Morgan Stanley Was One Of The Biggest Margin-Loan Providers To Luckin Coffee’s Founder

Among the banks who made margin loans to Luckin Coffee’s founder, one stands out in particular: Morgan Stanley.

Morgan Stanley was part of a consortium of banks that extended loans to Lu Zhengyao across three different funding rounds. Morgan Stanley is said to have put up about $100 million of a total of over $340 million in loans. Credit Suisse Group AG and Haitong International Securities Group were also named as lenders.

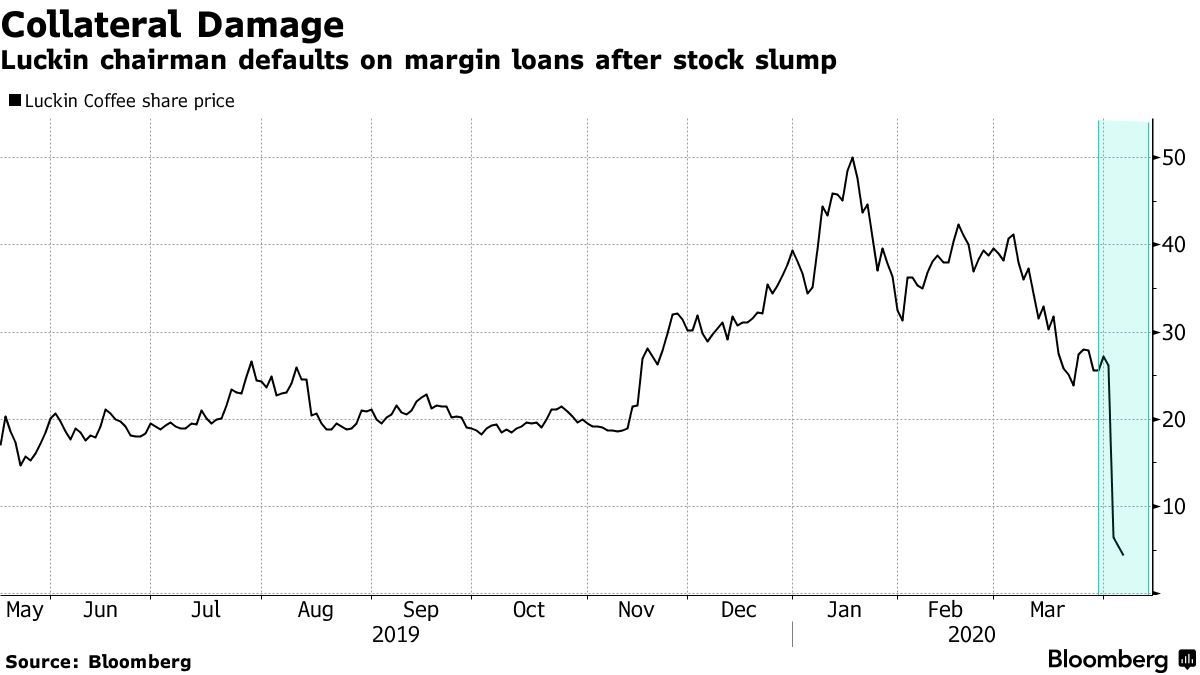

The recent fraud allegations at the company caused the loans to default, according to Bloomberg.

Additionally Goldman Sachs said that an entity controlled by Lu’s trust reneged on $518 million of margin debt and that lenders had seized up to 76.4 million LK shares as a result. It’s unclear whether or not the shares have been sold yet.

Goldman and Barclays’ were said to have about $70 million in exposure, each, to the loans. Credit Suisse and other banks that helped the company IPO and subsequently helped it raise convertible debt, have been sued as a result of the stock plunge.

Meanwhile, Morgan Stanley is also one of the largest lenders to Elon Musk, with the Tesla CEO taking $50 million from the bank and mortgaging five homes with their help back in early 2019. The bank was also part of a consortium of lenders to Alibaba’s Chairmen back in 2015.

Recall, on April 2, we reported that Luckin Coffee had brought to the attention of the board information indicating that COO Jian Liu and several employees engaged in certain misconduct, including fabricating certain transactions, starting in Q2 of last year. It was estimated that total ‘fake’ revenue was around $310 million.

Shares immediately crashed:

Tyler Durden

Wed, 04/08/2020 – 20:20

via ZeroHedge News https://ift.tt/2RncOC9 Tyler Durden