“Let Them Fail” – Billionaire Explains To Gobsmacked CNBC Host How Capitalism Is Supposed To Work

With millions of Americans sitting at home working on their laptops, the passive viewership of cable news channels like CNBC must be waaaay up this month, as finance nerds welcome normies to the strange and often hilarious world of live markets news.

In terms of drama, CNBC is usually pretty staid. But every once in a while, there’s a fight, or a contentious interview, that really grabs people’s attention. On Thursday, such a confrontation occurred during “the Halftime Report” as Scott “The Judge” Wapner interviewed early Facebook investor and uber-wealthy VC investor Chamath Palihapitiya.

Wapner brought up the question of the bailouts for main street and corporate America that the Trump Administration has packaged as part of its $2.2 trillion plan. Palihapitiya raised an issue with the program, arguing that the administration would be using taxpayer money to prop up “zombie companies.”

Then Wapner asked: “Are you arguing to let airlines fail?

Palihapitiya, who was speaking on the phone, responded with a very assertive “Yes.”

Wapner seemed blown away by this. Struggling to process the answer he had just been given, he followed-up, incredulously: “But how does that make sense in the broader scheme of the economy.”

Then Palihapitiya went off.

“This is a lie that’s been propagated by Wall Street. When a company fails, it does not fire its employees…it goes through a packaged bankruptcy…if anything, what happens is the employees end up owning more of the company. The people who get wiped out are the people who own the unsecured debt and the equity…but the employees don’t get wiped out and the pensions don’t get wiped out.”

[…]

“And if a bunch of hedge funds get wiped out – what’s the big deal? Let them fail. So they don’t get the summer in the Hamptons – who cares.”

Out in the real world, people say mean things about the rich all the time. But it doesn’t happen quite as often on CNBC. In fact, sometimes CNBC’s hosts seem downright confused when people don’t seem to care about asset prices above all else – like that time Rick Santelli said we should all just go get infected and let grandma die to save the stock market. What’s more, Wapner seemed almost personally insulted by Palihapitiya’s response.

As to why, well, we can’t be certain.

Because after all, airlines as an industry are especially prone to bankruptcy (the president once owned an airline that went bankrupt), even under completely normal circumstances.

Hell, even if such a vitally important company as the aerospace and defense giant Boeing went bankrupt, its factories in Washington State wouldn’t stop running.

Remember when the CEO of Boeing demanded a taxpayer-funded bailout, but said he wouldn’t accept the money if the federal government demanded a stake in Boeing in return (note: exchange money for equity is standard practice for…literally every investor in the world)?

How is Boeing able to so blithely bite the hand that feeds? Because it has alternatives should the bailout not come through. If Boeing really needs the money, it’s free to sell stock and raise cash – the opposite of what it did for decades when it bought up shares, shrinking its float and helping maintain a buoyant valuation.

Say this isn’t enough, and Boeing fails: The company could file a prepackaged Chapter 11 where the creditors take over all the equity and the company emerges from bankruptcy debt-free in one day. Without a dollar of debt, Boeing should be able to weather any disruption no matter how long, and once the economy normalizes it should be able to rehire all the workers that had been laid off. In reality, the company could probably manage to get through it without firing so many employees…or offering “voluntary buyouts”.

Which brings us to our next point. After Palihapitiya explained the bankruptcy process, Wapner responded with a question that’s probably asked on his channel at least half a dozen times a day: “What about the 401(k)s?”

“But you don’t think the employees of these companies own stocks, own the company’s stocks?”

To which Palihapitiya had another point ready.

“These things are owned by these huge amorphous organizations…ultimately downstream the employees own a few hundred dollars or a few thousand dollars of shares.”

That’s right: After the world saw what happened to Enron employees who invested their entire retirement savings in Enron stock, there probably isn’t a single American who keeps literally all of their money in the shares of their employer. Even employee pension plans are typically managed by third parties and don’t consist of a larger percentage of the company’s stock.

As Palihapitiya explained, while people absolutely need jobs to come back to, not every business will fail during this shut down. Many small businesses, like a small cafe or a restaurant, if they can’t pay the rent, it’s over. There really is not “business”, it’s just a lease and the restaurant setup. You can have partial owners, but if that restaurant goes under, it’ll likely shut down immediately, firing all of its staff. If a company like, say a large chain of newspapers that’s publicly traded, goes bankrupt, it will continue to operate.

While the rich certainly didn’t cause the coronavirus, they typically aren’t also responsible for the many unanticipated risks that can make an investment or a business go south.

But on Main Street, it’s a different story. There’s not as much nuance: People are panicking and scrambling to apply for government benefits because they don’t know how they’re going to keep a roof over their heads.

“On main street today, people are getting wiped out, and right now rich CEOs are not, boards that had horrible governance are not, hedge funds are not…6 million people just this week along said ‘holy mackerel, I don’t know how I’m going to pay my rent.'”

“And what we’ve done is protect CEOs and boards…when you have to wash these people out.”

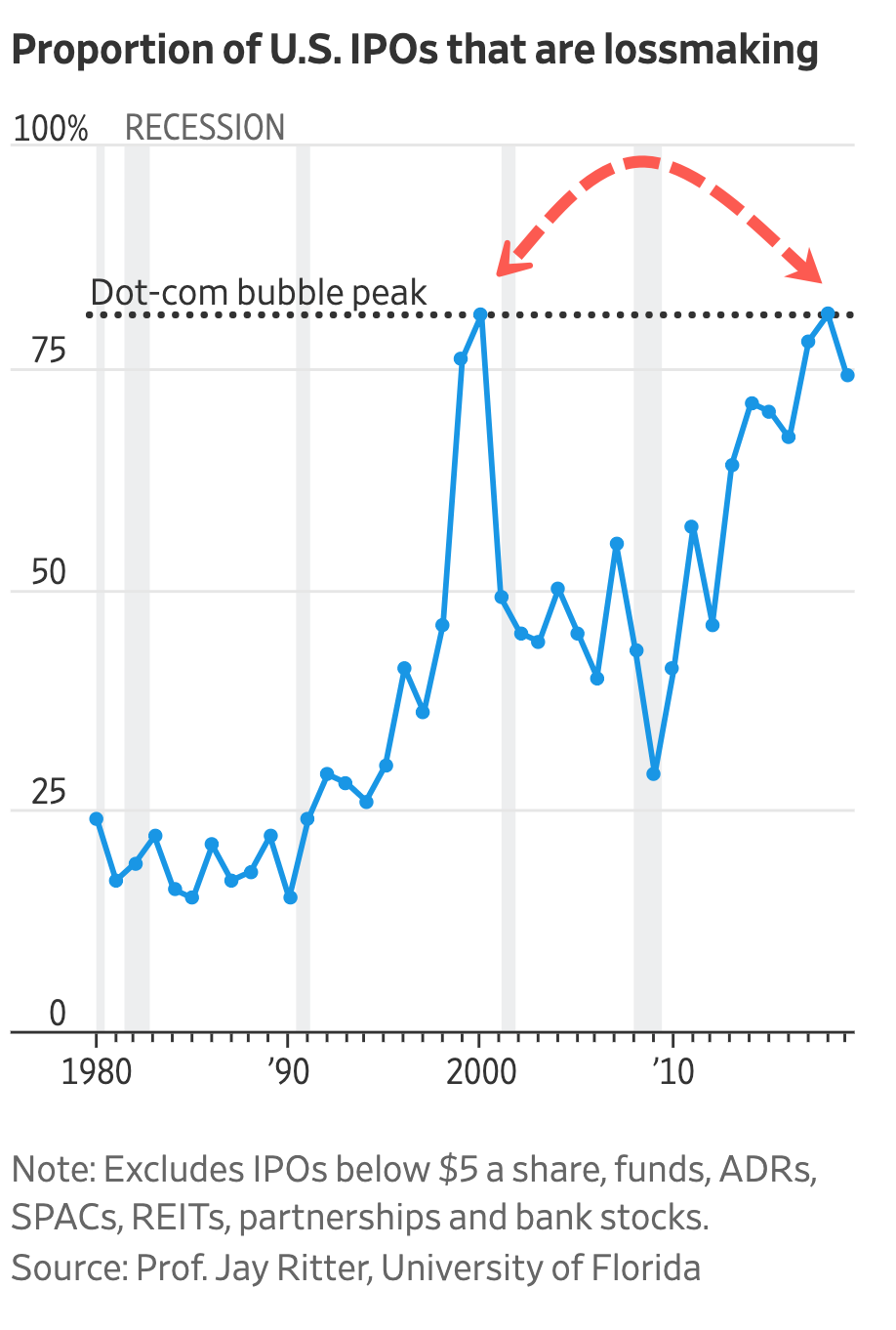

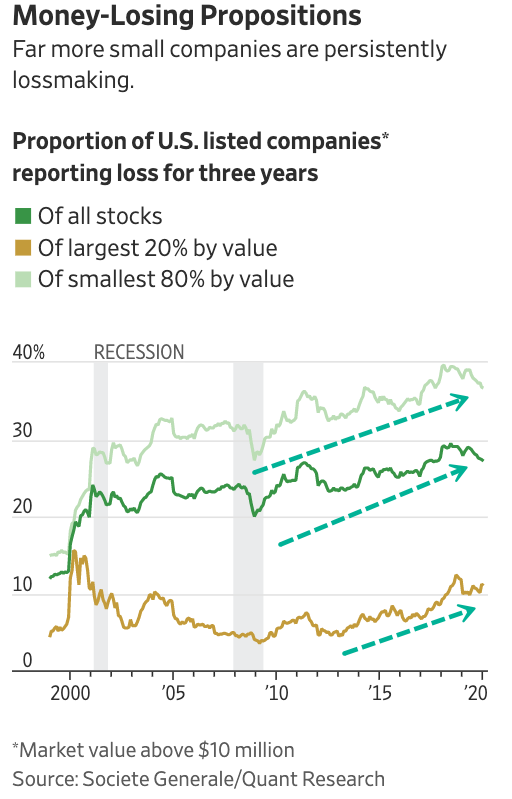

Just last year, millions of investors were forced to face up to the fact that not every new enterprise, including companies who grow to the point that they can raise money in an IPO, is profitable. In fact, thanks to various levels of government intervention in the free market, many of these ‘zombie’ companies exist in countries around the world, to varying degrees.

More recently, many more persistently loss-making companies have managed to struggle on for years, even when it’s become clear the enterprise is essentially doomed, because of all the investment capital bouncing around places like Silicon Valley.

We also found this handy guide from Investopedia offering a moderately detailed explainer on how corporate bankruptcies work, the various chapters, etc.

But right at the top of that post, the writers make clear that even the investors don’t always get wiped out:

If a company you’ve invested in files for bankruptcy, good luck getting any money back, the pessimists say – or if you do, chances are, you’ll get back pennies on the dollar. But is that true?

Alas, there’s no one-size-fits-all answer.

So maybe Wapner’s plan to simply fork over billion-dollar bailouts to every company or airline who asks needs a rethink.

And it’s fitting that this heated exchange, which attracted so much attention that the producers over at CNBC made room during “the Closing Bell” lineup to have one of their reporters interview Wapner…about his interview with Chamath, happened today.

Because earlier, the Fed unveiled a lending program aimed at saving ‘small businesses’ that is, in reality, just the latest assertion of dominance over a market where genuine price discovery has been suppressed for more than a decade now.

To quote Bob Rodriguez, as we did during Thursday’s market wrap:

With the initiation of the Fed’s complete takeover and control of the US financial economy, there is now absolutely no accurate pricing discovery in the capital markets and we have entered a period of total manipulation. In light of this, the only markets I have an interest in are those where the heavy hand of government is not involved or only minimally involved. This leads me to rare commodities and collectibles. The public equity and debt markets are now nothing more than greater fool markets that are led by the greatest fools of all, the Fed and the Congress. US capital markets, RIP!

When all market risk is essentially socialized, a return vs risk evaluation is essentially meaningless.

Over a period of time which I cannot estimate yet, I will continue my preparation for a far different economic and financial environment.

Capital deployment strategies will likely have to change from what has been the norm in the post WW2 environment. We are in a New World Order.

* * *

Simply put, the global business environment is being transformed: Like AOC and George W Bush, we are all socialists now.

And Wapner’s incredulity at being confronted by an investor who doesn’t accept bailouts as nothing short of a moral imperative just shows how badly the public has been brainwashed to simply accept this dynamic, where the wealthiest business owners are always given priority.

Watch a clip from the interview below:

The U.S. shouldn’t bail out billionaires and hedge funds during the coronavirus pandemic, Social Capital CEO Chamath Palihapitiya says. “Who cares? Let them get wiped out.” https://t.co/dIbizumtqG pic.twitter.com/u8BSVvr0B1

— CNBC (@CNBC) April 9, 2020

Tyler Durden

Thu, 04/09/2020 – 20:20

via ZeroHedge News https://ift.tt/34AMZnH Tyler Durden