US May Pay Shale Drillers Billions To Leave Oil In The Ground

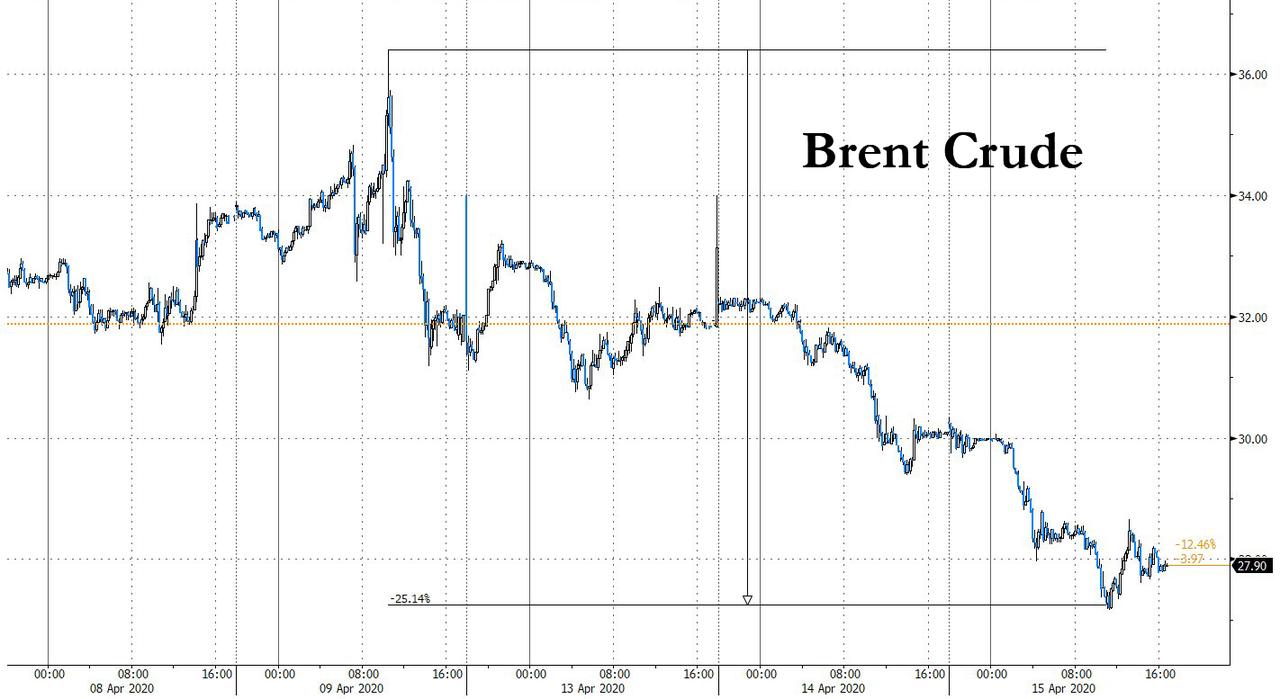

If one listened to the US president, or any other member of OPEC+ in the past few days, this weekend’s history production cut deal (which we said was not nearly enough to offset the plunge in global demand), would have been sufficient to push the price of oil by $10/per barrel or more. Instead, after spiking last Thursday as high as $36 as triggerhappy algos were fooled by OPEC+ jawboning, Brent is down as much as 25% in the past 4 days.

Meanwhile, realizing that the US has become ground zero for excess oil production, and is unwilling – or unable – to cut output, thus shooting itself in the foot, on Tuesday Scott Sheffield, CEO of Pioneer Natural Resources, argued that Texas can lead in producing a “real” U.S. oil production cut to save the shale industry, and called for the state to take action to force companies to hold back their production for the first time since 1973.

Alas, with billions of junk bonds at stake and a lot of private equity vested interests assuring that the “spice flows” that is unlikely to happen. So on Wednesday, with US producers seemingly at an impasse and with Trump terrified that a wave of Texas defaults could doom his reelection chances as millions of shale workers are out of a job, Bloomberg reported that the Trump administration was considering paying U.S. oil producers to leave crude in the ground to help alleviate a glut that has caused prices to plummet and pushed some drillers into bankruptcy.

According to the report, the Energy Department has drafted a plan to compensate companies for sitting on as much as 365 million barrels worth of oil reserves and counting it as part of the U.S. government’s emergency stockpile. West Texas Intermediate crude oil futures rose fractionally, about 20 cents to $20.42, on the news.

Unlike previous ideas float by the administration which included ordering forced production shutdowns, this plan is actually workable as federal law gives the Energy Department authority to set aside as much as 1 billion barrels of oil for emergencies – without dictating where they should go. That creates a legal opening for storing crude outside the government’s existing reserve and even blocking its extraction in the first place, according to Bloomberg.

There is just one problem: money, lots of it, and it will have to be paid to shale companies which are already on the verge of default which means that this would be seen as yet another industry bailout. Indeed, as Bloomberg explains, the keep-it-in-the-ground plan, which would require billions of dollars in appropriations from Congress, could be unprecedented and reflects a Trump administration push to help domestic drillers battered by a surge of oil production.

Of course, since “billions of dollars” would be headed to the shale sector, we doubt democrats would be excited unless of course similar billions of dollars were directed at illegal aliens or some other progressive ideal.

The effort comes after President Donald Trump helped broker a deal to cut global crude production and help rescue oil markets from a pandemic-fueled collapse. However oil demand has sunk even further, as lockdowns around the world paralyze air and ground travel. While the U.S. government doesn’t control oil production, Trump has said domestic output will automatically shrink due to market forces.

* * *

Meanwhile, with every day of delays a historic day of reckoning comes closer: the moment when storage runs out. Analysts expect storage tanks to fill by summer, with some predicting as soon as May. Whenever that happens, oil producers with no place to put their crude would be forced to halt production and lay offworkers. Some are already idling drilling rigs and stowing excess supplies in rail cars, while pipeline operators are reversing flows to transport crude to underused storage sites. President Donald Trump on April 3 asked his energy secretary to “check out other areas where you can store oil,” and look for places “bigger than what we have now.”

To delay the moment storage tanks are full, the Energy Department is discussing other ideas, including stashing oil in floating tankers, unused refinery storage tanks and underground salt caverns, the officials said. But those approaches might take too long to help as U.S. crude inventories build toward a crisis point.

The quicker solution would be to effectively reward drillers for taking a timeout. Under the approach being developed by the Energy Department, the agency would contract with companies to delay production of proven oil reserves for several years, if not indefinitely. When that crude is finally extracted and sold, the proceeds would go to the Treasury. Companies would be selected through an auction, with the government picking the lowest-price bidders.

And, as Bloomberg notes, Energy Department officials developed the plan after affirming they had legal authority for the move and studying alternatives. According to senior administration officials the effort would benefit independent oil companies across the U.S., and it would be focused on sites that are either producing today or those with infrastructure in place so they could quickly yield oil.

The Energy Department already moved to sop up some excess crude by renting out space in the U.S. Strategic Petroleum Reserve for private storage. The agency said Tuesday it is in negotiations with nine companies to store some 23 million barrels of crude in the underground salt caverns that make up the emergency stockpile. And it expects to offer more space in the reserve in coming weeks.

That said, the probability of this plan passing Congress is slim to none: an earlier administration proposal to spend $3 billion buying U.S. oil for the strategic reserve was blocked in Congress, as Democrats sought to offset the purchase with investments on clean energy. Similar opposition will likely derail the Trump administration’s new plan too. Democratic leaders have said they oppose anything that smacks of a “big oil bailout”, although what they really mean is that they want a mirror-image bailout for their own causes. Worse, while environmentalists have favored a “keep-it-in-the-ground” approach to phasing out fossil fuel production, Trump’s venture is aimed at sustaining the industry – not ending it.

The price tag? With some 635 million barrels already socked away inside underground salt caverns in Texas and Louisiana, the government has authority to snap up 365 million more as long as Congress doles out money for the transaction. At current prices it could cost at least $7 billion.

Energy Secretary Dan Brouillette said in an interview on Bloomberg TV this week that he would “be working closely with Congress” on a possible storage expansion, adding that “It’s something that the Congress should consider. They will of course make the ultimate decision as to whether or not they want to pursue that. But we’re going to make some I think very strong and credible arguments why additional storage capacity is important to the country.”

At today’s low prices, the U.S. government could fare well on the deal. Buying 365 million barrels at the current price of $19.87 a barrel – and selling at the 2019 average price of $57.04 would yield more than $13 billion profit. Even selling at just $30 a barrel could net nearly $4 billion, minus any transport and holding costs. It’s an idea not lost on Trump, who in an April 3 meeting with oil executives wondered why everyone wasn’t socking away cheap crude to sell later.

“At these prices,” Trump mused, “you would think you’d want to fill up every cavity that we have in this country.”

Tyler Durden

Wed, 04/15/2020 – 17:26

via ZeroHedge News https://ift.tt/2yiegiB Tyler Durden