Blain: Do Markets Even Matter Anymore?

Authored by Bill Blain via MorningPorridge.com,

What have we got to look forward to in markets?

The Coronavirus first wave is ebbing across Northern Europe and New York. Nations are now contemplating limited economic reopening. Government bailouts, support packages and central bank QE infinity have handed markets an extraordinary boost – it’s one of the biggest bull rallies on record!

Let joy be unconfined…

What’s not to like?

Well… don’t get me started. One of the big issues for markets is separating the news that actually matters from the stuff that is just news noise.

Real news is how effective the C-19 mitigation, QE-infinity and unlimited spending packages are likely to prove in the real world.

They are certainly working well for markets – which have arbitraged them to the max. The question is consequences – how much money will actually reach the real economy, how will it be spent, against how much will simply continue to fuel financial asset price inflation? All that money in financial markets keeps pushing up prices – just like tulips push out the ground. As long as central banks are willing to give a free put – does it matter for markets that economies are in free-fall? (I suspect.., at some point it will.) Mind the Gap.

Real news is that Oil prices didn’t actually need a spat between Saud and Russia to tumble – it’s the absolute dearth of demand for the black black oil that’s killing prices. What does that tell us about the real prospects for the global economy? Oil prices plunge to 20-year low as virus hits demand.

Real news will be about what markets are not telling us. As banks around the globe find credit lines being fully drawn down by corporate customers, they are being forced to lend even more. Virus Forces Deutsche Bank to Confront Fears. It’s the old adage – if you owe the bank a $1000, you are in trouble. If you owe the bank $10 billion, then the bank is in trouble. Yet, lending more and more to already over-levered companies to see them through the C-19 Shutdown, is apparently not a problem. It’s a curious sort of doublethink… but heck, markets buy it.

Real news is Ford demonstrating how it’s now perfectly possible to believe 6 impossible things at once. It tumbled into Fallen Angel status last month when it lost its investment grade rating. (How careless..) But, backstopped by the Fed declaration that, in their eyes, anyone who was investment grade on March 22nd, remains investment grade, it was able to issue a $10 bln bond issue at sub 10% yields which is eligible for QE Infinity. The institutional investors who posted over $20 bln of bids are keen to lock in yields today, secure in the knowledge the Fed will bail them if it gets worse, and the next similar deal will probably flip the 9% coupon to a 6%! I wonder how many more cars Ford sold as a result of the bond issue, and how many car buyers will still have incomes when Ford has to start paying it back? Just asking.. ?

Real news will be how monetary bailouts on the market and fiscal handouts to the real economy actually work. In the UK we have painfully slow delivery of policy promises. The second US SME bailout package is held up because the Democrats are trying to ensure the money actually goes to the small companies unlikely to survive the month is real news – the bulk of the first $350 bln rescue package was scooped up by big firms with the legal and financial resources to do so. The big pigs got to the trough first. Shake Shack, Potbelly Among Chains Tapping Small-Biz Funds.

Real News will be what companies say through this earning season about long-term plans and expectations. If you strip out the distortions of unlimited free money and QE infinity, markets are ignoring record P/E levels, and anticipate swift recovery. If companies are telling us about plans to mitigate for slowing business conditions, to cut costs and rationalise jobs in the wake of anticipated slowdown.. then we have a disconnect. Goldman Sees Record US Corporate Cash Spending Cuts This Year.

Real News will be just how deep the business pain goes across sectors. The pain in some, like aerospace and tourism, is already understood. How coronavirus brought aerospace down to earth. How others will react to slowing demand, lower discretionary consumer spending, and continuing uncertainty will be critical. Again, we’ll be listening for clues in what companies say.

Real news will be what the Europeans decide on Thursday re debt support for Italy (and by extension the rest of enfeebled Europe). It’s a big decision – do they tinker with the Euro’s creaking mechanisms to fudge more support, or do they come up with something that’s long term effective and transformational for Europe. Italy PM Calls for EU Solidarity.

Europe needs to solve for long-term growth, structural and youth unemployment, and increased unification to move the European economy forward and make it relevant. Or they can “kick the can” down the European goat track a little longer. Solving Europe is a real event with real market implications in terms of how the looming European Sovereign Debt crisis evolves and plays out.

Real news is working out how the future global economy is going to shape up – especially in terms of China and the Rest of the World. It feels like lines are being drawn. The papers are full of conspiracy theory. It’s easy to believe the Chinese have massively fudged the numbers of infections and deaths to avoid the worst possible outcome – making the Party Government look incompetent, and President Xi look complicit.

The distrust looks likely to deepen the divides between the Occident and Orient – with a host of implications for protectionism, tech eco-systems, and global supply chains. China arrested a host of Hong Kong Pro-democracy protestors at the close of last week. Under the cover of a pandemic, China is dismantling Hong Hong’s last freedoms. They’d been betting the world would not notice – too concerned with the rising daily C-19 numbers.

I am amused at some of the threads I’ve been following on business social media. Chinese Linked-in and Twitter users are either extremely naïve or are propaganda bots – responding to new ECB officials are concerned about Chinese takeovers while European countries were struggling, chat bot accounts showing pictures of pretty Chinese girls were writing about how beneficent Chinese capital is prepared to step in and rescue failing western firms – even throwing in sops like setting up R&D facilities in newly acquired Occidental companies. It would make me giggle – if it wasn’t so serious..

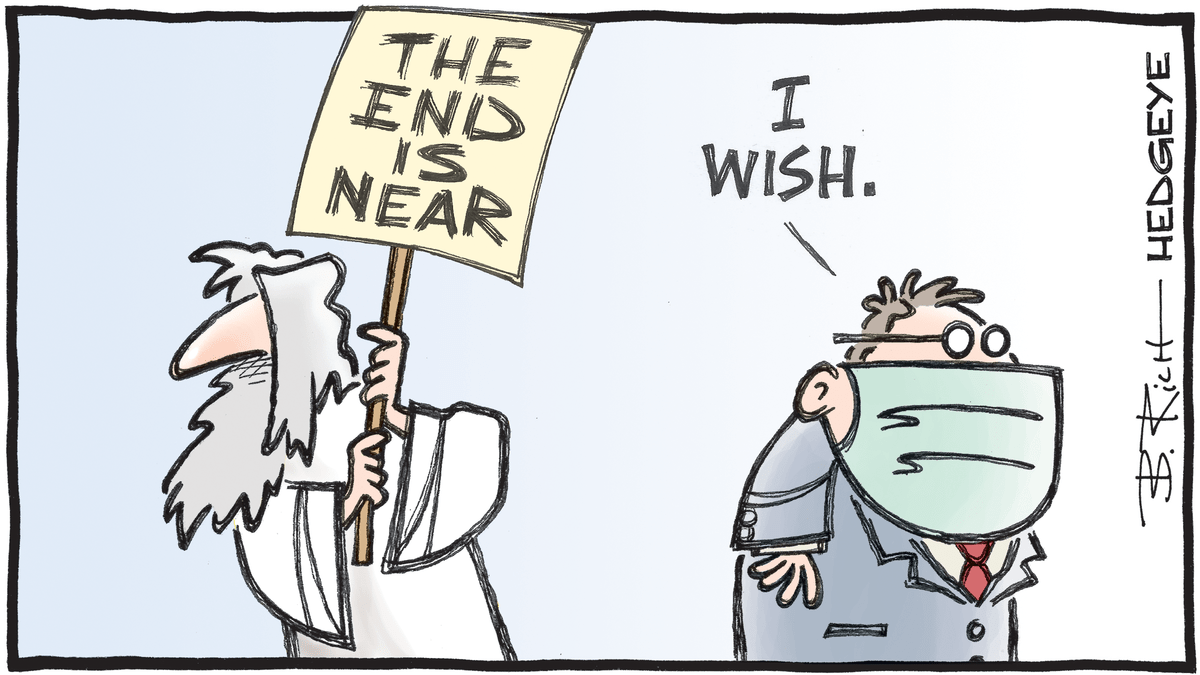

But when it comes to what is really important News, and what isn’t these days.. then I am beginning to wonder if markets actually matter any more?

When central banks make sure all companies are special by ensuring all survive, then none are special. The discipline of financial rectitude and the fear of default count for naught.

The sanction of bankruptcy is meaningless.

If you want to make successful investment choices now, work out which companies will get the biggest bang from the government buck, not just those most likely to survive the 2nd quarter pretty much earnings free, devoid of income and shuttered.

Tyler Durden

Mon, 04/20/2020 – 08:28

via ZeroHedge News https://ift.tt/2VktA7c Tyler Durden