Deutsche Bank: “There Is No Such Thing As A Free Market Anymore”

In his latest FX Special Report, Deutsche Bank macro (and market) strategist George Saravelos, like many others, appears to have reached his tipping point after last week’s unprecedented Fed takeover of capital markets, and writes that “there is no such thing as a free market anymore”, which of course is correct, but in a time when telling the truth is viewed as treason by many George may regret his harsh assessment of the current state of central planning (we know from over a decade of experience).

Below, we present his latest note, “The end of the free market: impact on currencies and beyond.“

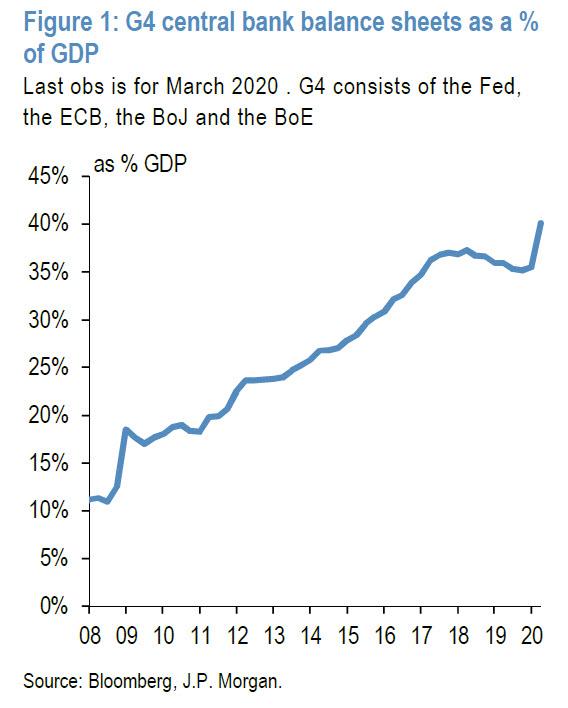

There is no such thing as a free market anymore. All developed central banks have cut rates to zero and buying trillions of assets. Inflation is very low. A global liquidity trap may be in the making. In a world of international yield curve control and administered asset prices, what does that mean for FX?

Classical economic theory suggests low volatility in rates should mean low volatility in FX. If central banks can’t change yields or inflation, nothing changes in exchange rates either. We argue this effect will serve to greatly diminish FX volatility originating from bond markets. Central bank interest rate announcements will lose relevance for FX, just like the Bank of Japan has lost relevance for the yen in Japan. But lower “monetary” volatility may mean higher volatility elsewhere. Exchange rates also react to financial and real economy shocks. Central banks that lose power to cushion shocks could lead to much higher volatility in FX. If the Fed or ECB were absent during the Lehman or Eurozone crises, FX dislocations would have been much higher.

But will central banks be absent? In a matter of weeks policymakers have become a backstop for private-sector credit markets. At the extreme, central banks could become permanent command economy agents administering equity and credit prices, aggressively subduing financial shocks. It would be a bi-polar world of financial repression with high real economy volatility but very low financial volatility. A “zombie” market.

The impact on FX volatility of this scenario is far more ambivalent and could well be negative.

For now central banks are focused on subduing asset price volatility. But an emerging global liquidity trap also means that the exchange rate becomes an increasingly important instrument for central banks. Policymakers can always impact FX via selling infinite amounts of their own currencies. If central bank focus returns to FX, this could be a new source of volatility. The SNB’s huge intervention program is a case in point. The current environment may eventually sow the seeds for “beggar thy neighbour” policies similar to the 1920s Great Depression.

Our punchline is that the ultimate impact of the current environment on exchange rate volatility is ambivalent and depends on how far central banks are willing to go in pursuit of financial repression. The more central bankers control global asset prices, the more this could offset higher real economy volatility on exchange rates resulting from the exhaustion of policy space.

Our conclusion is critically dependent on the assumption that we are stuck in a zero inflation world and that central banks avoid targeting FX. If inflation or currency wars come back, exchange rate as well as broader FIC market volatility will almost certainly return with a vengeance.

Tyler Durden

Sun, 04/12/2020 – 16:45

via ZeroHedge News https://ift.tt/2XvinCv Tyler Durden