London-Based ’50 Cent’-Fund Made $2.6 Billion As Markets Collapsed

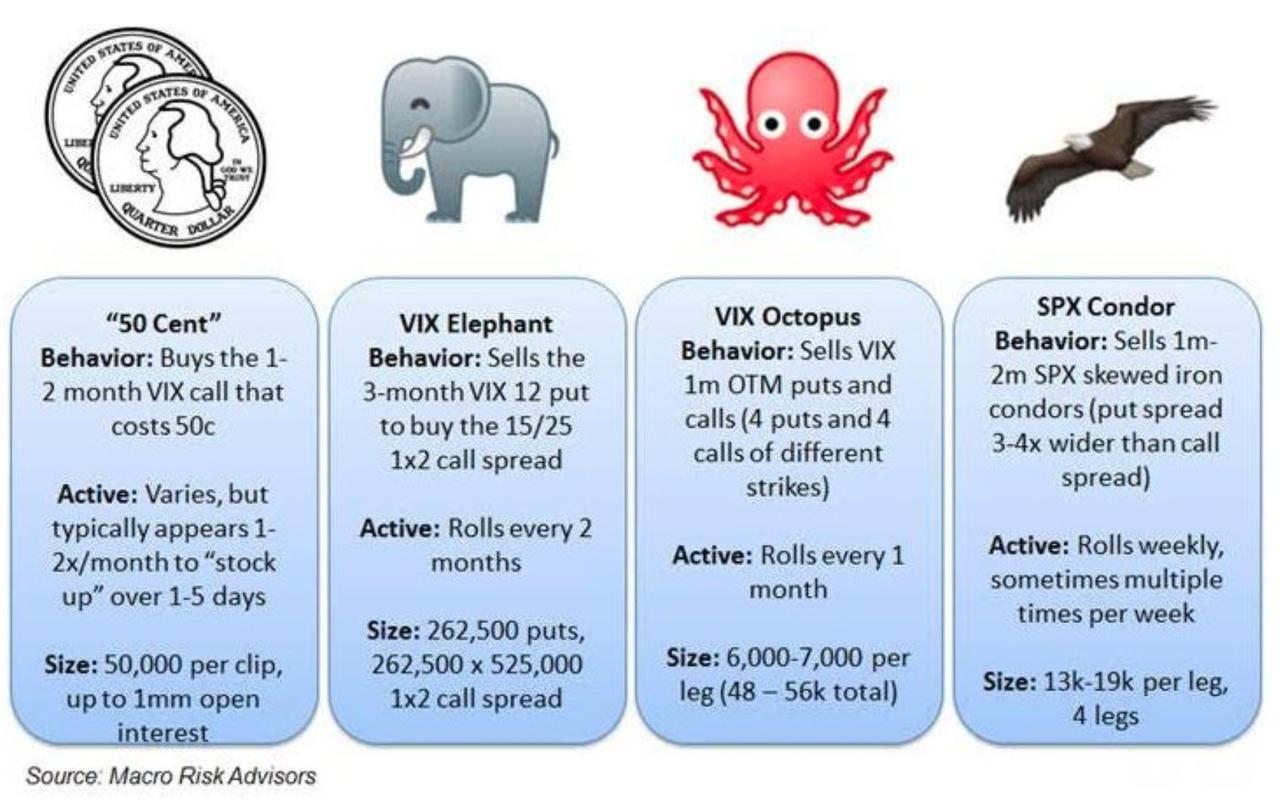

As we detailed last week, since 2017, we have been following the bread-crumbs of the mysterious VIX-whale nicknamed “50-Cent” – so-called for his habit of scooping up super-cheap VIX calls at a price around 50c (and with very good timing):

-

April 2017 – Who Is The Real “50 Cent” – A Mystery Trader Is Systematically Betting Massive On A VIX Spike

-

Feb 2018 – VIX-Trader ’50Cent’ “Steamrolls” XIV-Traders To $200 Million Gain

-

Jul 2019 – Is VIX Whale ’50-Cent’ Back? Volatility Collapse Sparks Huge Bearish Bets

-

Dec 2019 – VIX Options-Whale ’50 Cent’ Re-Emerges As New Short-Vol ETF Appears

He is among several VIX whales discovered in recent years.

And then, according to The FT, the real ’50-cent’ has stepped forward as Jonathan Ruffer – a London-based fund manager for investment firm Ruffer Capital… and as The FT reports, Westminster-based Ruffer, which has about $23bn under management, made roughly $2.6bn on a series of trades in March, offsetting losses stemming from the global sell-off sparked by COVID-19 and the oil price war.

The fund said it made more than $800m from a $22m purchase of VIX-related derivatives, and a further $1.8bn gain came from other equity, gold and credit derivatives that insulated against the manager’s losses.

Rather notably, these massive gains offset losses leaving Ruffer’s flagship Total Return fund down 0.8% at the end of Q1.

Of the hedge gains, the fund made $1.3 billion from CDS – protecting against credit weakness:

“I think the US is going to see a massive default cycle,” Ruffer told the FT.

“It’s too big of a shock to cushion. You cannot just put the whole economy on a cryogenic freeze.”

But, as we noted previously, we may have seen the last ’50 cent’ footprint in the VIX markets.

“I won’t say I’ll never use VIX again but I don’t think I will for some time. This was a regime-change moment,” he said.

“The essence of this was protection. We have performed in a lacklustre way for years and part of the reason for that is because we were worried about a sell-off like this.”

In sum, Ruffer noted that “the catastrophe insurance did absolutely everything that might be expected of it. And it is now spent. It is likely to be some time before this insurance again prices at levels that makes it attractive as a defensive investment.”

So what is that new protection?

“Our investments in credit spreads have protected the overall values of the portfolios, as conventional asset prices have tumbled. As I write, there still seems a good deal more mileage in this idea – we had positioned ourselves just outside the ‘safest’ corporates, as these could be the beneficiaries of Federal Reserve intervention. The Fed has intervened, and it will be interesting to know whether this does in fact stabilise the corporate bond market.

But we think gold is the right place to be for the battles ahead.

Any loss of confidence in the value of the collateral will manifest itself in a fear of inflation, since money is an expression of confidence in a token (fiat money, it is called – the divine ‘let it be’) – and if that confidence is lost, it ceases to do its job as a store of value.

What is clear is that central banks and governments will use whatever firepower they have – even if it turns out that their cheques are blank.

Accordingly, we have increased again our holdings in inflation-linked bonds (notably in the US). These will be a proper protection against a grinding bear market in money, in savings, in prosperity. The time is moving on from a world where we had to protect against sudden shocks – catastrophe insurance is behind us, job done. The investment landscape is going to become much more familiar, but it will only be a homecoming to the greybeards (what’s the gender neutral word for this? The mind boggles) who have lived it before.

Thirty-three years is a long detour – and for many it will have proved a cul-de-sac. It is difficult to master old tricks, secondhand, but my prediction is that it will prove a valuable quality over the next longish while.

His firm’s philosophy is built around the fact that clients love making money, but they hate losing it more than they like making it… something we suspect many “gurus” who have ‘come-up’ in the last decade of central bank largesse are about to discover this lesson the hard way.

Finally – Ruffer had one piece of advice for today’s non-veteran traders – “The biggest danger comes from an overwhelming desire in all of us to ‘buy the dips’.”

Tyler Durden

Thu, 04/09/2020 – 10:43

via ZeroHedge News https://ift.tt/3e7SeiK Tyler Durden