“The Default Cycle Has Officially Started”

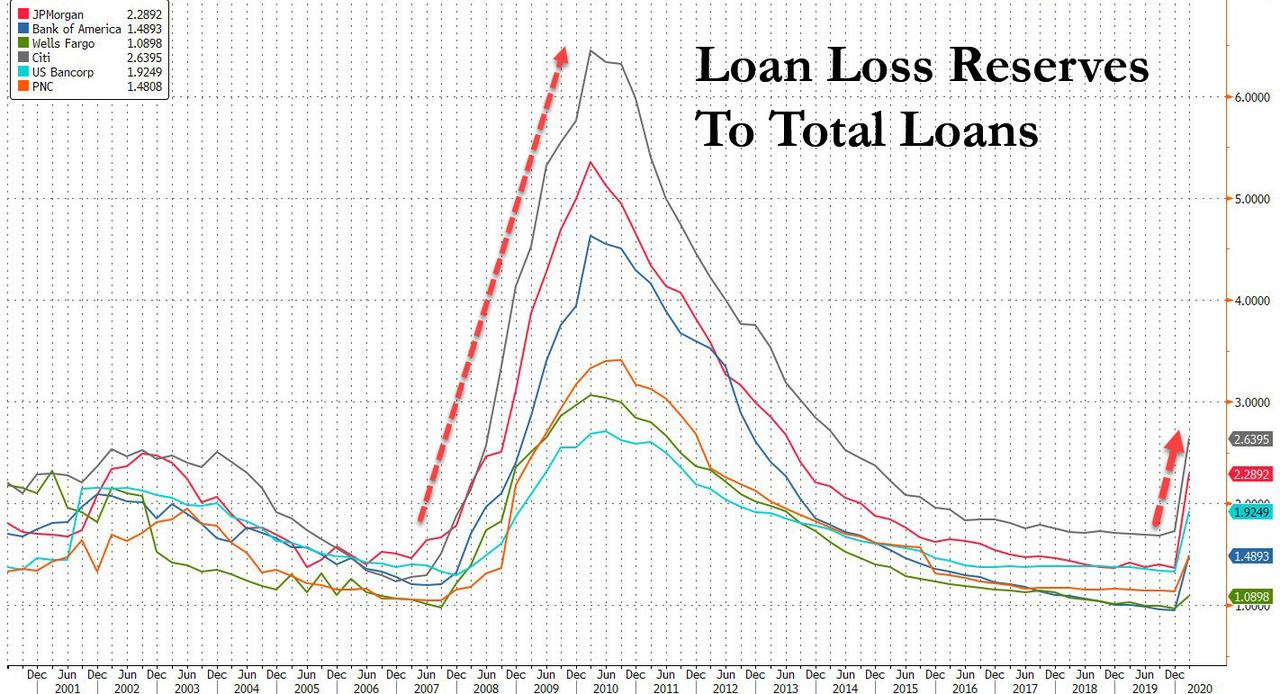

We didn’t really need any more confirmations. In recent weeks, as the US economy came to a screeching halt because of the coronavirus pandemic, we have seen banks take over $20 billion in reserves in anticipation of a looming default wave (a five-fold increase if not nearly enough based on historical precedent)…

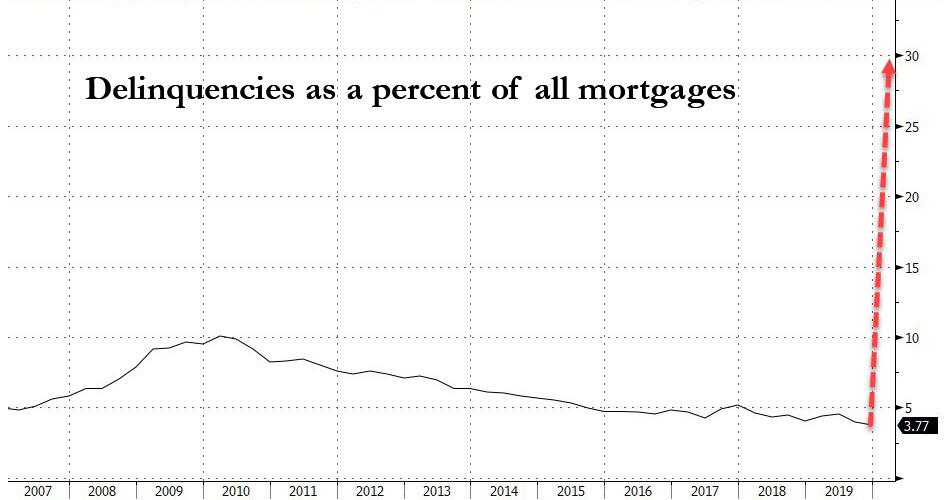

… Moody’s predicting that as many as 30% of Americans with home loans – about 15 million households – could stop paying their mortgages if the U.S. economy remains closed through the summer or beyond…

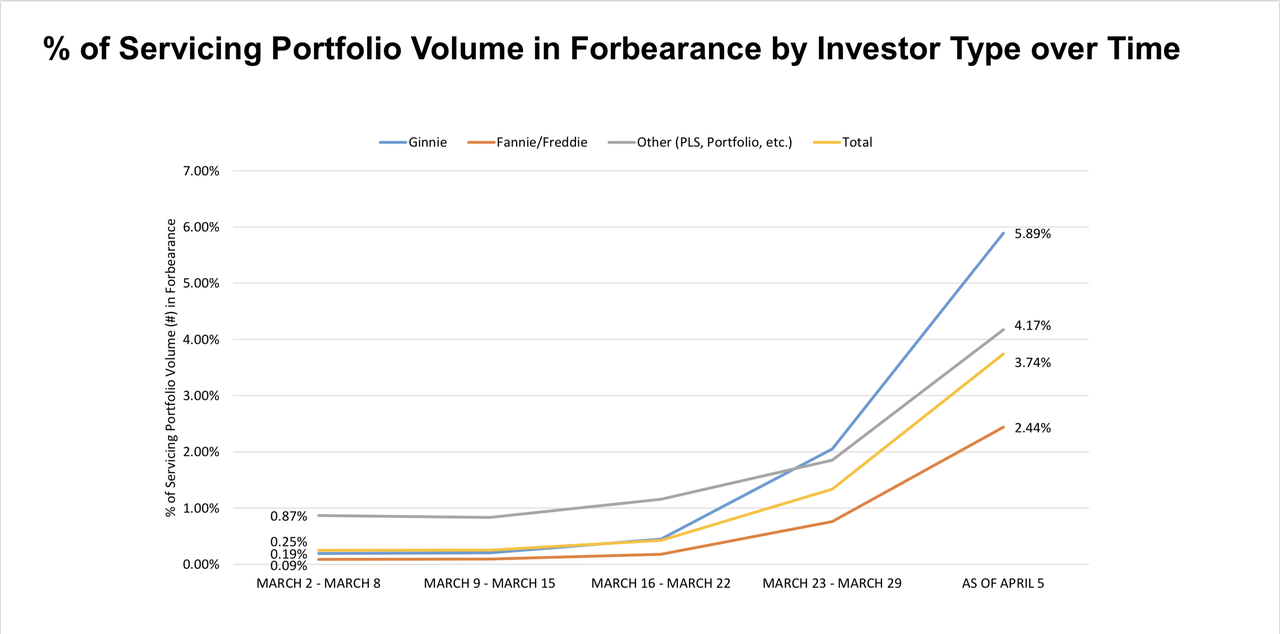

… with the number of households that have already stopped paying their loans soaring by 1,496% in just six weeks…

… and even JPMorgan in the process of shutting down its entire net interest margin origination platform, by getting out of new loans and HELOCs and boosting the standards on new loans.

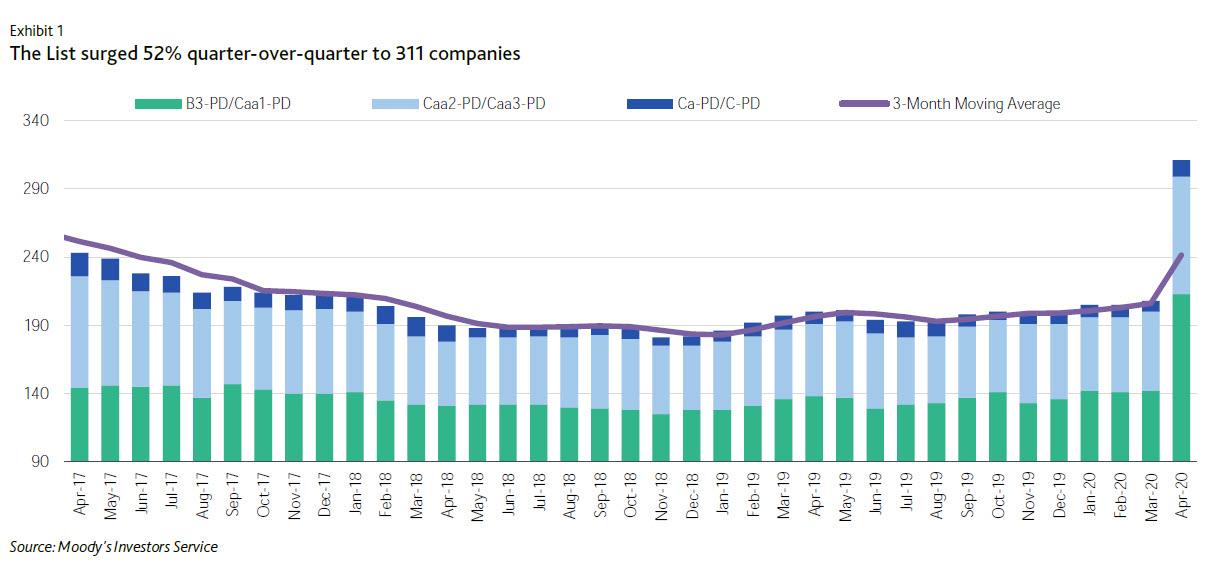

These are all clear signs that a wave of mass defaults has started and is about to break all across America as tens of millions of household suddenly lose their jobs, and yet with the Fed now openly buying investment grade and some junk bonds, there is a terminal disconnect between bond pricing (i.e., default probabilities) as a result of the Fed’s interventions, and the underlying cash flow dynamics. Alas, said dynamics are becoming dire especially for lower rated credits, i.e., those with the most debt, and according to Moody’s its list of distressed credit names, those rated B3 Negative and lower, soared to its highest tally ever – 311 companies – with Services, Oil & Gas, Gaming, and Restaurant sectors the largest contributors.

That tops a former peak of 291 companies, reached during the credit crisis of 2009 and the commodity-related downturn in April 2016. At 20.7% of the total rated spec-grade population, the list also shot up above its long-term average of 14.8%, and closing in on its all-time high of 26.1%. This spike is the result of the confluence of a coronavirus outbreak, plunging oil prices, and mounting recessionary conditions, which created severe and extensive credit shocks across many sectors, regions and markets, the effects of which are unprecedented. New companies added to the B3N list during the first three months of the year numbered 133, with 110 added in March alone. Speculative-grade companies with weak liquidity and poor refinancing profiles, that are also in the most-exposed sectors, dominated recent negative rating actions.

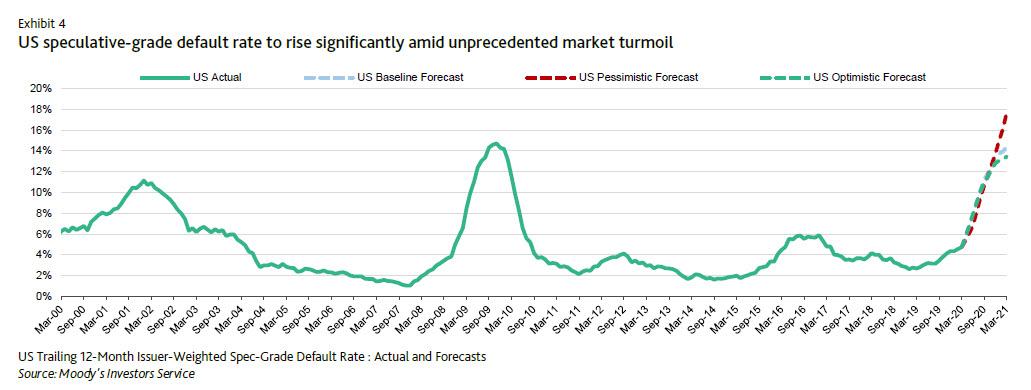

The last, and perhaps least, confirmation that the default endgame has arrived came from Goldman which late last week reported that the US default cycle has officially started, with the bank forecasting a 13% default rate, which while aggressive is well below Moody’s own forecast of slightly above 14% and on par with the financial crisis. Here is Moody’s comment on the coming default wave: “Our baseline default forecast is for the US spec-grade default rate to end 2020 at 13.4% and edge higher, to 14.4%, by the end of March 2021 — almost matching the peak of 14.7% recorded in 2009 during the credit crisis (see Exhibit 4). This forecast is underpinned by our expectations of a sharp downturn in the global economy during the first half of the year and of the US unemployment rate jumping to 8.7% in Q2 before easing to 6%-7% in the subsequent three quarters. In our baseline default forecast we further assumed US high-yield spreads will increase and remain elevated at recessionary levels in the next two quarters.”

Under Moody’s pessimistic scenario (red line), which assumes that the virus will persist into 2021 and create wider and deeper economic disruptions, the US default rate will rise to 17.7% a year from now. Ominously, Moody’s admits that the likelihood of its pessimistic forecasts crystallizing is “higher than it would be in more benign cycles. This is because there is still a high degree of uncertainty around when the coronavirus pandemic will be contained, and how quickly economic activity will return to normal.”

Perhaps even more notably, Goldman is quick to pour cold water over speculation that the Fed’s actions may somehow ease the coming default wave, writing that “some observers have expressed optimism that the Fed’s recently-expanded policy actions may help ease the pressure on HY defaults. We disagree and continue to point to the severity of the economic downturn as a key driver of HY defaults. In our view, the Fed’s expanded policy actions will not translate into material fundamental improvement for the weak HY balance sheets”

Bank of America echoes this and writes that the Fed’s “bold, surprising” announcements “do nothing to address the ultimate credit risk – nonpayment, downgrades, and fallen angels, nor should they, and we thus remain comfortable with our existing views on expected default rates, which we estimate at 9% over the next 12mo.” However, it will only rise from there as BofA continues to make the argument that “default rates are unlikely to reach their peak levels in the next 12mo, given their historical tendency to rise only gradually following a turn in a given credit cycle. Issuers generally have a runway to deal with maturities, revolver capacity to tap, covenants to waive, and levers to pull to preserve cash by cutting employment and capex.”

As a result, BofA is sticking with its 21% cumulative default rate in HY once the credit cycle turns… which it now has, because going back to Goldman, the vampire squid writes that “the recent news flow suggests the acceleration phase of the default cycle has officially began” and points out what we first reported last week that in Retail, J.C. Penney elected not to make its $12 million scheduled interest payment this week, and has entered a 30-day grace period, with a default now inevitable. At the same time, Neiman Marcus Group was downgraded by S&P to CCC-/Neg O, with the rating agency viewing a restructuring as “more certain in the near term.”

Other defaults included Frontier which also filed for Chapter 11 bankruptcy protection this week, while satellite provider Intelsat skipped its scheduled interest payment ($125 million). Finally, in Energy, offshore driller Diamond Offshore elected not to make its coupon interest payment.

And while Goldman remains “comfortable with our 13% trailing 12-month forecast, expecting financial distress will remain acute, especially for sectors impacted by the compound effect of social distancing and collapsing discretionary consumer spending” the question is just how much higher the real default rate end up being.

Tyler Durden

Sun, 04/19/2020 – 11:50

via ZeroHedge News https://ift.tt/3amRhQL Tyler Durden