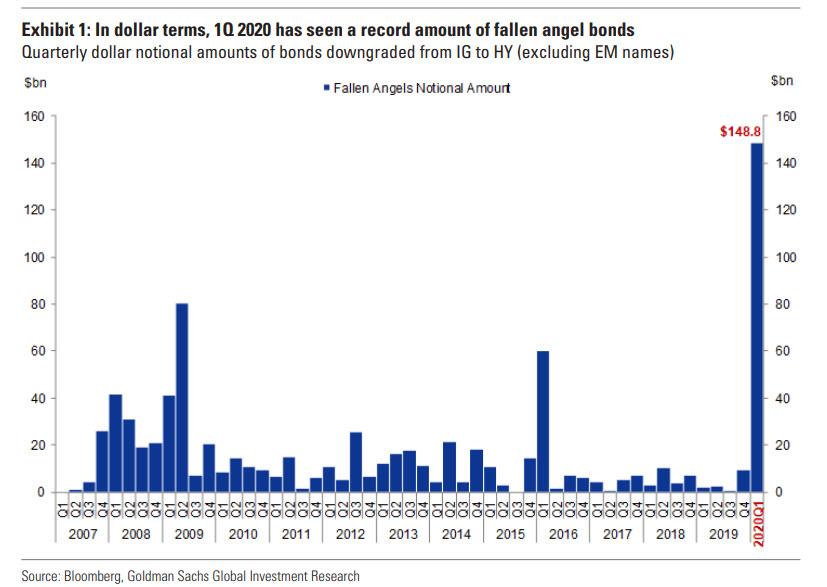

But let’s back up. A few days ago, we pointed out that the day so many credit bears had been waiting for had arrived, when a record $150BN in investment grade bonds were downgraded to junk, becoming so-called fallen angels, and sparking concerns about what will happen to the $1.3 trillion junk bond market as hundreds of billions of formerly investment grade debt is downgraded to junk and violently reprices the entire high yield space.

Those concerns were answered this morning when as part of the Fed’s expanded $2.3 trillion loan/bailout program, the Fed announced the expansion of its Primary and Secondary Market Corporate Credit Facilities, which will now purchase – drumroll – junk bonds.

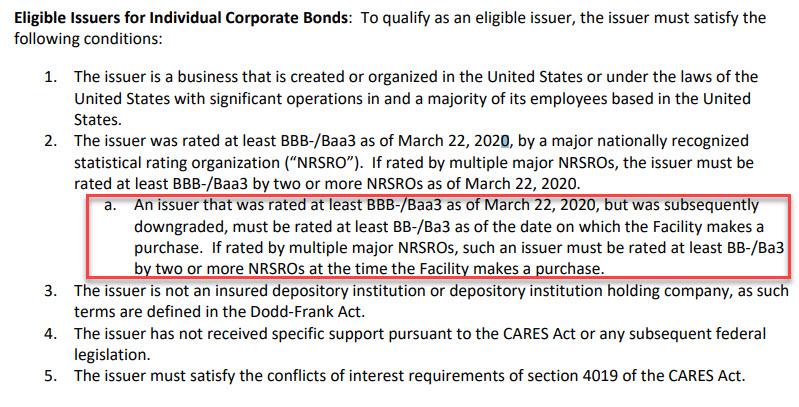

In the term sheet of the revised term sheet of the Secondary Market Corporate Credit Facility, the Fed now writes that “to qualify as an eligible issuer, the issuer must satisfy the following conditions”

The issuer was rated at least BBB-/Baa3 as of March 22, 2020, by a major nationally recognized statistical rating organization (“NRSRO”). If rated by multiple major NRSROs, the issuer must be rated at least BBB-/Baa3 by two or more NRSROs as of March 22, 2020.

An issuer that was rated at least BBB-/Baa3 as of March 22, 2020, but was subsequently downgraded, must be rated at least BB-/Ba3 as of the date on which the Facility makes a purchase. If rated by multiple major NRSROs, such an issuer must be rated at least BB-/Ba3 by two or more NRSROs at the time the Facility makes a purchase.

The section in question:

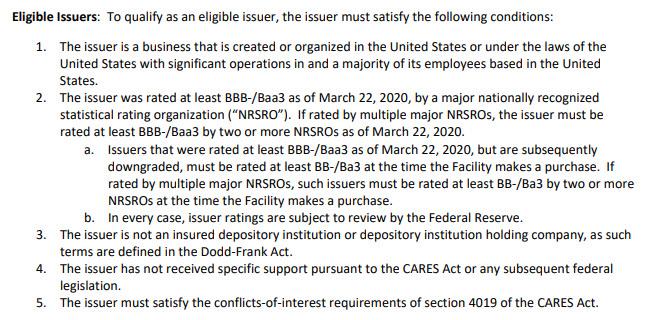

The same logic applies to Fed purchases in the Primary Market: going forward the Fed’s Primary Market Corporate Credit Facility, where a Fed SPV will purchase qualifying bonds as the sole investor in a bond issuance; and purchase portions of syndicated loans or bonds at issuance, it will also include junk bonds and junk loans:

But wait there’s more: in addition to buying the IG ETF LQD as we noted two weeks ago, going forward the Fed will also be buying junk ETFs such as JNK:

The Facility also may purchase U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. corporate bonds. The preponderance of ETF holdings will be of ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds

Translation: buy JNK with leverage as market prices are now terminally disconnected from underlying fundamentals.

Finally, the Fed also laid out the type of leverage it will apply using the Treasury’s equity “investment” as a capital base, noting that the facility “will leverage the Treasury equity at 10 to 1 when acquiring corporate bonds from issuers that are investment grade at the time of purchase and when acquiring ETFs whose primary investment objective is exposure to U.S. investment-grade corporate bonds.” Additionally, “the Facility will leverage its equity at 7 to 1 when acquiring corporate bonds from issuers that are rated below investment grade at the time of purchase and in a range between 3 to 1 and 7 to 1, depending on risk, when acquiring any other type of eligible asset.”

In short, the only asset that the Fed is now not directly buying is stocks, and here too it’s just a matter of time before the Fed unveils it will start buying the SPY.

Tyler Durden

Thu, 04/09/2020 – 09:37

via ZeroHedge News https://ift.tt/2RqdoPr Tyler Durden