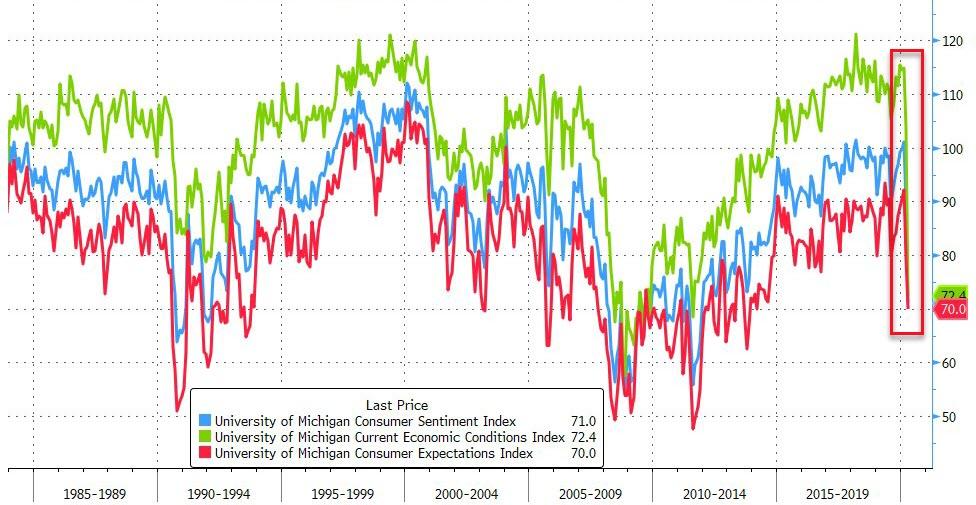

UMich Consumer Sentiment Crashes By Most Ever

While not entirely surprising, the scale and suddenness of the collapse on confidence among American consumers is stunning.

The latest data from University of Michigan is a bloodbath…

-

The preliminary University of Michigan consumer sentiment survey for April fell to 71.0 vs. 89.1 prior month, largest monthly decline on record

-

Current economic conditions index fell to 72.4 vs. 103.7 last month; 31.3-point drop nearly double prior record decline of 16.6 points set in Oct. 2008

-

Expectations index fell to 70.0 vs. 79.7 last month

This is the biggest crash in the current conditions index ever…

Indeed, the peak decline in the Expectations Index recorded in December 1980 reflected a relapse following the end of the short January to July 1980 recession, signaling the start of a longer and deeper recession that lasted from July 1981 to November 1982.

“When consumers were asked about their financial prospects for the year ahead, 38% expected improvement, barely below February’s 41%, suggesting a temporary virus impact.”

Social-distancing measures and closures of non-essential businesses across most U.S. states have resulted in an unprecedented 16.8 million applications for jobless benefits in the past three weeks. Consumer spending is projected to collapse and the economy is likely in a recession.

“Surging unemployment was spontaneously mentioned by 67% of consumers, just below the all-time record of 74% in February 2009.”

Buying Conditions have collapsed to the weakest since the 80s…

While the declines in vehicle and home buying attitudes were not as steep, the share of consumers who cited income uncertainty as the primary cause for postponing purchases of vehicles and homes was also the highest level ever recorded.

The survey was conducted March 25 through April 7, a period that includes the record surge in applications for jobless benefits and stock-market volatility.

“Consumers need to be prepared for a longer and deeper recession rather than the now discredited message that pent-up demand will spark a quick and robust economic recovery,” said Richard Curtin, director of the survey, in a statement.

“Sharp additional declines may occur when consumers adjust to a slower expected pace of the economic recovery.”

“When asked about prospects for income gains during the year ahead, the expected median change in income was a negative six-tenths of a percent, the largest decline ever recorded.”

Finally, one-year-ahead inflation expectations have also crashed to their lowest since 2009 at +2.1%.

Tyler Durden

Thu, 04/09/2020 – 10:14

via ZeroHedge News https://ift.tt/2yKHtCR Tyler Durden