Futures Plunge As WTI Crashes By Most On Record, Tumbling To $11 Per Barrel

Oil prices crashed the most on record with the May WTI futures contract hitting its lowest level since 1999, plunging as low as $11 or down 38%, as nobody wants to take actual physical storage amid widespread fears crude storage will soon be full; meanwhile companies prepare to report the worst quarterly earnings since the financial crisis, while tens of thousands of people continue to get sick every day with the coronavirus.

While Brent was only down $1.12, or 4%, at $26.96 a barrel on Monday morning, the carnage took place in the landlocked WTI, whose May contract fell $5.70 to its lowest since March 1998 though the sell-off was exaggerated by the contract’s Tuesday expiry because no one wants to be left long to take delivery as there is nowhere to put the physical product. In any case, the 37% drop was the biggest one-day drop on record!

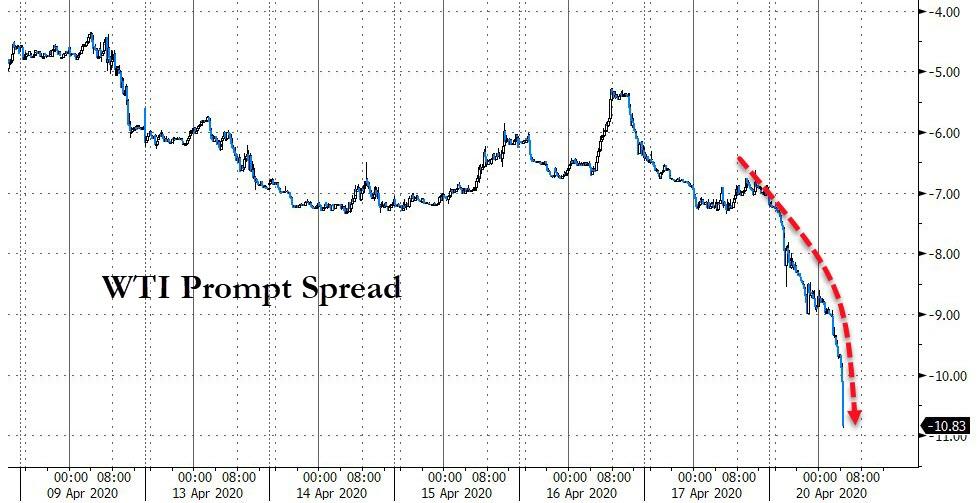

“The May contract is set to expire tomorrow and the bulk of the open interest and volume is already in the June contract,” said ING’s head of commodities strategy, Warren Patterson. To be sure, the June contract, which is more actively traded, fell only $2.18, or 8.7%, to $22.85 a barrel, sending the prompt spread to a record $11/barrel.

Not helping oil was an interfax report that Russia increased oil output by almost 1% in the last 3-days. While the OPEC+ deal comes into effect on May 1st, Russia is not bound by the pact to reduce its output until then; and – it appears – Moscow is looking to make the most of the next 10 days, even if it means sending the front-end to zero.

While some may dismiss the plunge in the front contract, the reality is that the world most popular oil ETF, the USO which, is driven mostly off the front end of the curve has crashed to just $3.73 despite registering a record one-day inflow of $552.5MM on Friday, and steamrolling countless retail traders who went long USO after the OPEC+ deal only to see their “profits” turn into catastrophic losses.

Commenting on the oil price move, Bloomberg points out that

the first of these spikes, in December 2008, came as the S&P 500 was putting in a nice rally of some 27.5% on a trough to peak basis from mid-November to early January. Perhaps it’s a coincidence that the index is once again ripping higher as crude exhibits this type of behavior. But maybe the oil market is offering a warning of just how significant the economic damage will be — damage that you could argue is no longer reflected in the price of equities.

Meanwhile, with a record 198MMb/d now stored offshore, the volume of oil held in U.S. storage, especially at Cushing is rising as refiners throttle back activity in the face of weak demand. “As production continues relatively unscathed, storage is filling up by the day. The world is using less and less oil and producers now feel how this translates in prices,” said Rystad’s head of oil markets, Bjornar Tonhaugen.

The mood in other markets was also gloomy as the first-quarter earnings season gets underway. Analysts expect STOXX 600 companies to post a 22% plunge in earnings, which would represent the steepest decline since the 2008 global financial meltdown, IBES data from Refinitiv showed.

After starting off higher, U.S. equity futures fell alongside European and Asian stocks on Monday as investors grappled with everything from the spread of the coronavirus to oil’s collapse and the next raft of corporate earnings. Contracts on the S&P 500 extended their decline through the European morning as the price of West Texas oil cratered.

The Stoxx Europe 600 Index fluctuated before turning lower, with energy companies slumping. Shares retreated across much of Asia, though the benchmark in Shanghai rose. The euro, pound and yen all weakened. European bonds mostly dropped. The German economy is in severe recession and recovery is unlikely to be quick, given that many coronavirus-related restrictions could stay in place for an extended period, the Bundesbank said on Monday.

Earlier in the session, Asian stocks also fell, led by health care and materials, after rising in the last session. Markets in the region were mixed, with Australia’s S&P/ASX 200 and Jakarta Composite falling, and Thailand’s SET and Shanghai Composite rising. The Topix declined 0.7%, with Takakita and Fuji PS falling the most. The Shanghai Composite Index rose 0.5%, with Sichuan Xichang Electric Power and Shanghai Sanmao Enterprise Group posting the biggest advances. Japanese exports declined the most in nearly four years in March as U.S.-bound shipments, including cars, fell at their fastest rate since 2011.

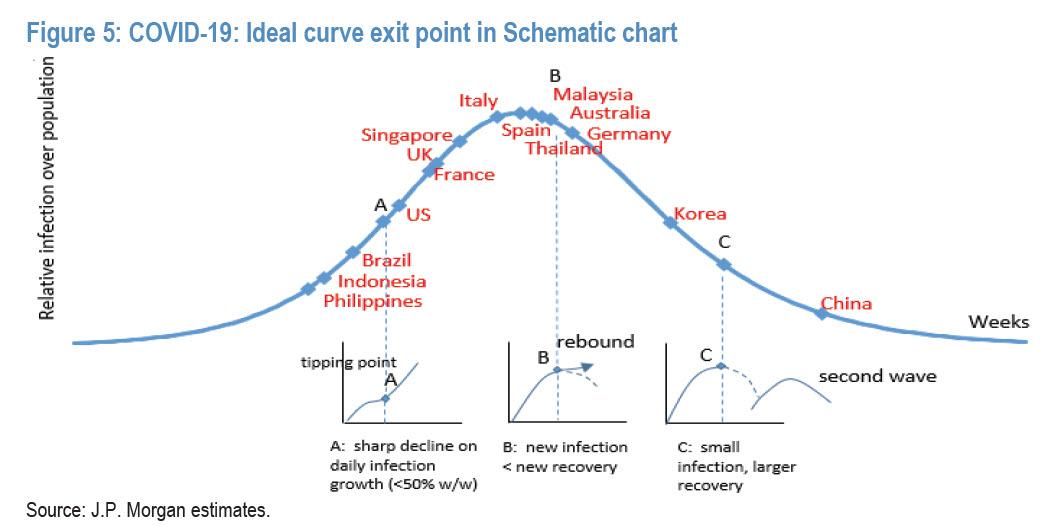

It was not all bad news with coronavirus infection rates clearly slowing in several major economies, while investors were bracing for the pace of earnings season to pick up.

IBM, Coca-Cola Co. and Netflix Inc. are among companies due to report in the coming days. Meanwhile, governments and policy makers are continuing attempts to limit the economic damage of the outbreak. U.S. lawmakers are moving closer to a deal to top up funds for small businesses, China pledged more stimulus as banks lowered borrowing costs and European officials are discussing creating a bad bank for the region, according to the Financial Times.

In rates, 10Y TSY yields were slightly lower, trading at 0.6273% with bunds trading through Friday’s best levels and peripheral debt widens to core as regional sensitivities around jointly issued debt come to the fore. Moves are modest, save for Italy as short-dated yields rise 14bps. Cash USTs drift higher, outperforming Bunds by ~1bp at the long end. Gilts close their opening gap, brushing off comments from BOE officials. The Bund curve bull-steepened, yet underperformed Treasuries; Italian debt extended its decline, underperforming euro-area peers amid speculation the nation’s Treasury may announce a bond syndication this week. Japan’s government bond yield curve bull flattened as the government was seen boosting issuance of short-tenor bonds to fund its extra budget, which was boosted by 8.9 trillion yen to fund cash handouts

In FX, the Bloomberg Dollar Spot Index firmed along with Treasuries as risk sentiment was fragile, with European stocks mainly mildly positive and U.S. equity futures slipping as earnings season intensifies. Oil-linked currencies tanked as crude prices plunged further. The Dollar initially gave back most of Asia’s gains, before surging higher again and back to session highs. Australian and New Zealand dollars led Group-of-10 gains; the kiwi gained after the government said it will partially ease lockdown restrictions next week. The greenback’s overall advance came in the wake of the Fed’s slowing QE purchases and with the earlier rally in equity markets loosing momentum. The Norwegian krone and the Canadian dollar led losses following a deepening slump in oil prices to the lowest level in more than two decades.

Elsewhere in commodities, spot gold spiked to session highs in early US trading, rising to $1,690. Base metals are mixed, LME Nickel rallies over 2.5%, aluminum drops 1.2%.

Expected data include Chicago Fed National Activity Index. Halliburton, Equifax, and IBM are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.9% to 2,844.75

- STOXX Europe 600 down 0.02% to 333.41

- MXAP down 0.8% to 143.94

- MXAPJ down 0.6% to 465.88

- Nikkei down 1.2% to 19,669.12

- Topix down 0.7% to 1,432.41

- Hang Seng Index down 0.2% to 24,330.02

- Shanghai Composite up 0.5% to 2,852.55

- Sensex up 0.3% to 31,679.98

- Australia S&P/ASX 200 down 2.5% to 5,353.01

- Kospi down 0.8% to 1,898.36

- German 10Y yield fell 1.7 bps to -0.489%

- Euro down 0.1% to $1.0864

- Italian 10Y yield fell 4.0 bps to 1.619%

- Spanish 10Y yield rose 1.6 bps to 0.832%

- Brent futures down 3.7% to $27.04/bbl

- Gold spot little changed at $1,682.21

- U.S. Dollar Index down 0.1% to 99.67

Top Overnight News

- Signs emerged that the global pandemic is easing in some hot spots, as regions from Spain to New York saw a slowdown in fatalities, though some Asian countries wrestled with worsening conditions

- Chinese banks lowered borrowing costs and the government promised to sell another 1 trillion yuan ($141.3 billion) in bonds to pay for stimulus spending after the economy had its first contraction in decades due to the coronavirus outbreak

- Spain will propose a rescue fund for Europe of as much as 1.5 trillion euros at an April 23 summit, according to newspaper El Pais

- Britain and the EU will restart talks on Monday over their future relationship, with time running out to get an agreement after a six-week interruption caused by coronavirus

- ECB officials have held early talks with the European Commission’s department for financial stability and capital markets on setting up a eurozone bad bank that would take billions of euros in debt off lenders’ balance sheets, the Financial Times reported, citing people briefed on the discussions

- President Donald Trump raised the prospect that China deliberately caused the Covid-19 outbreak that’s killed over 39,000 Americans and said there should be consequences if the country is found to be “knowingly responsible”

- Democrats and the Trump administration are near an agreement for Congress to act this week on a deal as large as $500 billion putting more funding into a tapped-out small business aid program and providing money for coronavirus testing and overwhelmed hospitals

- Markets are pricing for the spread between Libor and overnight index swaps — a proxy for the risk-free rate — to compress sharply into June as funding conditions improve. Huge activity in both Eurodollar options and futures — used to bet on the path of Libor — suggest divisions on the pace of the easing

Asian equity markets traded mixed amid the ongoing fallout from the coronavirus pandemic and extended rout in oil prices which briefly saw the WTI May contract drop below USD 15/bbl for the first time since 1999 and the June contract briefly slip below USD 23/bbl with the sell-off due to a collapse in demand, concerns of declining storage capacity and ahead of Tuesday’s contract settlement. ASX 200 (-2.5%) and Nikkei 225 (-1.2%) were negative with the energy sector front-running the broad declines in Australia alongside the oil market woes and as Caltex also suffered from Couche-Tard abandoning its pursuit of the Co., while Tokyo risk appetite was sapped after mostly weaker than expected trade data including the largest decline in exports since 2016. Hang Seng (-0.2%) and Shanghai Comp. (+0.5%) were somewhat indecisive although outperformed their regional peers after the PBoC cut the 1-year and 5-year Loan Prime Rates by 20bps and 10bps respectively as expected, while the state planning agency noted that China will roll out more forceful and targeted fiscal, financial and employment policies. Finally, 10yr JGBs lacked demand following recent comments from the Japan Securities Dealers Association that global funds sold record levels of 10yr JGBs last month and with Japan’s government planning to issue more than JPY 25.69tln to fund supplementary budget, although losses were stemmed by support at 152.00 and amid weakness in Japanese stocks.

Top Asian News

- China Pledges More Stimulus as Banks Cut Lending Rates

- India’s Ban on Flying to Stay Until Virus No Longer a Danger

- Singapore’s Daily Virus Infections Top 1,000 For First Time

European equities have given up gains since the open and trade mostly lower (Euro Stoxx 50 -0.4%), as the cautious tone from APAC trade reverberated across the continent. US equity futures see more pronounced losses in comparison following the State-side gains posted on Friday. European sectors remain mixed with no clear indication of the risk-tone, whilst Energy and Materials reside at the bottom of the bunch. Looking at the breakdown, the downside sees Basic Resources alongside Oil & Gas, whilst Healthcare resides at the other end of the spectrum; Travel & Leisure remains relatively flat. In terms of movers, miners see pressure in European trade after giant Vale reported Q1 iron ore sales -6.8% YY and iron ore production -18% YY. Co. cut its FY20 iron ore production to 310-330mln tons vs. Prev. 340-355mln tons amid delays to the resumption of operations at certain mines. FY nickel production guidance cut to 180-195k tons vs. Prev. 200-210k tons. Thus, Glenore (-1.6%), Rio Tinto (-1.8%), Anglo American (-2.8%), Fresnillo (-2.5%), BHP (-1.3%) all see losses. European bank also see downside after reports downplayed ideas that the a EZ bad-bank will be formed to deal with debt from the 2008 crisis. Elsewhere, Phillips (+6.4%) extends on opening gains despite overall downbeat earnings as the Co. aims to return to growth and improved profitability in H2 2020. Sanofi’s (+1.1%) Head of French business said the Co. will pay out a dividend this year, with the overall value modestly higher YY, albeit shares are moving in tandem with the European Healthcare sector.

Top European News

- Riksbank Governor Lashes Out at Efforts to Strip Bank of Powers

- CEO of Norway’s Wealth Fund Faces Probe After Luxury Jet Use

- Nordic M&A Lawyers Say Clients Want to Exit Deals Already Struck

- German Virus Cases Rise the Least Since March as Curbs Ease

In FX, the Kiwi only got a fleeting fillip from firmer than forecast NZ inflation overnight, but is outperforming fellow majors on PM Arden’s acknowledgement of the progress made in containing the spread of nCoV to the point that plans are afoot to re-open businesses end lockdown this time next week. Nzd/Usd is firmly back over 0.6000 in response and eyeing resistance ahead of 0.6100, while the Aud/Nzd cross has retreated markedly to test 1.0500 as the Aussie lags below 0.6400 vs its US peer amidst weak oil and other commodity prices, albeit with the DXY unable to retain a grasp of the 100.000 handle.

- CAD/NOK/RUB/MXN – The Loonie, Norwegian Krona, Russian Rouble and Mexican Peso are all suffering alongside crude that is extending losses to deeper multi-year lows ahead of the looming May WTI futures expiry, with Usd/Cad hovering around 1.4050, Eur/Nok above 11.3000, Usd/Rub circa 74.5900 and Usd/Mxn back over 24.0000.

- GBP/JPY/CHF/EUR – Pragmatic rather than poignant in terms of policy remarks from the BoE via Broadbent and Haldane have not really impacted the Pound, but Cable has pulled back from 1.2500 and Eur/Gbp is edging up towards the 200 DMA (0.8739) despite the draw of a particularly large option expiry at the 0.8700 strike (2.8 bn). Instead, Sterling seems to be suffering from general coronavirus fallout highlighted by IHS reporting the biggest fall in household income since it began publishing data. Similarly, but to a lesser extent due to fading risk sentiment after a mild boost from PBoC rate cuts, the Yen on a softer footing across the board, as Usd/Jpy meanders from 108.00 to 107.00 and Eur/Jpy pivots 117.00. Conversely, the Franc is rebounding from around 0.9700 and still close to 1.0500 against the Euro even though the single currency is forging gains vs the Greenback towards 1.0900 and latest Swiss bank sight deposits reveal even heftier intervention to curb Chf strength.

In commodities, WTI and Brent futures kick the week off on the back foot, with the former’s front-month future (May) -18% but disregarded given its expiry tomorrow and with open interest and volumes minuscule in comparison to the following month (June). There is little by way of fresh fundamental developments to sway the markets, although traders continue to attempt to gauge the supply/demand imbalance against the backdrop of COVID-19. WTI June dipped sub-23/bbl to a low of around USD 22.70/bbl (high USD 24.92/bbl), whilst the Brent June future losses further ground below USD 28/bbl, having printed a fresh intraday base at 27.06/bbl. Meanwhile, the Arb between the two June contracts has widened to almost USD 4/bbl vs. sub-3/bbl on Friday. Elsewhere, spot gold continues to be subdued below USD 1700/oz, with a firmer Buck providing further pressure to the yellow metal. Copper prices largely tracked lower with APAC sentiment, whilst action in the USD provides no relief to the red metal. Elsewhere, iron ore futures and nickel prices were supported overnight after mining giant Vale cut its production figures for the metals.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. -3, prior 0.2

DB’s Jim Reid concludes the overnight wrap

Talking of working from home I must say it suits the hours I work far better so I’m a fan. However when something goes wrong at home being able to escape to the office has always been a piece of salvation. Today I could have done with it as yesterday we had a small leak that I discovered in our garage. I came back into the house and told my wife I was going to go back and try to find the stopcock and turn it off. She rapidly replied that she didn’t want me to mess with it and she’d ring the builders that re-plumbed our house after she’d prepared lunch. I went back to lock the garage feeling like my masculinity had been taken away from me and couldn’t resist trying to turn off what I suspected was the stopcock just by the leak. As I turned it the valve blew and a small leak turned into a replica of the Las Vegas Bellagio fountains. Water was gushing out powerfully and spraying everywhere. To cut a long story my wife was furious at me for meddling and given that the stopcock had failed we had to find where the water supply came into the house. Half an hour and a lot of damage later we uprooted a manhole cover at the top of the drive and turned off the whole water supply to the house. That’s where we are still left this morning. Hopefully a plumber will be out this morning to give us water back. I think that classes as a job you can’t do working from home.

Talking of gushes of liquidity, the confusing thing for markets at the moments is the huge dichotomy between what will possibly be one of the worst synchronised global economic slumps in history against what is undoubtedly the largest ever intervention. On the second point DB’s Alan Ruskin showed at the end of last week ( link here ) that global central bank balance sheet expansion has already spiked c.$2.7 trillion since early March which now comfortably eclipses the full peak 12-month increase seen during the GFC (under $2.5tn). On our calculations this is the same amount as the annual total output of either the U.K. or French economies. Two thirds of this increase has come from the Fed so far.

Again using our back of the envelope calculations, given that the global economy is worth around $80 trillion dollars annually and that the IMF last week said it would fall -3% in 2020 (in real terms under the base case) that’s potentially ‘only’ $2.4 trillion of lost activity (less if you add inflation). Relative to the pre-covid trend they forecast $9 trillion of global GDP losses by the end of 2021. Even if you think these numbers are a bit low, when central banks have so far pumped in an annualised $23.4 trillion into the financial system you can see how it’s hard to get a feel for where markets can go. Clearly they won’t keep up that pace of liquidity injections unless economies fall even further but could you really have a situation in 1-2 months’ time where economies are still struggling to fully open and yet equity markets are back at record highs? I don’t think so but you couldn’t rule it out given the ginormous liquidity injections. Crazy times and we haven’t even mentioned the government injections.

In this liquidity rush one crucial part of the financial system that hasn’t managed to suck it up yet is Italian debt where 10yr spreads to bunds have widened around 100bps from the pre-covid tights to 226bps now. They’ve also widened nearly 70bps since the 26th March. For prospective the S&P 500 is up +9.30% since then.

On this hot topic and for other things in the market, Thursday is the key day this week with the EU leaders summit a potentially big event for the future of Europe as they discuss how close the region can get to joint issuance in the near future. Expect creative ambiguity to rule as it normally does on the continent. Nevertheless you would expect more explicit details to be outlined as to how Europe will help Italy. Will this be enough to keep Italian spreads (and domestic politics) in check though? To add to the story, S&P are expected to finalise the review of their BBB rating on Friday. Our colleagues did a piece last week on what the implications are if they are junked. See more here. Staying with European discussions, the FT broke a story yesterday saying the supervisory wing of the ECB is pushing for an EU wide bad bank. It’s not clear whether this story will have legs but it’s clearly something that the weaker members will welcome much more than the stronger ones. Whether it’s NPLs or peripheral debt, can this crisis be the catalyst for more European financial solidarity or will it be one to expose the cracks of an imperfect union.

On the issuance of joint Eurogroup debt, Italian PM Conte said in an interview to Germany’s Sueddeutsche Zeitung yesterday reiterating the need for joint debt issuance highlighting the risk of market contagion if European leaders fail to act on pressure from Italy and Spain. He also added that the ESM rescue fund, Germany’s preferred tool to address the economic impact, “has a bad reputation in Italy.” Meanwhile, Klaus Regling, the ESM’s director-general, said in a separate interview with Italy’s Corriere Della Sera that concerns that the fund’s lending will have two parts — one to specifically deal with the outbreak, the other to reduce budget deficits — was misplaced. He added, “The conditions agreed at first will change during the period of which the line of credit is available. The Eurogroup will clarify it, saying that the only requirement for obtaining the loan is the way in which they spend the money.”

Back to Thursday and not only will we see the latest jobless claims but also the flash PMIs from around the world for April – the first reading covering nothing but lockdowns. If you want a potential worst case scenario Italy was the only Western country to be on full lockdown in the survey period for March and they saw their services PMI fell to an astonishingly low 17.4. In all truth though the market has rightly or wrongly moved on from how bad data could get in the near-term to absorbing up the extra liquidity and also whether economies can open progressively through May.

On this the latest on new cases and fatalities generally continue to show steady improvements as you’ll see in our Corona Crisis Daily. However this improvement is being used by many countries to encourage debate on what exit strategies will look like and the lifting of restrictions at potentially an earlier stage than China did. A risky balancing act.

To markets now where the big mover overnight has been WTI oil which has slumped -16.31% to $15.29/bbl and the lowest in over 20 years. It should be noted however that near-term WTI prices are trading at massive discounts to later-dated contracts – primarily due to concerns about the storage hub in Cushing filling to capacity – with the more active June contract falling by around a third as much (currently trading at $23.73/bbl). Currencies for oil exporting nations are leading the declines this morning with the Norwegian krone down -0.81% while the Canadian dollar is down -0.52%. However, equity markets are more mixed. The Nikkei (-0.95%) and ASX (-1.25%) both down while the Hang Seng (+0.16%), Shanghai Comp (+0.30%) and Kospi (+0.33%) have all posted modest gains. The increase in confirmed virus cases over the weekend appears to be weighing on the markets in Japan as is the latest trade data. Elsewhere, futures on the S&P 500 are little changed.

In other overnight news, President Trump said that the talks between the White House and Democrats in Congress are near an agreement that would add cash to a program aimed at helping small businesses. He suggested that an announcement towards this might come today. Meanwhile, Bloomberg has also reported overnight that the US will allow importers and manufacturers to defer payments on many imported goods for 90 days, a move aimed at freeing up cash for pandemic-hit businesses. The deferral doesn’t apply to anti-dumping or countervailing duties, or so-called Section 201, Section 232 or Section 301 duties. As such, it won’t ease Trump’s duties on China, steel and aluminum, or enforcement actions he took including against Airbus. Elsewhere, China’s finance ministry said overnight that the country will issue an extra CNY 1tn ($141.3bn) in special-purpose bonds “in the near term,” for infrastructure spending. The moves comes after China’s top leaders in politburo meeting on Friday said that the nation is facing “unprecedented” economic difficulties and signaled that more stimulus was in the works.

Elsewhere this week, Q1 earnings will also step up a notch with 88 S&P 500 companies reporting this week and Europe joining the fray with 64 companies. In terms of the highlights to look out for, proceedings kick off today with IBM. Then tomorrow we’ll hear from The Coca-Cola Company, Netflix, SAP, Philip Morris International, Lockheed Martin, Texas Instruments and BHP. On Wednesday, we’ll then get AT&T and Thermo Fisher Scientific. Thursday sees releases from Intel, Eli Lilly and Company, NextEra Energy, Union Pacific, Credit Suisse and Hyundai. And finally on Friday we’ll hear from Verizon Communications, Sanofi, T-Mobile and American Express.

In the background, all this week we’ll see the UK and the EU holding their second negotiating round via videoconference on their future partnership following Brexit. This had originally been scheduled to take place in mid-March but was postponed as a result of the coronavirus pandemic. Although speculation has risen that the transition would be extended given the coronavirus, the UK reiterated last week that they would refuse to extend the transition period, which is due to conclude at the end of this year, even if it were the EU who requested the extension. Should either side seek an extension, under the Withdrawal Agreement they have until the end of June to agree on one. Before that deadline, a “High Level meeting” is planned in June where the two sides will be taking stock of the progress made. A high stakes game but maybe the U.K. are seeing the internal EU divisions over Italy as a chance to take some leverage at the negotiating table.

Reviewing last week now before the day-by-day week ahead listings. Equity markets continued their rally as investors weighed the expectations of economies reopening against the start of 2020 first quarter US earnings and deteriorating economic data. The S&P 500 rose +3.04% on the week (+2.68% Friday), after rising over +12% the week before. This is the first back-to-back weekly gains since the second week of February, before the index hit its highs. Technology stocks outperformed over the week and in general during the downturn, with the NASDAQ rising +6.09% (+1.38% Friday) on the week and is only just under 12% from its highs, versus the S&P 500 14.8% from highs. Bank (-7.64%) and Energy (+0.21%, but +10.4% Friday) sectors were key laggards as investors fretted about loan loss provisions in the former’s earnings and the further slump in oil for the latter. On the more positive side, European equities also rose for a second week in a row for the first time since February, with a strong Friday rally (+2.63%) pushing the Stoxx 600 to finish up +0.50% on the week. Equity performance was more mixed across Europe with correlations falling as different countries and regions roll out different reopening guidelines. The EU summit this week also cast a shadow on peripheral markets. The DAX rose +0.58% (+3.15% Friday), while the Italian FTSE MIB fell -3.21% (+1.71% Friday). The bank and oil heavy FTSE fell -0.95% (+2.82% Friday). Many Asian equities indices also rallied for a second week in a row, with Japanese stocks doing so for the first time since January. The Nikkei rose +2.05% (+3.15% Friday), while the CSI 300 gained 1.87% (+0.98% Friday) and the Kospi rallied +2.89% (+3.09% Friday) on the week. It was the fourth week in a row that Chinese stocks rose, with the CSI 300 roughly -8.7% down from both January highs and the more recent March 5 highs, before the virus outbreaks in the West.

The VIX fell -3.5pts over the course of the week to finish at 38.15, the lowest closing weekly level since February. Credit spreads continued to tighten even as oil again fell on the week. US HY cash spreads were -65bps tighter on the week (-27bps Friday), while IG tightened -27bps on the week (-2bps Friday). In Europe, HY cash spreads were -27bps tighter over the 5days (-3bps tighter Friday), while IG was -9bps tighter on the week (-1bps Friday). Oil was not able to benefit from the Easter weekend OPEC+ cut as investors did not think they went far enough and the gloomy demand forecasts grew more dire. Brent fell -10.80% (+0.93% Friday) while WTI fell -19.73% (-8.05% Friday) though this is partly due to the pressure on first month futures in US crude currently. WTI May futures, expiring next week, are trading at nearly a $7/barrel discount to June futures, close to the biggest spread between 1st/2nd month contracts in 11 years. This is due to concerns that some storage hubs could run into capacity problems.

Even as equity prices improved globally, core sovereign bond yields fell on the week in both Europe and the US, partly driven by increased central bank purchases. US 10yr Treasury yields fell -7.7bps (+1.5bps Friday) to finish at 0.64%, just 10bps from all-time lows. 10yr Bund yields fell -12.5bps (+0.2bps Friday) to -0.47% but peripherals spreads widened out on concerns about how coordinated the European recovery plan will be. French 10yr yields were -5.0bps tighter on the week against bunds (-0.6bps Friday), while Italian yields widened +32.7bps over the 5 days (-4.2bps Friday). Spanish 10yr bonds widened +15.9bps (-1.6bps Friday).

Tyler Durden

Mon, 04/20/2020 – 08:13

via ZeroHedge News https://ift.tt/2XQi9WL Tyler Durden