Largest French Bank Lost $200MM On Equity Derivative Trades As Market Crashed

BNP Paribas SA, the largest French bank, lost hundreds of millions of dollars on complex stock trades as markets crashed in March, Bloomberg reports. Traders at the Paris-based bank, which together with SocGen has long carved out a niche in sophisticated derivative trades which worked great as long as the market was levitating unperturbed – lost an estimated €200 ($219 million) on equity derivatives once the market tumbled. According to Bloomberg, the trades that went awry included dividend futures and structured products.

BNP lost about 100 million euros on structured products, ostensibly by taking the other side of trades they sold to retail investors across Japan and South Korea; the trades were linked to baskets of stocks and other assets. The bank also lost about 100 million euros on dividend futures, with losses surging at one point to about 300 million euros before improving.

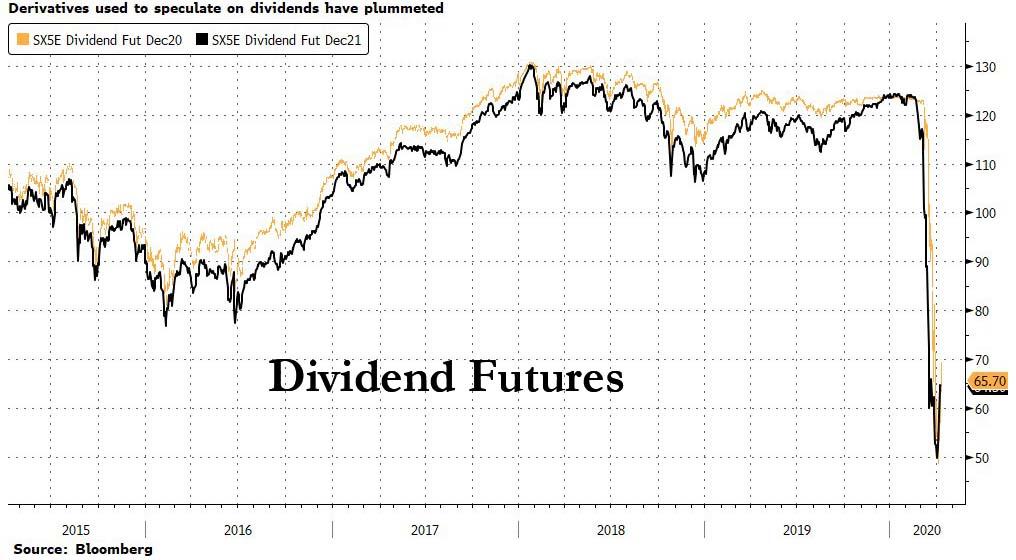

Dividend futures are derivatives that investors use to speculate on the payouts that companies make to shareholders. They have tumbled to historic lows in recent weeks as some of the world’s biggest corporations shred their awards in response to the coronavirus and, in some industries, pressure from regulators.

According to a JPM note, BNP and its crosstown rival SocGen are some of the biggest arrangers of dividend futures. Banks in this business are often “structurally long dividends,” JPM analyst Kian Abouhossein wrote, which means they were betting on an increase in payouts and “exposed to a decline in dividend expectations.” Alas, that’s precisely what happened.

That said, it’s unclear how much the losses will weigh on BNP Paribas’s overall first-quarter results. Banks taking a hit on dividend futures could likely offset them with gains elsewhere, Abouhossein wrote. He estimated that overall equities revenue at BNP Paribas could climb 13% year-on-year to 550 million euros.

While the French bank lost in the chaos, US banks were winners:JPMorgan and Citigroup made hundreds of millions in revenue from equity derivatives, as previously reported.

Tyler Durden

Thu, 04/09/2020 – 13:50

via ZeroHedge News https://ift.tt/39RtyYt Tyler Durden