Wells Fargo Reports 1 Cent Profit After Loan Loss Provision Soars To $4 Billion

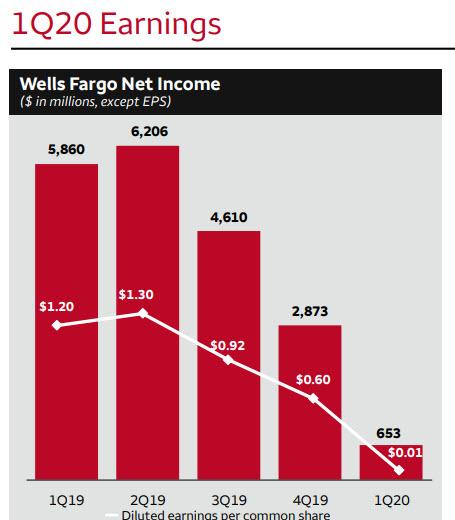

With JPM starting Q1 earnings season by taking a whopping $6.8 billion in covid-19 loan loss reserves in Q1, it appears that the bank is bracing for even more pain in Q2, even if the number was enough to allow JPM to report a profit in Q1 (albeit down some 69%, or the most since the financial crisis) instead of an outright loss. Moments after JPM, Wells Fargo followed suit, when it reported a surge in credit costs in the first quarter, setting aside $4 billion in loan-loss provisions in the first quarter, almost five times what it allocated a year ago and the most in a decade. Amusingly, despite this surge in provisions, Wells too reported an EPS profit, but the smallest possible of just 1 cent (!), down from $1.20 a year ago.

Net income dropped 89% to $653MM from $5.860BN a year ago, as a result of the following provisions:

- $4.0 billion of provision expense for credit losses

- $2.9 billion reserve build for loans

- $909 million of net charge-offs for loans

- $172 million of provision expense for debt securities, including $141 million reserve build (1) and $31 million in net charge-offs

- $950 million of securities impairment

- $621 million of net losses on equity securities from deferred compensation plan investment results, which were largely offset by a $598 million decline in employee benefits expense

- $464 million of operating losses

- $463 million gain on the sale of residential mortgage loans, reclassified to held for sale in 2019

- $379 million of mortgage banking income vs. $783 million in 4Q19 on higher losses on loans held for sale, and higher

As Bloomberg points out, provisions for credit losses were $1.7 billion in community banking alone, which pretty much wiped out the division’s profit, down 95% from a year ago. Net interest income in the segment were little changed despite falling interest rates.

Net loan charge-offs were $909 million in the quarter, up about 18%. Reserve build was $3.1 billion, which was four times a year ago. CECL accounting is forcing banks to build up reserves faster on expectations of loans going bad. Thus even though charge-offs are slower to rise, reserves have to be built up front when the economy is doing bad.

“Wells Fargo plays an important role in the financial system and the economic strength of our country, and we take our responsibility seriously, particularly in these unprecedented times,” Scharf said in a statement Tuesday.

The San Francisco-based lender, and Warren Buffett’s favorite bank, has been constrained by a Federal Reserve order limiting bank assets to their end-of-2017 level following a series of scandals at the bank, though it was granted a temporary break last week to expand lending to small businesses. Total assets were just above that level at the end of the first quarter. Scharf said last week that Wells Fargo extended almost $70 billion in new and increased commitments and outstanding loans in March alone.

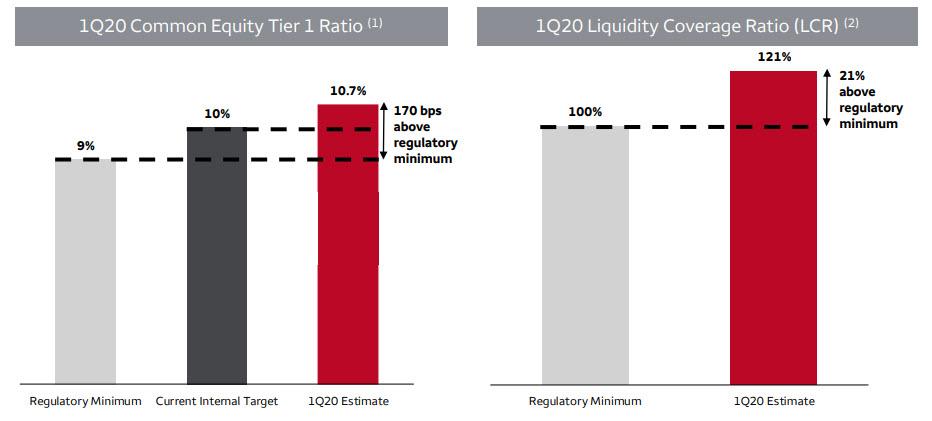

The bank was quick to assure the Fed that both its Tier 1 Ratio and its LCR Ratios were well above the regulatory minimum.

CFO John Shrewsberry outlined activities during the first quarter: “Commercial loans grew by $52 billion, deposits increased by $54 billion, we originated $48 billion of residential mortgage loans, and we raised $47 billion of debt capital for our clients.”

As expected, cash flooded the bank in this uncertain time, with period end deposits up $112.5BN to $1.4 trillion. Deposits have been flowing in to banks as lower interest rates and declining markets typically shift funds from money market funds and securities investments.

Commercial and industrial loans jumped $50.9 billion, largely as clients drew on their revolving credit lines because of the pandemic.

That said, consumer loans were down $4.4 billion from the previous quarter due to declines in credit card and mortgages.

And something unexpected: despite the plunge in rates to all time lows, in Q1, Wells reported that its Net Interest Income actually rose to $11.3BN, from $11.2BN, a NIM of 2.58%, up from 2.53% in Q4, although there was less here than meets the eye, and the rebound was largely driven by subsequent adjustments, to wit:

- $356 million higher hedge ineffectiveness accounting results reflecting large interest rate changes in the quarter

- $84 million lower MBS premium amortization resulting from lower prepays

- Partially offset by balance sheet repricing, including the impact of the lower interest rate environment, and one fewer day in the quarter.

Meanwhile, the NIM of 2.58% which was up 5 bps LQ and included:

- ~8 bps from hedge ineffectiveness accounting results

- ~2 bps from MBS premium amortization

- ~(5) bps from balance sheet mix and repricing

In other words, without the adjustments, NIM would have been flat Q/Q.

Curiously, interest Income rose even as average earning assets declined by $1.2 billion LQ:

- Debt securities down $7.0 billion

- Mortgage loans held for sale down $3.6 billion

- Short-term investments / fed funds sold down $1.6 billion

- Equity securities down $746 million

- Loans up $8.5 billion

Noninterest income was uglier, dropping 31% Y/Y to $6.4BN from $9.3BN a year ago.

Finally, on staffing, Scharf says the company has enabled about 180,000 employees to work remotely, and with approximately 260,000 employees at year-end, which means about 69% if its staff are able to work remotely.

The full Wells presentation is below:

Tyler Durden

Tue, 04/14/2020 – 08:31

via ZeroHedge News https://ift.tt/3cj0KtK Tyler Durden