Japan Proves Again Just How Laughable The Idea That Central Banks Can Support Markets Is

Authored by Jeffrey Snider via Alhambra Investments,

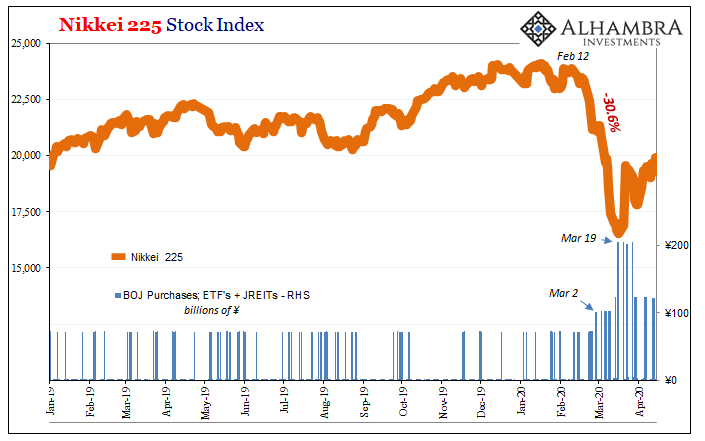

On March 2, the Bank of Japan leapt into the stock market, Haruhiko Kuroda burnishing his Superman cape as he flew in to rescue the Nikkei. Purchasing a record amount of ETF’s that day, shares in Tokyo surged. It was a clear message, or so everyone thought.

Don’t fight the Fed nor the Bank of Japan, not when they can buy theoretically unlimited amounts.

Right?

The following day, however, Bloomberg wrote up the bad news:

The Bank of Japan’s surprise purchase of a record volume of exchange-traded funds turbocharged the nation’s shares on Monday, but the effect vanished on Tuesday with investors talking down odds of a lasting impact.

Indeed. Over the next two weeks, the Nikkei 225 index would go on to lose a boatload, on top of the big losses equities had suffered which had spurred Kuroda’s superhero act in the first place. From start to finish, the index dropped a little over 30%.

What good did the ETF purchases do?

Furthermore, BoJ kept on buying at the record pace all the way through to the end. By March 19, at the bottom, that prior record was surpassed as the central bank just about doubled it.

The cultists will have you believe it was those purchases which ended the rout. Even if it was, again, what good did they do? If a market goes bananas and drops 30% before the central bank finds the “right” amount of its own activity to finally support it, that’s not anything like an effective backstop.

And we know better; the end of the global liquidation wave (GFC2) ended the affair, the Bank of Japan along for the ride holding on for dear life the whole time. It is the eurodollar’s world, even Kuroda has to figure a way to live in it.

The Federal Reserve says it is going to purchase corporate bonds via ETF’s. So? Everyone is assuming that is the same thing as supporting the corporate bond market, particularly those higher risk segments which went practically bid-less during the same global chaos of (US$) illiquidity that punished Japan and made a mockery of this kind of program.

A central bank is not a market, but it often pretends it can be. So long as you believe in the fairy tale, you might take a little risk yourself – which is the whole damn point. Expectations rule here, not actual money even when there are actual bids and buys.

It really doesn’t matter if any central bank steps in, as the Bank of Japan’s ineptitude ably demonstrated (again). The official trading desk isn’t fielding every call from panicky bank clients desperately ditching to sell anything not nailed down; that’s just the perception they try to produce so that you will calm down and not join the cascade.

When the avalanche of selling shows up, the central bank desk continues to operate according to its rigid bureaucratic rules. And often well behind the curve, unable to keep up with events and developments. It was and never will be possible for Kuroda to buy up every offer. He just wants to fool you into thinking he can so that you don’t push the panic button yourself.

That’s not market support, it’s absurd puppet theater. Push came to shove, the Bank of Japan could no more backstop the Nikkei than the Fed will be able to support junk corporates in the (near?) future.

Don’t fight the Fed. Sure.

With so much presumed central banking purchasing now open to each and every one of them, the financial media has been filled with such stories (yet another one flagged by M. Simmons).

The implications, of course, go much farther and deeper than the portfolio considerations of ETF investors, especially passive ones, who wonder if now is the right time to jump all over risk. Jay Powell wants you to think that it is and more than that it is perfectly safe to do so.

He guarantees it (The actual guarantee: Jay Powell’s FOMC will, like the Bank of Japan, buy a few shares of some issues and then when it’s all over, markets in the toilet again, he will come out and claim how successful his program was because the rout absolutely, definitely would have been worse if he hadn’t.).

The far greater consequences are in repo and relate to the now-proven collateral bottleneck. Repo participants won’t soon forget the collateral calls and fire sales they were just forced into. If the Fed’s Chairman thinks he’s fooled those on the inside of the global monetary system with his ridiculously simple showtunes, he’s really only fooling himself.

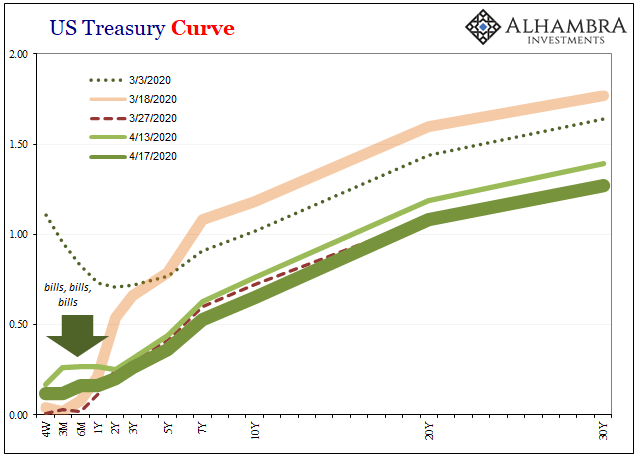

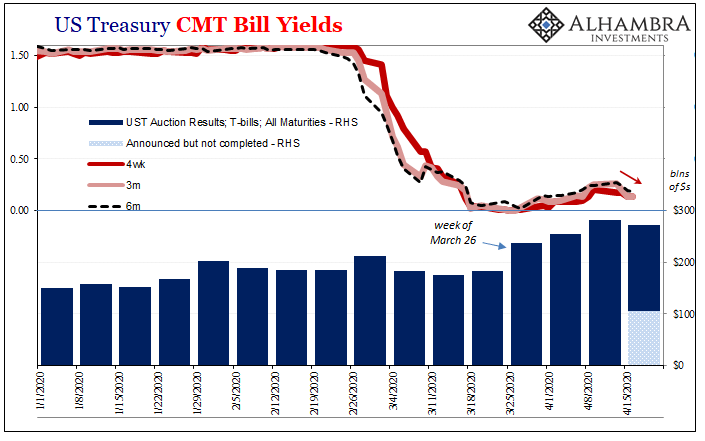

What does that mean? Bills, among other things. Suddenly in high demand especially after hours during early Asian trading.

It was unnerving during the worst of GFC2 last month to search through T-bill prices at night during those times and find them often deeply negative. Though the closing yield on those certain days in March was slightly positive or zero, on several occasions Asian repo demand for this cleanest OTR pristine form was unquenchable (I spotted several sessions where the 4-week yield would drop as low as -17 or -18 bps; even the 3-month bill would trade in negative double digits at times).

The same thing is happening right now as I type, only today the bill yields were all over the place during the regular bond market session. Around 2pm in the afternoon, the 4-week was trading at a little less than 6 bps – even though the Treasury Department says the closing price today yielded 12 bps and an entire trillion of them have been auctioned off in just four weeks.

Corporate bonds (and EM Eurobonds, which the Fed isn’t going to touch either way) are the repo bottleneck, where it all begins. The average CNBC viewer and ETF investors might be impressed and comforted that the FOMC has authorized the Open Market Desk to buy corporate ETF’s here in America.

Outside of the financial media, no one else is, though. Thank you, Japan, for demonstrating perfectly how buying a few or even a lot of shares is nowhere near the same thing as supporting a market.

Sorry, folks, for the nth time there is no Greenspan put anywhere.

The eurodollar determines everything, certainly never bureaucrats.

Tyler Durden

Sun, 04/19/2020 – 17:15

via ZeroHedge News https://ift.tt/2Vn7MrH Tyler Durden