Insanity: As The US Enters A Depression, Stocks Are Now The Most Overvalued Ever

Two days ago, when a platoon of clueless CNBC hacks said that stocks were extremely undervalued, and must be bought (on their fundamentals, not because the Fed was about to nationalize the entire bond market and is set to start buying equity ETFs in the next crash), we showed just how “undervalued” the market was.

That’s when Credit Suisse chief equity strategist Jonathan Golub – usually one of the most bullish Wall Streeters – published a chart showing that any “temporary” cheapness in stocks hit in late March was long gone for the simple reason that forward earnings have plunged. As a result, as of noon on March 7, when the S&P 500 had risen as much as 22% from March 23 lows, forward stock multiples had surged right back 19.0x.

Why is this notable? Because as Golub wrote, “this is the same level the S&P500 held on Feb 19, the all-time high.”

In other words, at the start of the week stocks were valued the same as they were at the February all time highs.

Fast forward to today when the Fed’s latest “shock and awe” nuclear bomb announcement which included purchases of junk bond ETFs and muni debt – and by implication terminally disonnects risk prices from any fundamental values and instead only the size of the Fed’s balance sheet matters – sent the S&P as high as 2,818. And, in doing so, the forward PE multiple on the S&P has risen from the record 19.0x reached in February to a new all time high of 19.4x.

In other words, the market has never been more overvalued than it is right now.

That’s not all.

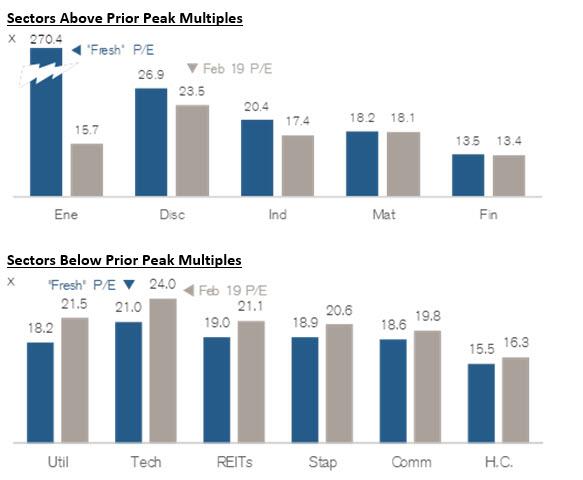

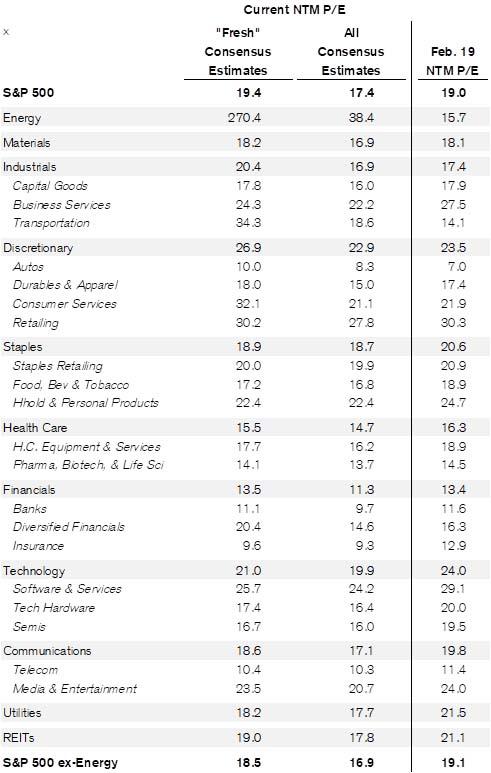

As Golub writes today, “we’ve expanded this analysis to cover sectors and sub-groups. Multiples for cyclical groups (Energy, Materials, Industrials, Discretionary, Financials) have surpassed prior P/Es. Valuations for defensive sectors (Staples, Utilities, Health Care, REITs) as well as Tech and Communications remain below Feb 19 levels.”

And a full sector breakdown.

So congratulations Jerome Powell: you have succeeded in the impossible – with the US economy entering a depression, with US GDP set to plunge as much as 50%, with US unemployment already 15% and set to hit 20% or more, the Fed chair has single-handedly disconnected stocks from all fundamental anchors and made the S&P the most overvalued in history as its forward P/E hits the highest number ever recorded.

Tyler Durden

Thu, 04/09/2020 – 16:40

via ZeroHedge News https://ift.tt/2JPhzQO Tyler Durden