Oil Plunges As Saudi Deal “Nowhere Near Enough”; Goldman Now Expects WTI To Drop Back To $20

Moments ago, we reported that as part of what is the largest production cut deal in history, both Saudi Arabia and Russia will cut their output by 20%, capping their output to 8.5MM b/d in May and June under the new OPEC+ deal removing about 5 million barrels. The remaining countries in OPEC+ will contribute another 5 million or so with Bloomberg reporting that all members of OPEC+ have agreed to cut their output.

The market is unimpressed, though; after rallying as much as 10%, crude has swung to a 7% drop.

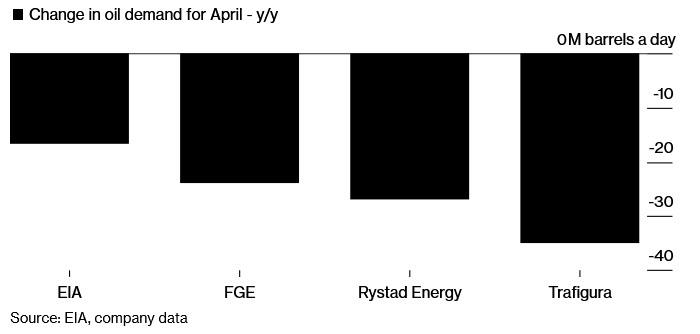

The reason: as we noted earlier, in a world where there is as much as 35MM b/d in less demand, the 10MMb/d production cut is, as Bloomberg puts it, “nowhere near enough.”

Worse, it appears that even the so-called deal is not really a deal, with Mexico reportedly objecting in the last minute, and Kazahkhstan and Brunei also unhappy:

Kazakhstsan, Brunei and Mexico consulting with their governments on their base line… they are not happy #OOTT

— Amena Bakr (@Amena__Bakr) April 9, 2020

And just when everyone thought there is a deal, an energy reporter notes that “the drama continues…. the smaller producers are holding up the deal now!”

The drama continues…. the smaller producers are holding up the deal now! #OOTT

— Amena Bakr (@Amena__Bakr) April 9, 2020

Assuming there is a deal, what happens to oil next?

Well, according to Goldman which predicted precisely this outcome – namely a 10mmb/d production cut today – WTI is headed back to $20. For those who missed it yesterday, here again is the summary:

Our updated 2020 global oil balance suggests that a 10 mb/d headline cut (for an effective 6.5 mb/d cut in production) would not be sufficient, still requiring an additional 4 mb/d of necessary price induced shut-ins. While this argues for a larger headline cut of close to 15 mb/d, we believe this would be much harder to achieve, since the incremental burden would likely need to fall on Saudi Arabia to be effective. Further, our price modeling suggests that Brent prices near $35/bbl already reflect such an outcome, with last week’s rally having brought crude prices to levels that likely slow the large-scale US production drop that are necessary to a deal in the first place.

Net, while the prospect of a deal can support prices in coming days, we believe this support will soon give way to lower prices with downside risk to our near-term WTI $20/bbl forecast. Ultimately, the size of the demand shock is simply too large for a coordinated supply cut, setting the stage for a severe rebalancing.

And some more details:

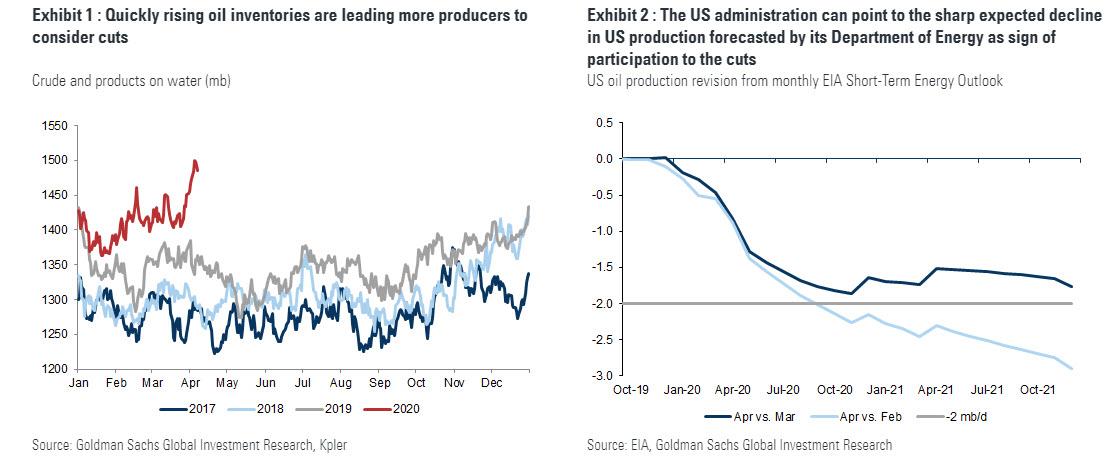

The ability for the US to participate in coordinated cut is limited by regulation (as we discuss in this footnote) although such hurdles are unlikely to prevent a deal. First, the US administration has expressed its willingness to use political/defense leverage or tariffs on Saudi and Russia oil imports to obtain a cut. Second, and perhaps most importantly, the US can point to its contribution with upstream activity already dropping and the US Department of Energy forecasting on April 6 that production would be falling by 2 mb/d by year-end relative to its previous March forecast.

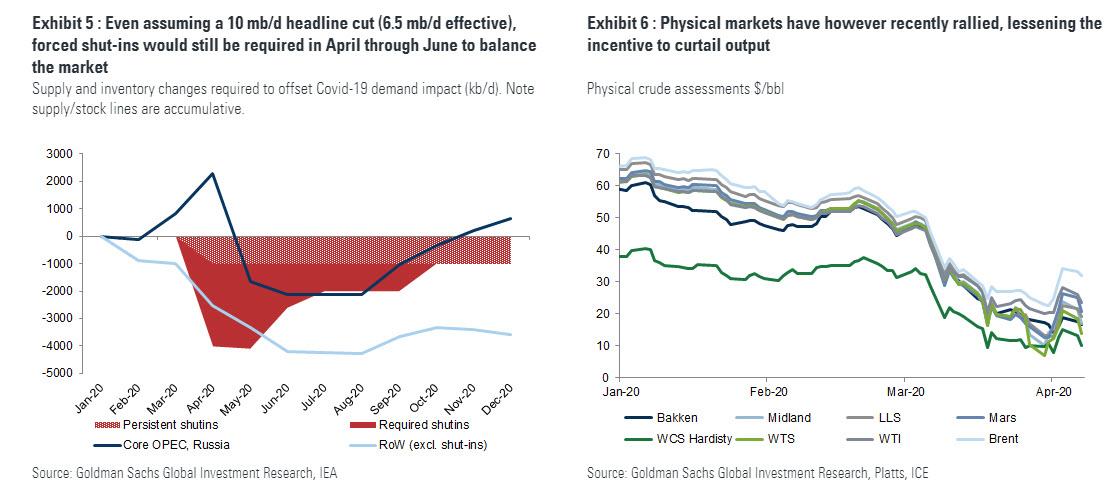

Assuming that a deal is reached – our base case now – the key question will be whether its size and timing will improve global oil balances sufficiently to support prices above current levels. This is key, as a cut that would prove too little too late would lead to storage saturation and additional necessary production shut-in, with distressed producers driving physical crude prices and spot oil prices sharply lower. Our updated 2020 global oil balance suggests that a 10 mb/d headline cut would not be sufficient, still requiring necessary price induced shut-ins on top of such voluntary curtailments.

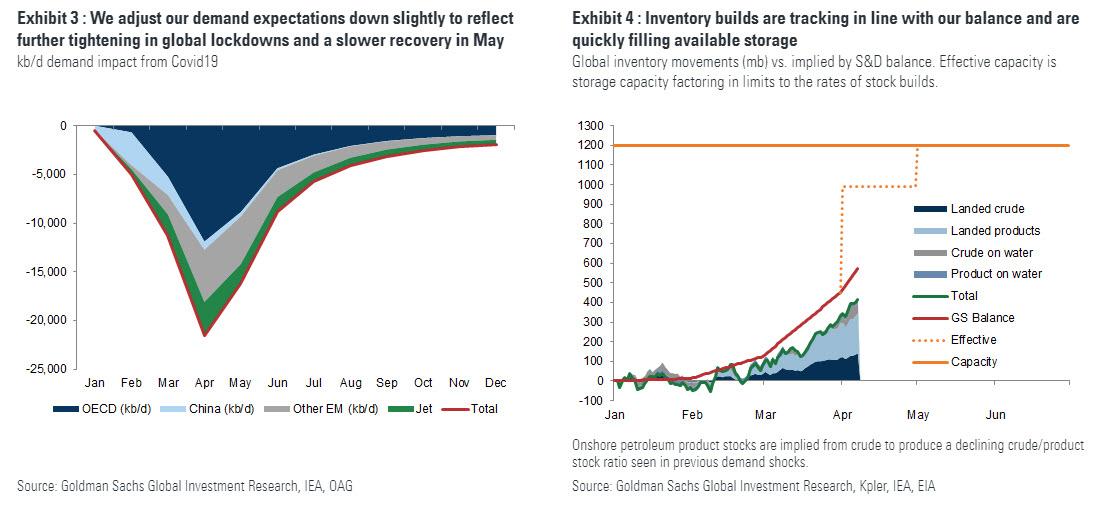

To come to this conclusion, we update and refine our 2020 global oil balance (we provide a full breakdown of this analysis in Section 2 of this report). First, we once again slightly lower our demand expectations as isolation policies get deployed in a still growing number of countries and with their lift date increasingly pushed back. We now expect a hit to April/May/June global oil demand of 22/16/9 mb/d (19/12/6 mb/d previously). Second, we introduce an estimate of peak monthly storage fill capacity, which starting from current stock levels is of 17 mb/d in April (with 20 mb/d likely achieve last week[3]), 13 mb/d in May and only 5 mb/d in June. From a base-case production perspective, we broadly maintain our last published production forecast from March 17 (which reflected steady declines in output but did not allocate the necessary shut-in), allowing us to estimate both the sizes of the voluntary and necessary shut-ins.

While this would simply argue for a larger 15 mb/d “headline” cut (with “effective” supply reduction of 10 mb/d), we believe it would be much more difficult to pro-actively allocate an incremental 5 mb/d of voluntary cuts across countries that do not have Saudi’s geological oilfield flexibility, with the Kingdom’s own ability to cut to 8 mb/d likely challenged. In fact, recent price levels would likely keep US crude prices at levels that disincentivize the large scale US production drop that backdrop the rationale for the cuts in the first place. As a result, an 10 mb/d “headline cut” that would still require additional large but short-lived price-induced cuts is likely the preferred outcome for core-OPEC, as it ensures the contribution of many producers (and higher OSPs even should Brent prices return to their lows).

While the prospect of a deal can support prices near current levels in coming days, we believe this support will soon give way to lower prices, due to both positioning and fundamentals. First and foremost, we don’t believe that a 10 mb/d “headline” production cut can shore up oil balances with lower prices still needed. Second, the sharp short-covering rally of the past week has already brought prices to the levels that we forecast in 3Q20 when the surplus would be ending, a still uncertain outcome. Third, downward price pressure in coming days will be exacerbated by the roll of the long WTI future positions underlying the recent increase in speculative buying[4], as visible on April 6 and in early 2009. Fourth, the potential inability to broker a cut sufficiently large to support seaborne crude prices suggests that Saudi producing at high levels instead to maximize cash flow would actually not be irrational, an outcome that appears mis-priced, with the WTI options market currently only assigning an 18% probably that prices reach $15/bbl by mid-May.

Ultimately, the size of the demand shock is simply too large for a coordinated supply cut, setting the stage for a violent rebalancing (see Top of Mind – Oil’s Seismic Shock page 9). Looking forward, our base-case remains unchanged, with a shift to a deficit by July and a gradual recovery in Brent prices (from lower levels than currently) to $40/bbl by October as inventories start to wind down. The path of the demand recovery will be of course essential to how this price recovery plays out. But after such a violent rebalancing, supply cuts will matter increasingly and could create upside price risks later this year.

It will take time to restart the 10.5 mb/d of shut-in wells (6.5 mb/d voluntarily and 4 mb/d out of necessity) which could also lead to permanently lost productive capacity. For example, if we assume (1) a recovery in OPEC/Russia production through 3Q-4Q20 back to 1Q20 levels, (2) that production declines expected outside of shut-ins (due to lower capex and decline rates) don’t reverse and (3) that 1 mb/d of the remaining production cuts take at least a year to return online, our oil balance would feature fully normalized inventory levels by early 2021 and point to Brent prices at $55/bbl. While such a rally could be delayed by a faster unwind of the cuts, it does illustrate that the violent rebalancing we expect in coming weeks can set the stage for a potential large price recovery later this year.

After all that, it appears that oil trading algos have finally had time to google supply and demand.

Tyler Durden

Thu, 04/09/2020 – 14:37

via ZeroHedge News https://ift.tt/3c6ewj6 Tyler Durden