24 Hour Fitness Prepares For Bankruptcy

Despite hopes of a gradual reopening in the coming weeks, the US economy remains paralyzed with most non-essential venues still closed, and since gyms were among the first to be put on lockdown it will hardly come as a surprise that gym chain 24 Hour Fitness has been working with restructuring advisors including Lazard and law firm Weil, Gotshal & Manges to weigh options including a bankruptcy that could come as soon as the next few months, according to CNBC.

The story is familiar for most US gym operators: a heavy debt load, deteriorating performance and a coronavirus pandemic that forced it to shut its more than 400 clubs. Worse, the mid-priced fitness provider was already struggling to compete against premium rivals like Equinox and cheaper competitors like Planet Fitness. Moody’s recently downgraded the chain over worries around its “negative membership trends, very high-interest burden and negative free cash flow prior to the coronavirus outbreak, as well as approaching maturities to provide limited flexibility to manage through the crisis.”

As CNBC reports, 24 Hour Fitness has an $837 million term loan maturing in March 2022 and $500 million in unsecured notes maturing in June 2022, if more than a fifth of those notes remain outstanding. And while the San Ramon, California-based fitness chain had roughly $1.5 billion in sales in 2019, its cash is currently a catastrophic $1 million, according to Moody’s. It is controlled by private equity firm AEA Investors, which acquired it through a $1.8 billion deal with Fitness Capital Partners and Ontario Teachers’ Pension Plan in 2014.

Already highly levered, the company found itself in a dire predicament after regulators and states ordered they close their doors to help prevent further spread of the virus. “We need to limit indoor activities that are purely recreational, especially those where there are a lot of shared surfaces that can be contaminated,” said former FDA Commissioner Dr. Scott Gottlieb. “Bars and gyms fall squarely in that category.”

As a result, 24 Hour Fitness announced on March 16 it was closing all its clubs, later acknowledging the closures may last for “an extended period of time” due to coronavirus. It has said it would suspend all membership billings effective this week if it was unable to reopen its clubs.

In other words, the company’s cash flows have hit a hard stop.

Its struggles are emblematic of broader challenges and questions the fitness industry must face. Even after gyms reopen, mounting unemployment may mute appetite for excess costs like gym membership. There remain questions as to how many people will be comfortable working out in a crowded environment.

It’s not just the mid-range clubs that are hurting; in early April the high-end gym chain Equinox sent a letter to its landlords declaring that it would not be paying its monthly rent because of the hardship caused by the crisis, according to the FT. Like 24 Hour Fitness, Equinox has had to halt most of its operations because of the outbreak. The indebted group stopped collecting monthly fees from members when it began closing its clubs, forgoing tens of millions of dollars in revenues.

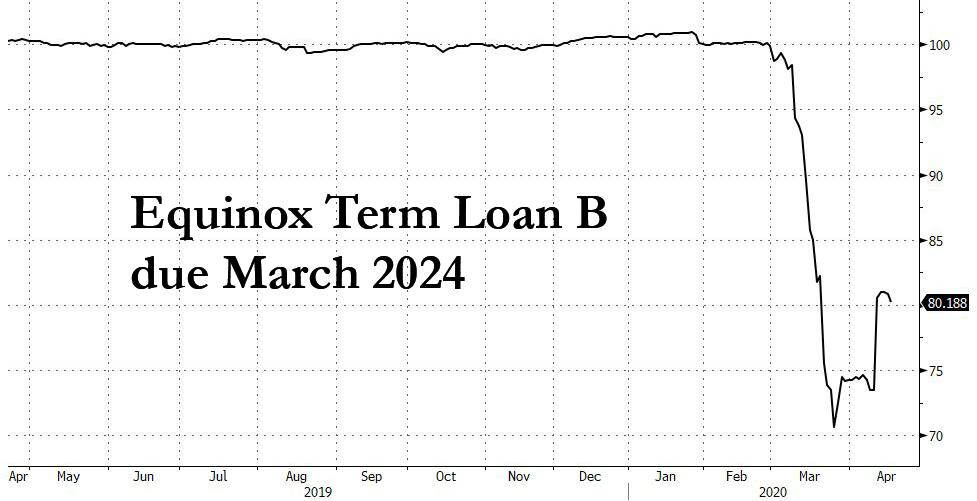

The move put immediate pressure on its finances. The group borrowed $140MM in emergency funds from its lenders through a revolving credit facility to cover what credit rating agency Moody’s called its “high monthly cash burn”. Investors have nonetheless raised concerns about the company’s cash position, sending the price on a $1bn loan it owes in 2024 tumbling in value. The Equinox loan traded at roughly 80 cents on the dollar on Friday, after tumbling as low as 70 cents in late March.

While the industry scored a small victory last week when the administration said gyms would be among the first to reopen business in a 3-phase plan, provided gyms “adhere to strict physical distancing and sanitation protocols”, the recommendation to open gyms before school raised some eyebrows. It is also unclear how many (former) clients will jump at the opportunity.

Tyler Durden

Sun, 04/19/2020 – 16:25

via ZeroHedge News https://ift.tt/2VKudG8 Tyler Durden